2021-7-15 18:00 |

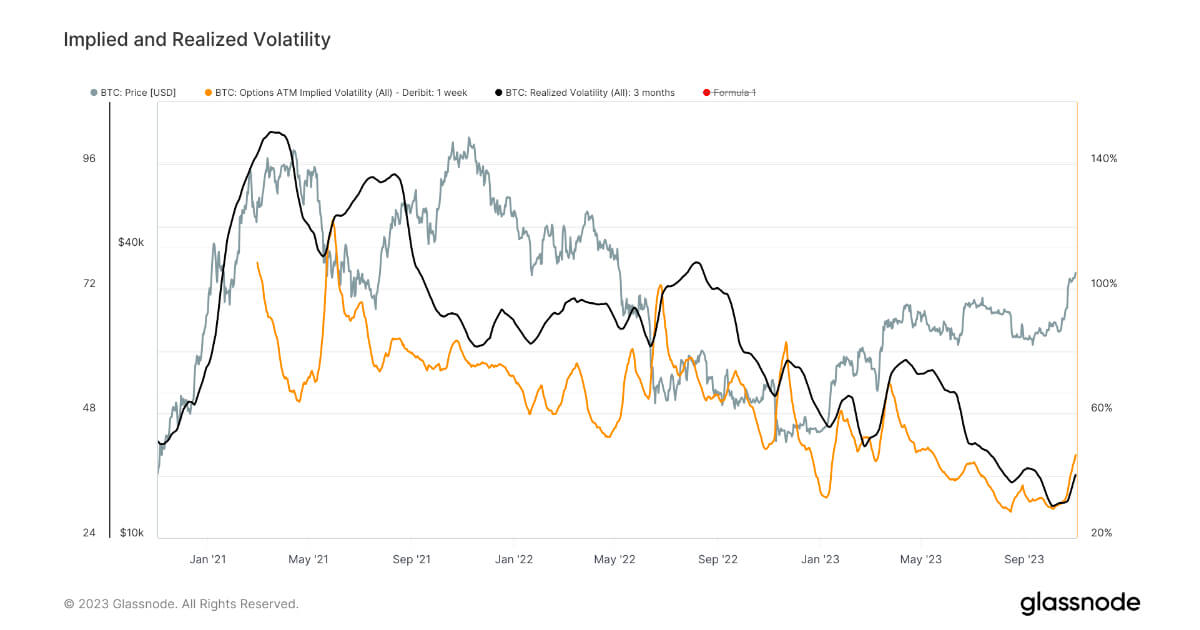

A volatility squeeze usually takes place when the volatility of an asset drops below its recent levels, causing the asset to enter a period of consolidation.

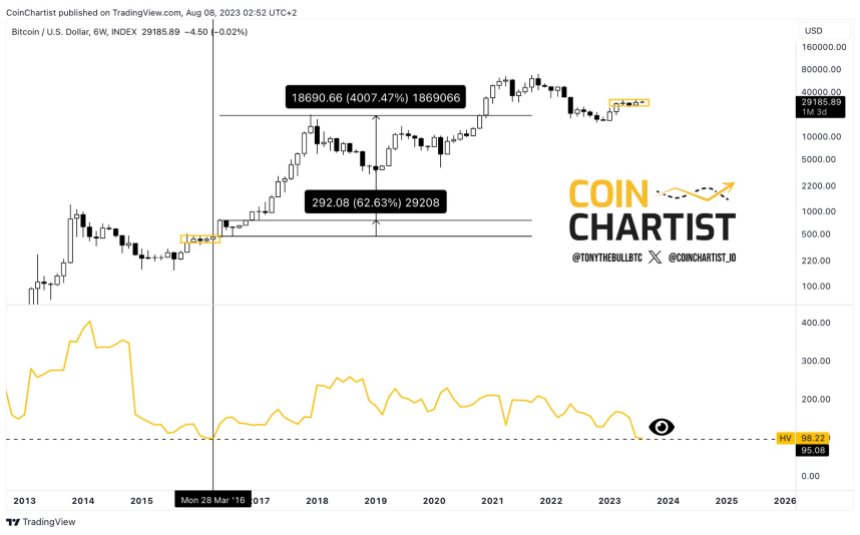

Bitcoin is about to get greenerAs of today, analyst William Clemente confirms that Bitcoin is entering its first major volatility squeeze, following the last one in April that pushed prices below their all-time high, and triggered the bull rally in July of 2020. According to the analyst, this is a rare occurrence that essentially signals a brewing bull market for Bitcoin. As he is quoted saying “all it means is a big move coming.”

BTCUSD Chart By TradingViewPopular Crypto Trader ZeroHedge also shares Clemente’s assertion, writing; “William beat me to it!We’re officially in a volatility squeeze ladies & gentlemen”.

The volatility squeeze pattern surfaced not long after analysts pointed out that Bitcoin was imitating the technical analysis approach which is known as the Wyckoff accumulation semantics. Essentially, analysts had expected that Bitcoin hits $50,000 in the near term if it successfully follows through the fourth phase of the accumulation, but ZeroHedge is convinced that Wyckoff has “broken perfect structure on Bitcoin,” implying that that chapter is done.

Mixed Sentiments wrap crypto market, but bulls remain confidentGenerally, the sentiments are mixed, but they are mostly bullish. Even with the FUD’s pronounced presence in the market, investors like Lark Davis maintain that the fears are no different from the usual. He puts his faith in the long term possibilities, saying;

“The same people who said Bitcoin would never reach a new high throughout 2018, 2019, and 2020 are the same ones saying that BTC will never reach a new ATH again. We’re going 6 digits, only question is when.”

On the not-so-bullish side, crypto trader and analyst “RektCapital” observers a possible downtrend, should Bitcoin fail to close above $34,600 this week.

His tweet reads ;

“Despite the recent rebound, BTC is still threatening to lose its multi-month Higher Low. BTC needs to Weekly Close above ~$34600 to secure this Higher Low as support for an 8th week in a row”

In the on-chain scenes, it was last recorded that whales have resumed stacking. In usual Bitcoin fashion, demand could skyrocket any second now, and the result could be Bitcoin hitting fresh highs, or retesting previous highs at least.

origin »Bitcoin price in Telegram @btc_price_every_hour

Inverse Bitcoin Volatility Token (IBVOL) на Currencies.ru

|

|