2019-6-17 23:30 |

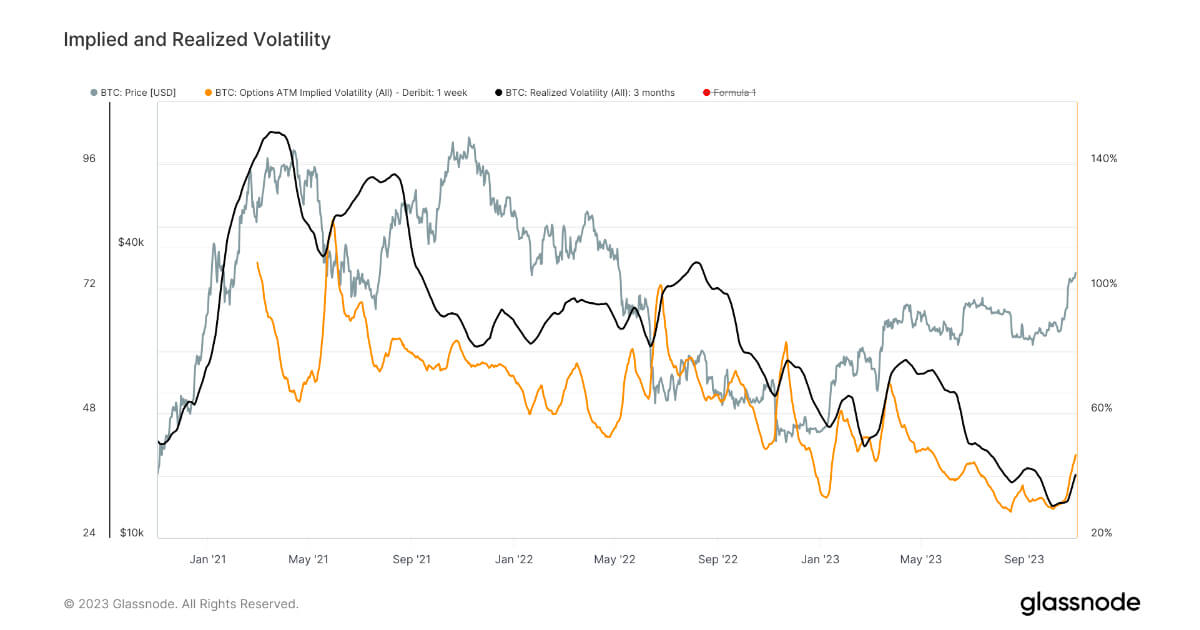

Market volatility plays a huge role in the financial ecosystem of assets and cryptocurrencies are regularly linked to its predominant effect. Whenever Bitcoin exhibits a rapid price movement in the market, the majority of the critics tagged the digital currency with extreme volatility and state that it would eventually lead to its downfall, since crypto assets cannot be trusted on a long term basis.

This assumption was recently widely questioned as data showed that over the last few months, the volatility rate had actually decreased for Bitcoin but the community continued to talk against the coin’s development solely on the basis of the crash witnessed by BTC after the bull run of 2017.

Pierre Rochard, a bitcoin enthusiast, recently spoke about the situation and stated, that the volatility might actually be one of the reasons why Bitcoin was starting to find prominent success in the market.

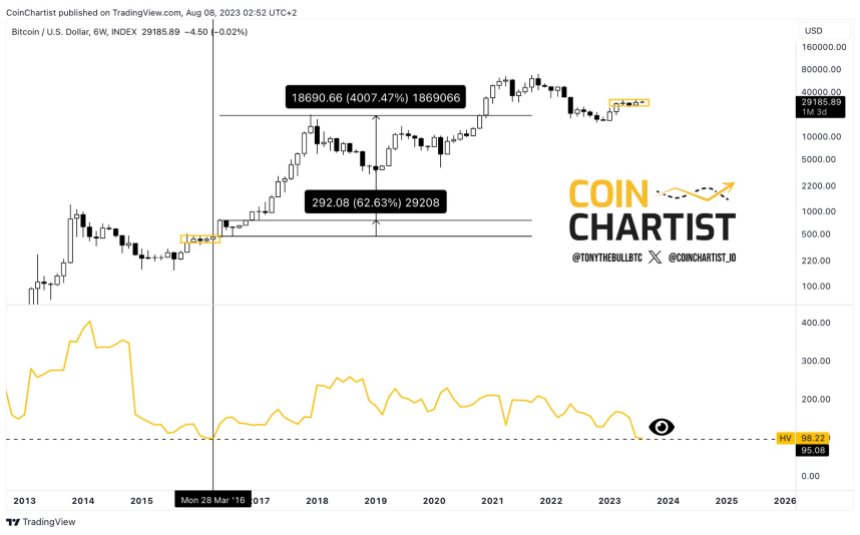

It was suggested that Bitcoin had been accumulating value over the years through various implementations and at specific time frames, short-term traders were causing an effect on the price, which would cause the “incidental price surge”. The price surge would then undergo correction and witness a fall but the price would continue to grow at a progressive rate.

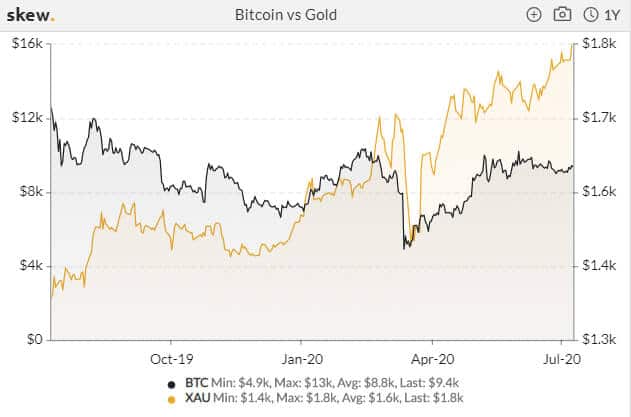

The aforementioned reason can be backed by the fact that Bitcoin had indeed outperformed the likes of commodities like gold in the recent market analysis, and it was released that Bitcoin attained more profit in the long-term returns and risks asset trade in comparison to the S&P 500.

A recent data also exhibited that since 2013, any investment that included 5 percent Bitcoin to 95 percent fiat currency gathered more returns and lesser risk than the S&P 500; which also witnessed losses in 2017.

Twitter user @1Mark Moss indicated that Bitcoin was growing at it’s natural growth rate and stated,

“The volatility is the difference between perception and reality. And the reality is BTC continues to progress, just not as fast as the perception makes it seem sometimes… just part of the natural evolution.”

However, another user @JordiMorris1 explained that the people had more to do with the volatility and anything else. He said,

“The relationship of people towards Bitcoin is volatile. Bitcoin is predictible by nature, its production is stable independently of how crazy people go about Bitcoin. No sense to blame on Bitcoin.”

The post Bitcoin’s volatility – an indication of growth or regression? appeared first on AMBCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|