2022-5-18 02:00 |

Bitcoin has had its fair share of highly volatile days since its inception. This comes as no surprise given that volatility remains one of the most prominent characteristics of the cryptocurrency and this volatility is a major pull for investors. Nevertheless, there have been days when the volatility has been higher than normal, usually following large market downtrends. One of such days was recorded recently, touching new one-year highs.

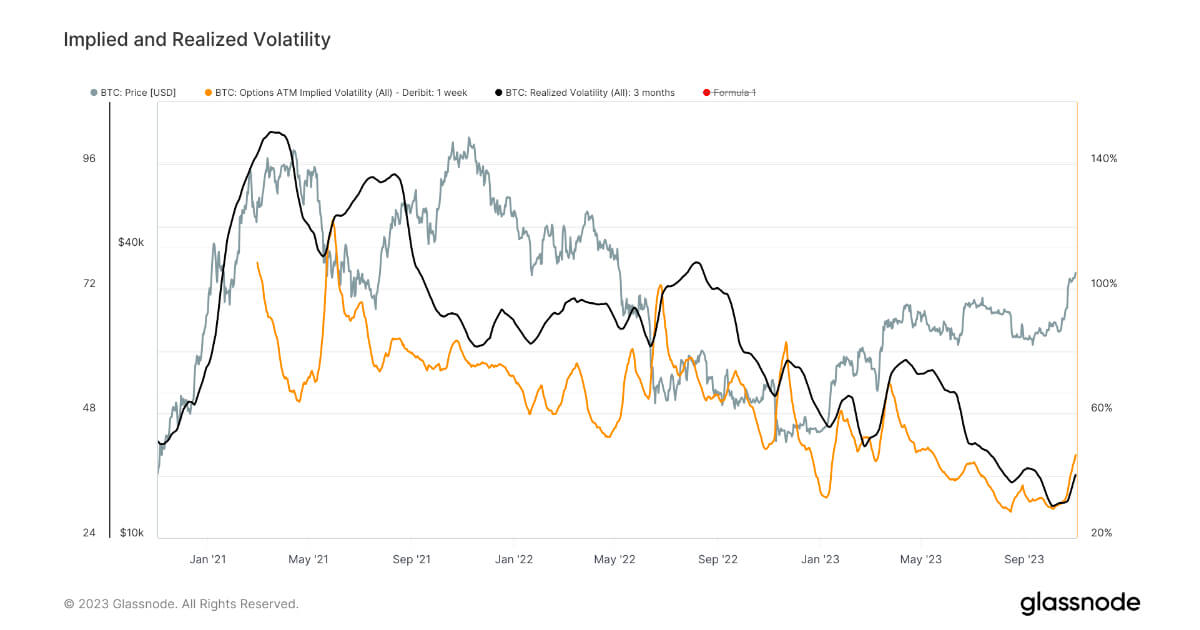

Bitcoin Volatility RisesA recent report from Arcane Report has shown that last Thursday, Bitcoin volatility had reached highs not seen since May of 2021. This analysis used the average hourly high-low difference in the digital asset in both the spot and perpetual markets. What this returned was that the volatility levels that were marked last Thursday were in levels that had last been recorded in May 2021, a time when the market had been going through a period fraught with dips and crashes.

Related Reading | DeFi Not Spared From Crypto Massacre As TVL Drops Almost 50%

The hourly average on the high and low prices on May 12th showed a 3.68% deviation in the spot market. Comparatively, the last time numbers like these were recorded had been on May 20th, 2021. This is not the highest that volatility has been, however.

BTC volatility reaches one-year high | Source: Arcane ResearchBack at the start of 2020, the volatility had been much higher given the movements in the market. The most volatile day for bitcoin would be recorded later that year in March. Match 13th, a day to remember for investors, has been billed as the most volatile day in bitcoin. The deviation in the spot market on the hourly average had touched as high as 11.91%. However, 2021 has been one of the most volatile years for the digital asset, reaching highs of 6.81% deviations.

What Triggers Volatility?While there could be a number of factors that could trigger intense volatility in a digital asset such as bitcoin, the most obvious culprit has been periods of intense sell-offs. During these periods, the price of cryptocurrencies such as bitcoin dipped significantly, triggering even more sell-offs.

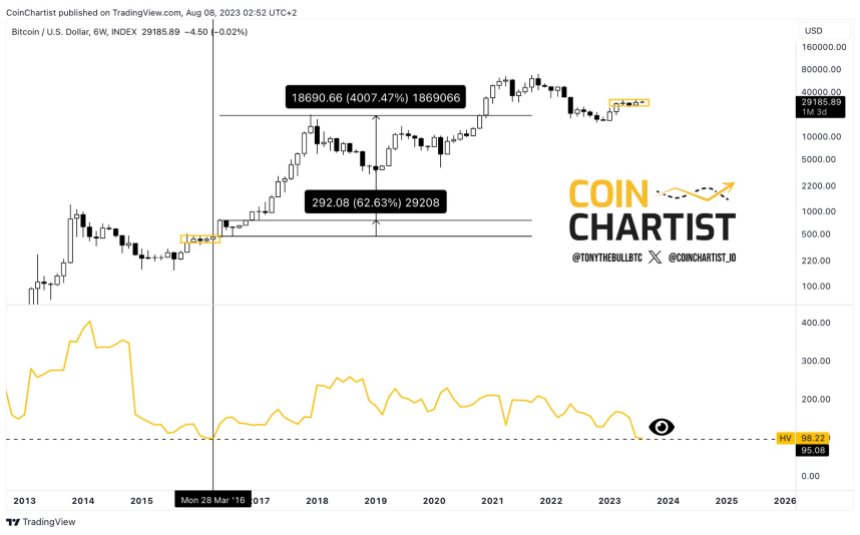

BTC dips in early hours of Tuesday | Source: BTCUSD on TradingView.comThe destabilizing effects in the derivatives markets along with leveraged positions unwinding can also lead to a ripple effect that is felt in all associated markets. Such is the case of what the market witnessed on Thursdays, leading to the most volatile day so far in 2022.

Related Reading | 44 Countries Set To Meet El Salvador To Discuss Bitcoin, Here’s What We Know

Arcane Research also notes that the spot market can also see more ‘extreme differences’ when it comes to stress compared to their perpetual counterparts. The report also added that the available liquidity in the perps market can cause active market participants to react more efficiently during growing volatility. Inversely, spot markets tend to react slower to sudden market shocks.

Featured image from Nikkei Asia, charts from Arcane Research and TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Inverse Bitcoin Volatility Token (IBVOL) на Currencies.ru

|

|