2018-9-4 18:09 |

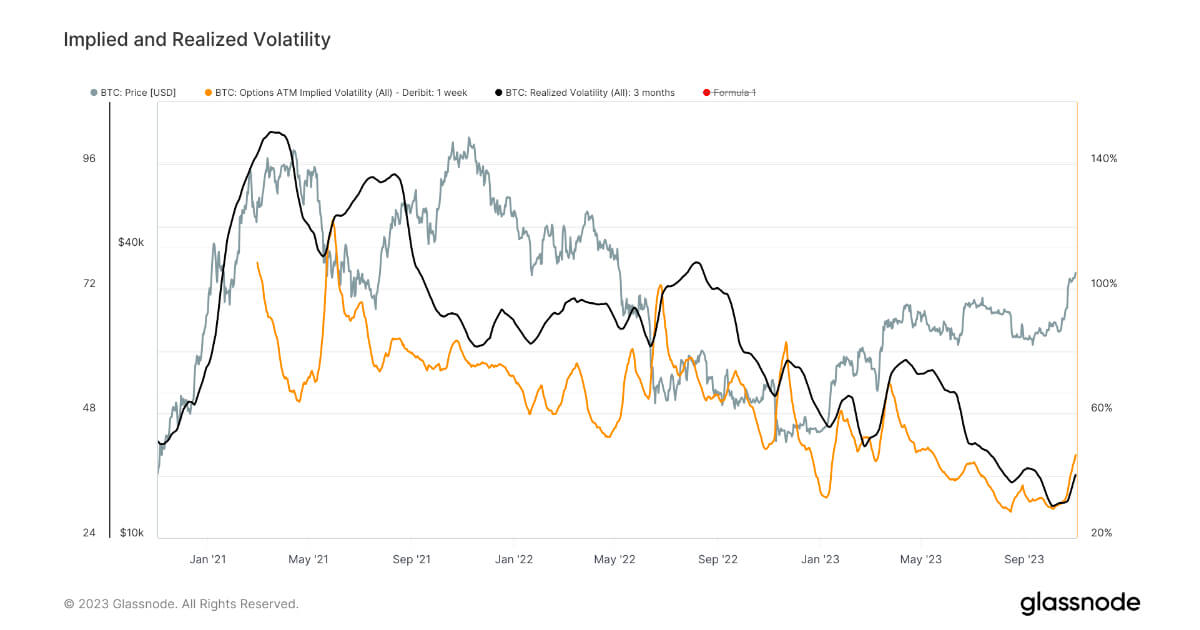

Bitcoin volatility is at one of its lowest ebbs in the past 12 months, although it is expected to be more a temporary blip rather than a permanent trend.

Data collected from CryptoCompare shows bitcoin volatility is well below other price movements experienced throughout the year, as well as at the end of 2017.

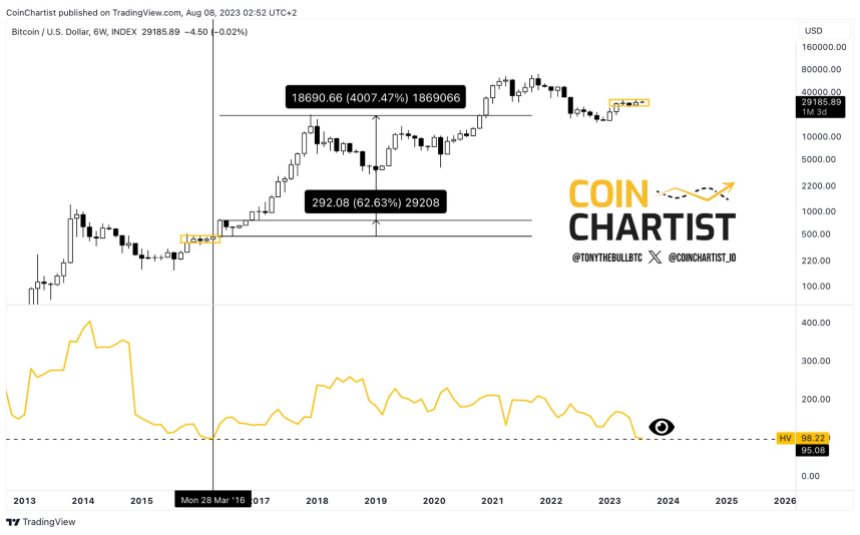

The BTC 7-day volatility average is currently at 8.88%, the lowest range since July of last year. Weekly price fluctuations have mostly been above 20% since the start of 2018; ranges could sometimes be well above 30% or 40%, especially at the beginning of the year.

