2020-4-28 17:46 |

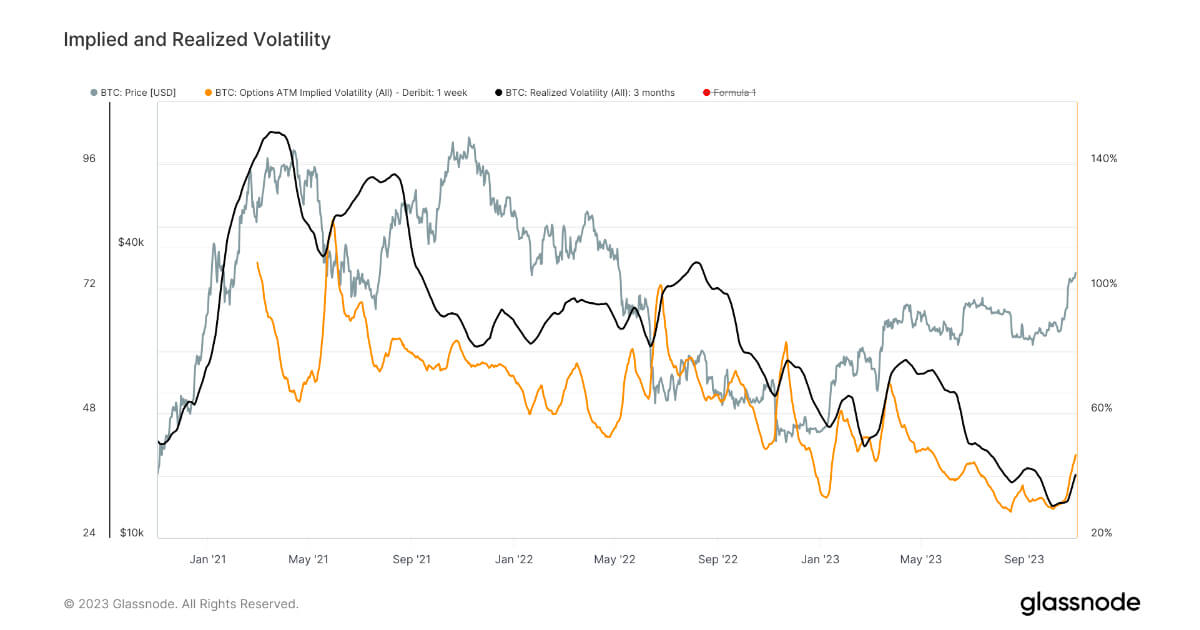

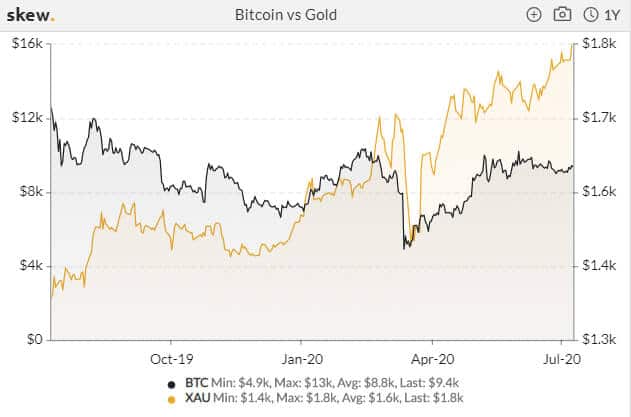

Bitcoin has seen one of its biggest peaks of volatility in the past 2 months after the collapse of the entire global market in March. According to the crypto statistics platform, Skew, Bitcoin has seen a significant decline in its implied volatility after the crash on March 12.

Six weeks later, bitcoin implied vol is nearly back to its pre sell-off level pic.twitter.com/IaBHd9yWZC

— skew (@skewdotcom) April 27, 2020The IV (Implied Volatility) is an indicator or metric that basically tries to predict the likelihood of big changes in an asset. There are other indicators for volatility like the historical volatility which is fundamentally different.

When the IV is high, it means Bitcoin is very likely to see big moves like 5-10% moves within hours, something that was extremely common in March when Bitcoin was surging 15-20% within minutes or crashing 30-40% within hours.

Bitcoin Has Recovered Almost EntirelyThe current price of Bitcoin is almost as high as it was before the crash. The IV has also dropped down to levels before the crash but skew remains positive.

However, skew remains positive. Will this be a structural parameter change? pic.twitter.com/5qvKo10Gxf

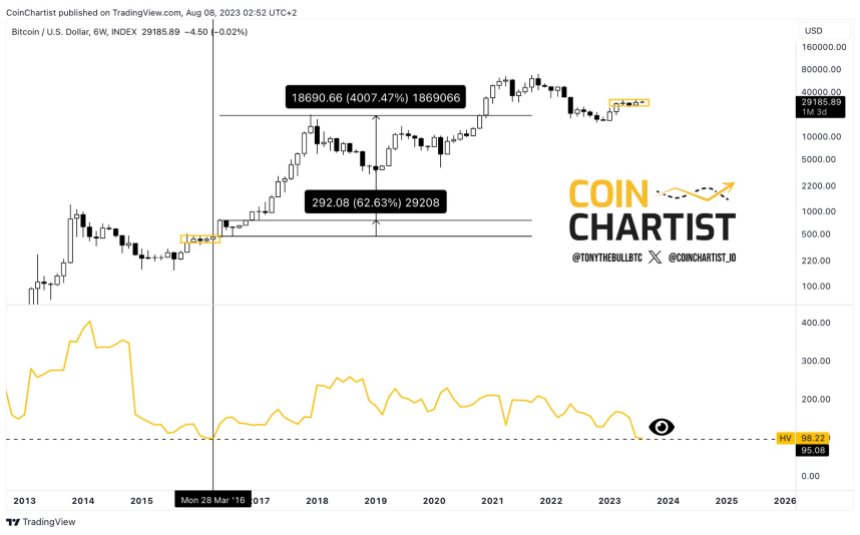

— skew (@skewdotcom) April 27, 2020The digital asset has been able to set a robust daily uptrend after bottoming at around $3,700 and it is currently trading at $7,700. There is a pretty clear pattern for Bitcoin currently where the digital asset enters a short period of consolidation before taking off.

The IV decreasing fast signifies that a possible explosive move is about to happen, however, bulls are concerned that it might be towards the downside as there aren’t a lot of buyers left. All top exchanges have a significant majority of long positions which means most traders are already holding Bitcoin and the price will have a tough time going up more as there is no one left to buy.

The number of long positions opened is also a risk factor because it could lead to a long squeeze propelling Bitcoin below $7,000 in a violent move.

Where is Bitcoin Headed Next?Disregarding the short-term, it seems that the demand for Bitcoin is still increasing as the halving event gets closer. It’s unclear if Bitcoin will take off more before the event as the digital asset has already seen a significant bull run.

According to many analysts, Bitcoin could actually crash into the halving event and trade sideways for weeks before eventually taking off. History suggests the same as past halving events did not have an immediate effect on Bitcoin’s price.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|