2021-6-28 17:53 |

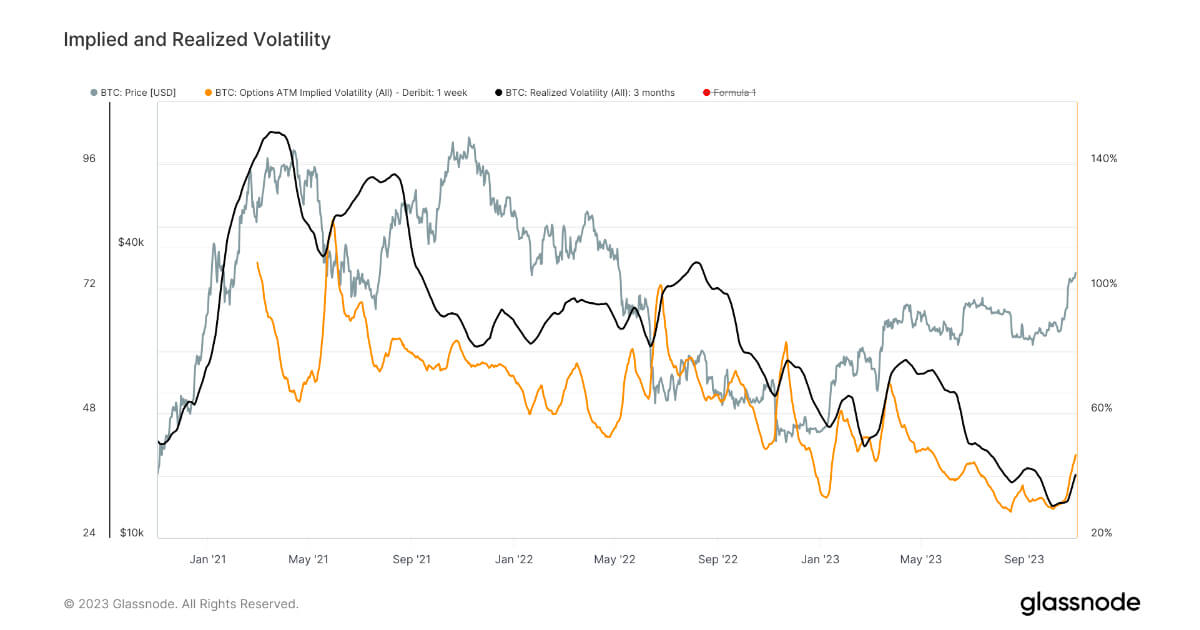

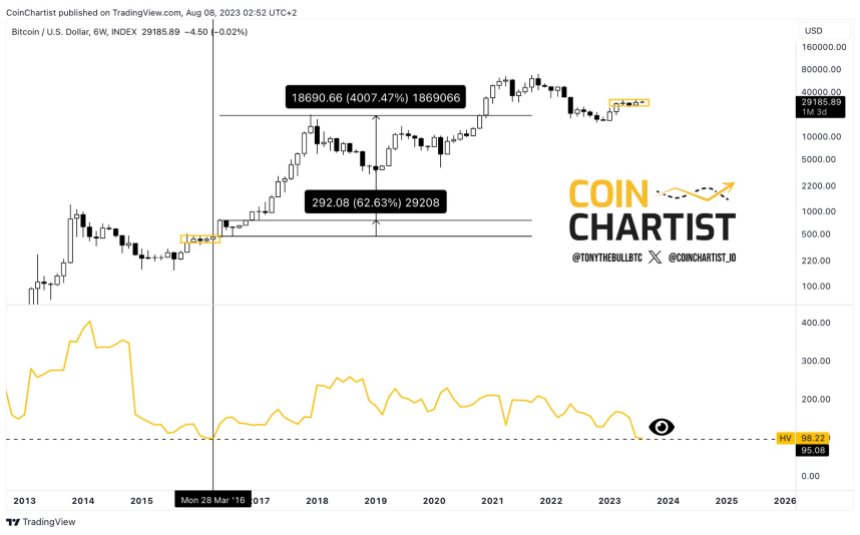

Several top crypto and market analysts have expressed their views on the volatility levels of Bitcoin (BTC/USD) and the reasons behind it.

Coindesk’s Michael Casey was speaking to CNBC and pointed out that the activities of institutional traders have had a major impact on Bitcoin’s volatility.

He stated that there has been a phenomenal amount of investments in the servicing aspect of the crypto industry. There is also a lot of corporate and institutional investments coming to the service section of the crypto industry.

Ethereum a different proposition to BitcoinCasey also commented on the division between Ethereum (ETH/USD) and Bitcoin (BTC/USD) when it comes to their performance this year. He stated that Ethereum is a different proposition compared to Bitcoin, but a lot of people still classify them side-by-side.

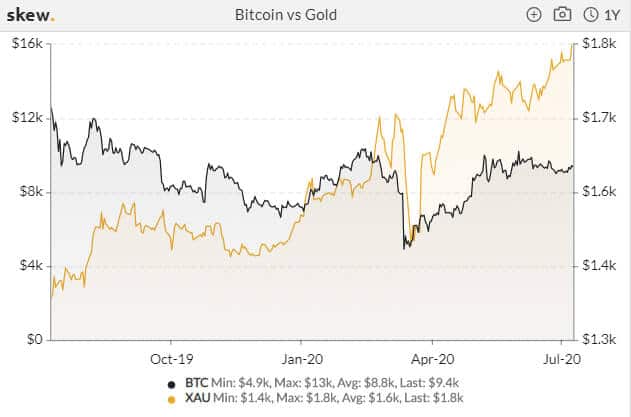

According to him, Ethereum is not expected to react in the same way as Bitcoin because, unlike the latter, the former is a commodity that is used to run the Ethereum network. On the other hand, Bitcoin is purely an asset used as a form of digital gold.

He said the market moves sometimes in a way that two of them are locked together and follow a similar volatility pattern. But at other times, the market favors one over the other.

On the impact of regulation of crypto’s growthCasey also noted that the irregularities in crypto regulation have stagnated its growth. He pointed out that apart from the issue of Bitcoin, so many things are happening at the same time, including the explosion of stablecoins and decentralized finance (DeFi).

The sector is a fast-changing one and governments and regulators are scrambling to find a better solution to regulate the crypto industry. Casey added that the regulatory risk is prevalent in the industry and it’s something investors have to get used to.

The post Here is what Coindesk’s editor Michael Casey says about Bitcoin’s volatility appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Inverse Bitcoin Volatility Token (IBVOL) на Currencies.ru

|

|