2025-12-11 18:00 |

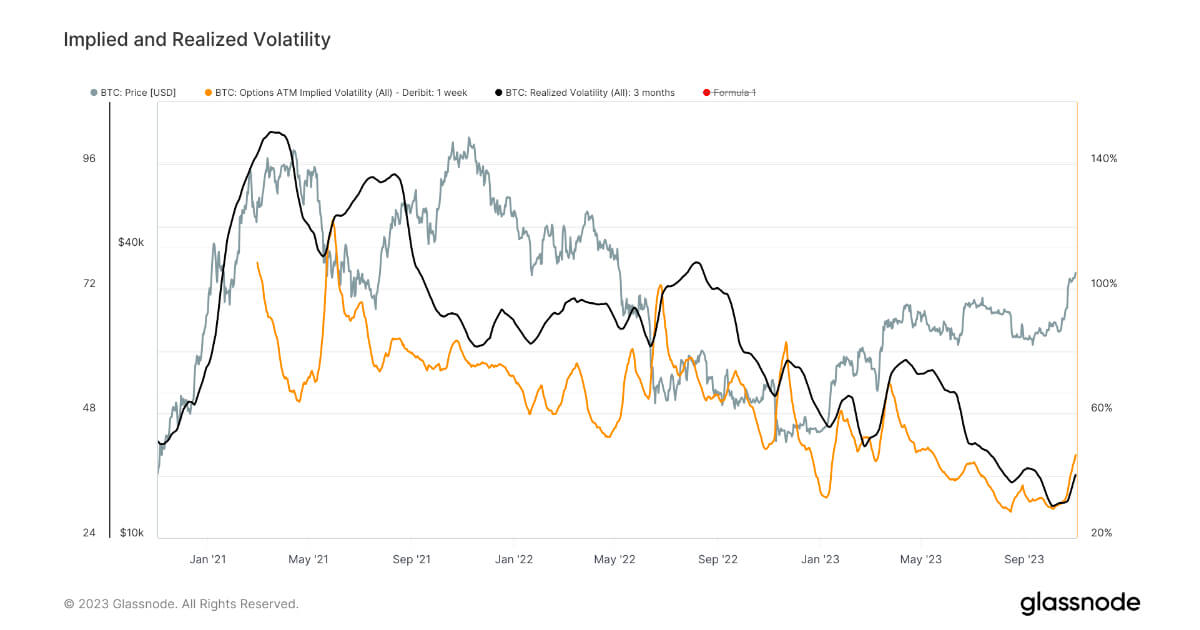

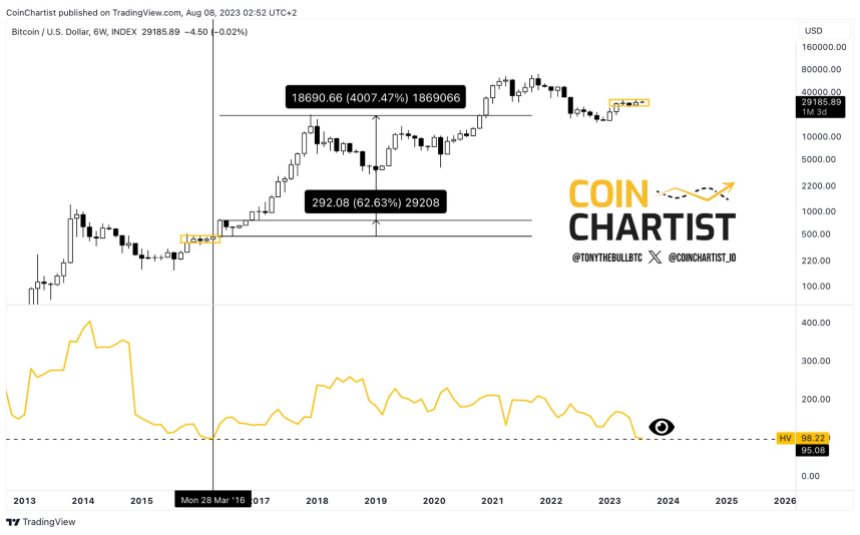

Bitcoin ($BTC), the leading crypto asset, is undergoing a significant shift in its market momentum. Particularly, Bitcoin’s ($BTC) volatility has slumped near $90K, raising concerns of a bear flag price pattern. As per the data from Aksel Kiber, CMT, amid the dropping volatility, the market members are keenly watching for the indication of a bearish continuation or a bottom. In this respect, the price action signifies a likely counter-trend shift that could be leading to a bear flag pattern.

Volatility dropping on $BTCUSD. Volatility is cyclical. High volatility is followed by low volatility and vice versa. If this is a counter trend move against the drop from the completion of broadening top, it can be analyzed as a bear flag. BTCUSD continues to look for a bottom. pic.twitter.com/arAhPbCxw6

— Aksel Kibar, CMT (@TechCharts) December 11, 2025 Bitcoin Struggles to Reclaim Previous Heights Amid Bear Flag ConcernsThe on-chain data points out that the drop in Bitcoin’s ($BTC) volatility has triggered speculations among the market participants. Thus, the top crypto asset is reportedly struggling to reclaim its higher price levels while standing significantly below the psychological barrier of $100K. As a result, the concerns over the likely bear flag price pattern are growing. So, the analysts point toward a potential continuation of the bearish momentum that could even lead to a bottom.

At the moment, Bitcoin ($BTC) is hovering around $90,220.17 in terms of price. This displays a 2.57% dip over the recent twenty-four hours. Additionally, the market capitalization of the leading cryptocurrency has also plunged by 2.6%, reaching $1.79T. Subsequently, the weekly and monthly price performances of $BTC show 3.25% and 14.26% decreases.

BTC Sees Consolidation While Bear Flag Pattern Highlights Potential Drop to $80KAccording to Aksel Kiber, the ongoing volatility drop of Bitcoin ($BTC) could result in a sheer directional move as seen in the historical movements. However, in line with the current context, a bearish setup is emerging amid the formation of a bear flag pattern. Particularly, the $80K is the likely target of this bearish slump. Thus, Bitcoin remains in a notably vulnerable consolidation period until a solid breakdown or breakout.

origin »Bitcoin price in Telegram @btc_price_every_hour

Inverse Bitcoin Volatility Token (IBVOL) на Currencies.ru

|

|