2020-4-21 02:00 |

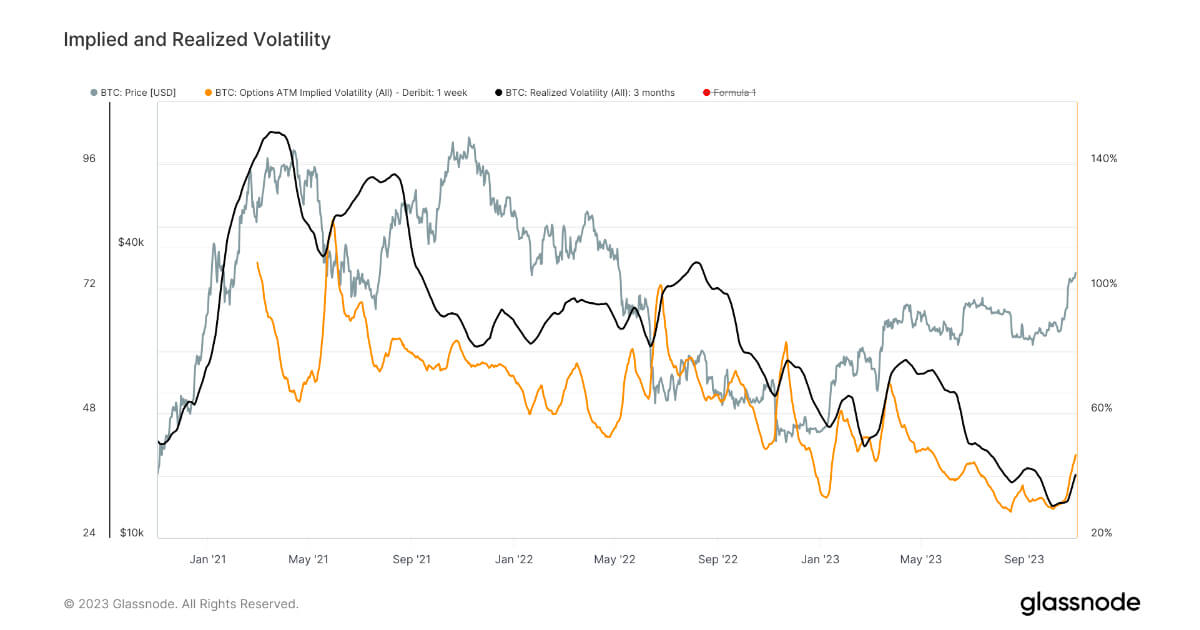

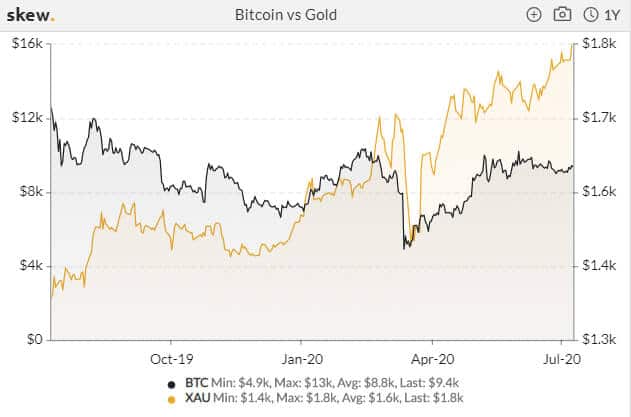

Bitcoin’s implied volatility has been caught within a consistent downtrend throughout the past several weeks This comes as global instability mounts and as BTC’s mining rewards halving fast approaches Following the massive volatility seen in mid-March when the cryptocurrency declined from roughly $8,000 to lows of $3,800 in an unprecedented movement, Bitcoin’s implied volatility has been consistently declining. This comes as BTC finds itself caught within a bout of sideways trading within the lower-$7,000 region, leading many analysts to anticipate that another large movement is imminent. Bitcoin Sees Declining Volatility; Is It Coiling Up for a Big Movement? At the time of writing, Bitcoin is trading down roughly 2% at its current price of $7,080, down slightly from daily highs of over $7,200. Throughout the past few weeks, BTC has established a unique trend in which it enters periods of consolidation before pushing higher, but it is a strong possibility that this trend of stable upwards momentum won’t last for too much longer. One factor that suggests explosive volatility is imminent is the massive decline seen while looking towards the crypto’s multi-week implied volatility, which plunged from 142% in late-March to 76% presently – according to data from Skew. “Implied volatility over the last month has been one-way traffic despite the halving approaching,” the research and analytics firm noted. Image Courtesy of Skew This nearly 50% decline may stem in part from the stability seen by the U.S. equities market in recent times. Most of the benchmark indices have recovered a significant amount of their recent losses due to the actions undertaken by the Fed and U.S. government to curb the economic impacts of the Coronavirus pandemic. Because BTC has established a trend of trading as a firmly risk-on asset in recent times, it could currently be coiling up before making an explosive movement once the equities market establishes a clearer trend. Next Movement May Favor BTC’s Bears This potentially explosive movement that is looming on the horizon may favor Bitcoin’s bears. One popular trader explained in a recent tweet that BTC recently broke below the ascending trendline that was formed after its dip to lows of $3,800. The break below this level suggests that buyers are growing weak and has led the trader to note that he is “expecting further downside” in the near-term. Image Courtesy of TraderXO The future of Bitcoin’s trend may rest partially in the hands of the stock market, although it is a strong possibility that the volatility resulting from its next major movement will far outweigh that seen by the traditional markets. Featured image from Unsplash. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|