2018-12-8 00:15 |

Between August and November Bitcoin and the crypto market remained somehow stable. Bitcoin operated around $6,400 and did not experience a lot of volatility. However, November moved the whole crypto market.

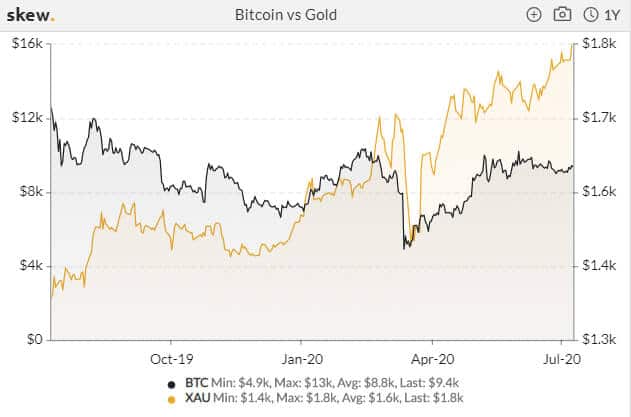

According to a recent report published by SFOX, virtual currencies had more volatility than the S&P 500 and gold during the last month. SFOX, informed that the increased volatility during November is related to four different factors.

The first point marked in this analysis is related to the uncertainty in the market before the Bitcoin Cash fork. On November 15 Bitcoin Cash experienced a network upgrade in which two different proposals tried to get the support of the community. During the previous days of the fork, there was FUD spreading on the media. However, the price of the most virtual currencies slightly grew during the first two weeks of the month.

However, on November 14, the whole market plummetted to new lows this year. The second point that the report mentions is related to the hash war that started after the fork. Once the upgrade took place, a hash war started between Bitcoin ABC and Bitcoin SV. This affected the value of most of the virtual currencies in the market. Both proposals were competing to see which of them was going to be the longest Bitcoin Cash chain.

The hash war ended and Bitcoin SV decided to split from Bitcoin Cash. Both virtual currencies are currently operating in the market. Bitcoin SV was able to surpass Bitcoin Cash in terms of market capitalization. Bitcoin Cash currently has $1.83 billion market cap and Bitcoin SV $1.86 billion.

The third event that affected the markets increasing their volatility was an announcement made by the U.S. Securities and Exchange Commission (SEC) in which it informed that settlements had been made with two Initial Coin Offerings form 2017 called Airfox and Paragon.

This situation raised questions in the market about the future of similar ventures in the country. During 2017 and 2018 there were hundreds of new Initial Coin Offerings (ICOs) launched to the market.

Later on November 28, Jay Clayton, SEC chairman, said that Bitcoin is not considered a security and that it is not subject to SEC regulations. Additionally, he said that digital assets such as Bitcoin are here to stay even when there is a hard bear market.

The crypto market is very susceptible to external pressures such as the ones that we mentioned in this article. Announcements, conferences and important decisions such as what those imposed by the SEC.

In the future, the launching of the Bakkt platform might help Bitcoin price to grow or start a new bull market. The same could happen if the SEC takes the decision of approving the first Bitcoin exchange-traded fund (ETF) in February 2019. These events could be very positive for Bitcoin and the crypto market.

At the time of writing, Bitcoin is being traded under $3,500 and it has a market cap of $60 billion. Most of the virtual currencies in the market are operating negatively in the last 24 hours with the exception of stablecoins.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|