2023-6-20 07:21 |

Bitcoin markets have returned to a state of lethargy following a period of volatility as U.S. regulators intensified their attacks on the industry. As a result, the consolidation has continued as the asset recovers from losses and returns to its range-bound channel.

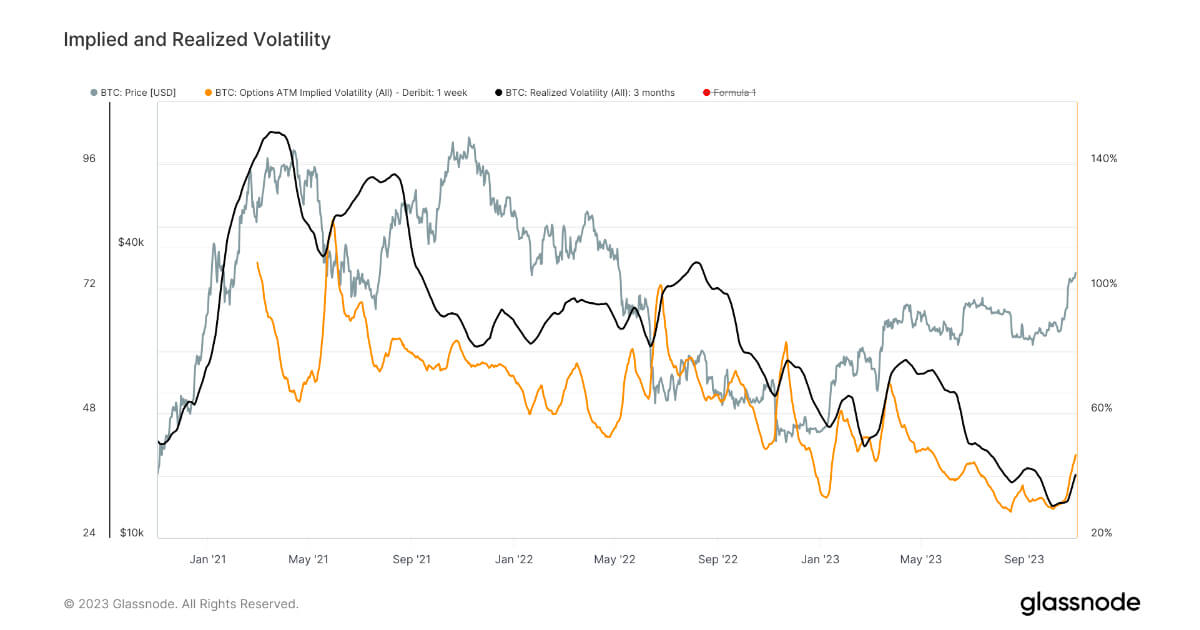

On June 19, on-chain analytics platform Glassnode reported that Bitcoin volatility, volumes, and realized values are at multi-year lows. On its “road to nowhere,” BTC markets showed a minimal response to the world’s largest asset manager, BlackRock, applying for a spot ETF late last week.

Bitcoin Volume in Hangover PhaseGlassnode analyst “@_Checkmatey_” described the current market situation as a hangover period.

“Bitcoin is quiet, volumes are down, and it is pretty clear we are in the hangover apathy phase.”

Examining the 30-day price range, Glassnode reported that quiet periods like this are “few and far in between.”

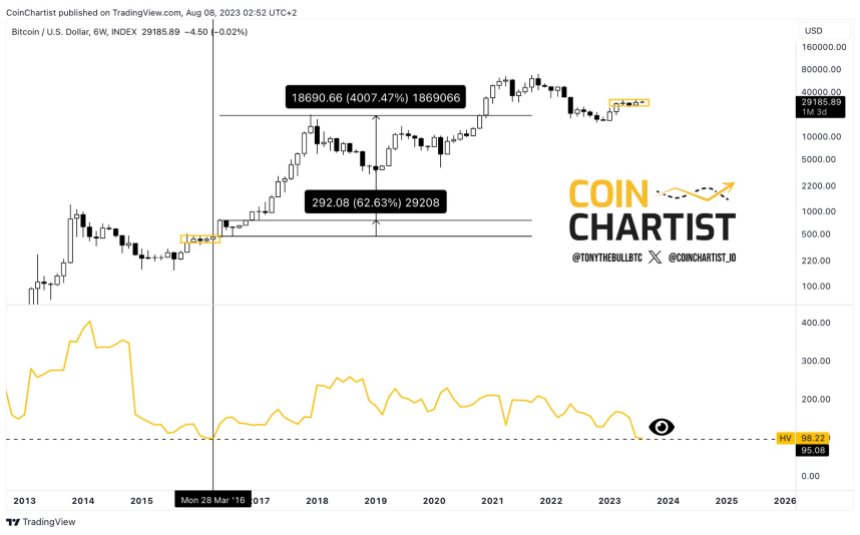

Bitcoin has been range-bound for more than three months now. The upper bound of that range was $31,000 on April 15 with the lower bound at $25,000 on June 15.

These market conditions tend to occur during the “apathetic hangover period that follows a bear market,” the report added.

Bitcoin BTC Price Highs and Lows. Source: GlassnodeFurthermore, one-month Realized Volatility has also fallen below 40%, one of the lowest recordings since the 2021 bull market.

“We can see such events are typically experienced during the long, sideways grind as the market finds its feet after a prolonged bearish trend.”

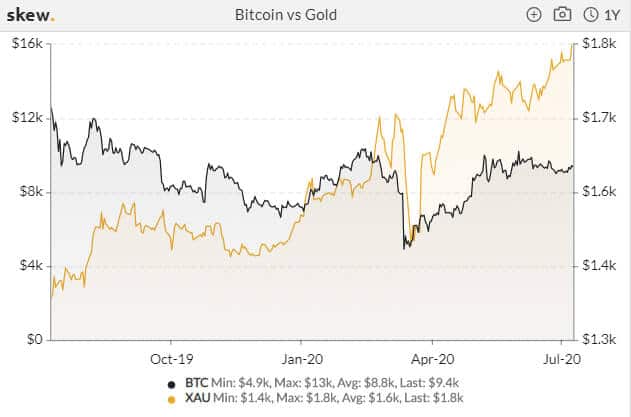

Additionally, the absolute value of profit and loss-taking events has sunk to cycle and October 2020 lows of around $268 million.

The declines have also been seen across derivatives markets, with futures trading volumes falling to $20.9 billion per day. This has occurred due to liquidity across digital asset markets continuing to decline.

On the upside, ‘hodlers’ continue to do their thing and accumulate BTC. Coins are being stashed at a rate of around 42,200 BTC per month. This suggests that the “price insensitive class are absorbing a non-trivial portion of the currently available supply.”

Crypto Market OutlookFollowing a flat three days, Bitcoin prices ticked up during the Tuesday morning Asian trading session. As a result, the asset was changing hands for $26,936, following a 2% daily increase.

Bitcoin Price in USD 24 hours. Source: BeInCryptoSince its SEC-induced dump last week, Bitcoin has recovered around 8% to current levels. However, the asset remains down 61% from its all-time high and firmly in bear territory.

The post Bitcoin Enters ‘Hangover Period’ With Low Volumes and Volatility appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Inverse Bitcoin Volatility Token (IBVOL) на Currencies.ru

|

|