Bitcoin volatility reached 74%, following an unexpectedly bullish Senate Committee hearing in early February. When the BTC price fell by over $1,000 in early June, its range nearly tripled from 10% to 29% in the space of two days.

Bitcoin volatility is at its lowest levels since September 2017

A volatile issue…

Low volatility is something of a double-edged sword for the crypto community. Returns made from savvy – or lucky – investments are likely to decrease, but so will the risk. This might lead to a decline in short-term speculation and the beginning of a long-term culture of investment into viable projects.

CEO of ShapeShift, Erik Voorhees, said low volatility would be met with mixed responses from the community but still offered a good mixture of short-term returns and long-term security and utility, on balance.

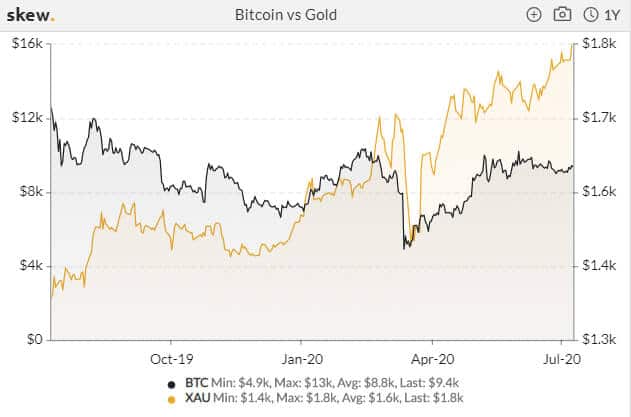

“For financial traders (and many other group segments), high volatility is the digital gold rush that they’re chasing after”, Voorhees said in an email. “For those groups, crypto is still a highly volatile asset class compared to anything traditional…regardless of traders, many crypto users still strongly prefer to see a stable digital currency. To those users, low volatility may be seen as a sign that Bitcoin and other assets are becoming stable enough to be used as currencies.”

It’s a mixed picture for other cryptocurrencies in the top-ten. Ether’s (ETH) price range has been comparatively high over the past month. ETH’s 7-day volatility sat at just under 50% last week, although it fell to 15% by the end of August; it is currently at 17%.

Bitcoin Cash (BCH) has bucked the trend, with a noticeable increase in volatility currently at 41%. This followed a successful stress test at the weekend, which showed the BCH network could process over 2m transactions without any significant increase in fees. Bitcoin Cash’s market cap went up by over $1bn at the news.

Can bitcoin volatility ever return?Low volatility could suggest traders and investors are beginning to build up a more accurate picture of bitcoin’s actual value. High volatility happens in periods of market disruption; a significant influx in new investors at the tail-end of 2017 led to the BTC price nearly hitting $20,000.

Hopes were high for a significant market upswing in 2018 but this has yet to materialize; despite the predictions made by bullish analysts, and this author, earlier this year.

It’s fashionable to imagine the halcyon days of wild, exciting swings are safely confined to the past. That said, this period of low volatility could be temporary; it can be easy for price trends to pick-up momentum in the crypto-sphere. When the SEC postponed its decision on CBOE’s Bitcoin ETF proposal, the market took a $70bn hit and is only now starting to recover.

“Even a year of low volatility will likely be followed by a new phase of high growth and thus more volatility”, said Voorhees. “As these markets continue to mature, volatility will diminish over the very long term, but from past experience, we’re simply in a local lull.”

“The huge swings in value that we saw through December and January are still fresh in people’s minds, and such expectations that this will return could easily be a self-fulfilling prophecy in the future,” he added.

The logic goes that when cryptocurrencies develop viable use cases, prices will stabilize. Isaac Newton, who formalized the law of gravity once despaired: “I can calculate the motion of heavenly bodies, but not the madness of people”.

It may take more than utility before cryptocurrencies begin to stabilize.

The author is invested in BTC and ETH, which are mentioned in this article.

The post Year-Low Bitcoin Volatility A Temporary ‘Lull’, Says Voorhees appeared first on Crypto Briefing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|