2020-9-23 00:30 |

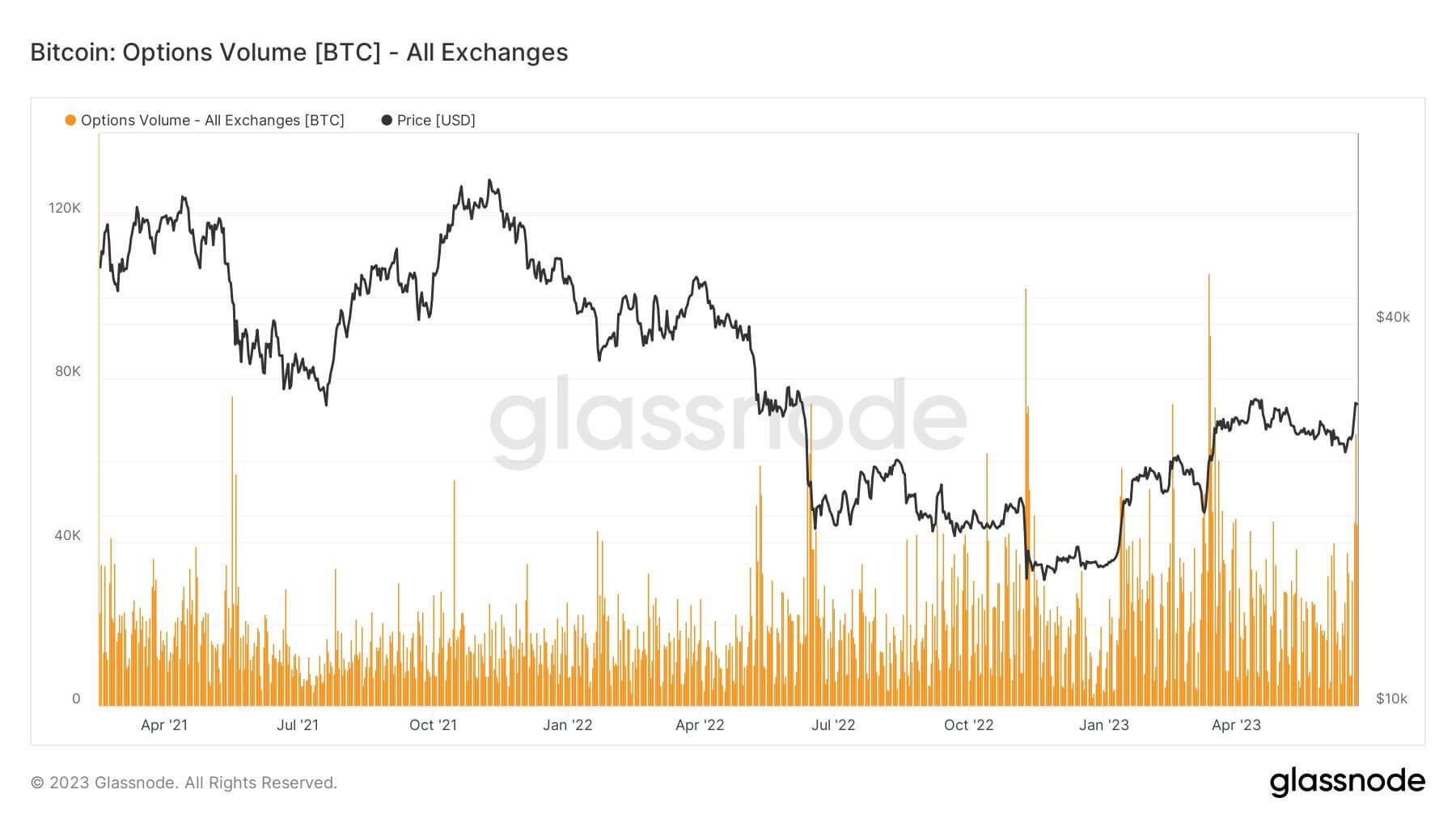

Markets are expected to be volatile this week, as a great number of bitcoin and ethereum options are set to expire this Friday. Data shows more than 87,000 bitcoin options will expire and 77% of the action is held on the Deribit exchange.

U.S. stocks dropped hard on Monday, as the Dow Jones Industrial Average dropped more than 700 points during the stock market’s afternoon trading sessions.

Meanwhile, bitcoin (BTC) took a hit on spot markets dropping over 4% in value. A number of other cryptocurrencies like ethereum (ETH -8%) lost even bigger percentages on Monday. However, crypto analysts are eying this Friday’s crypto options expiries, as there’s a large number of derivatives contracts across Deribit, Okex, Ledgerx, CME Group, Huobi, Bakkt, and Bit.com that will expire.

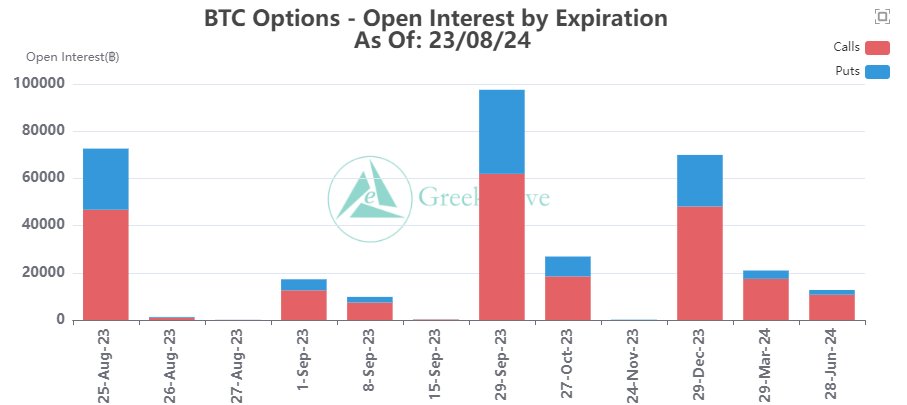

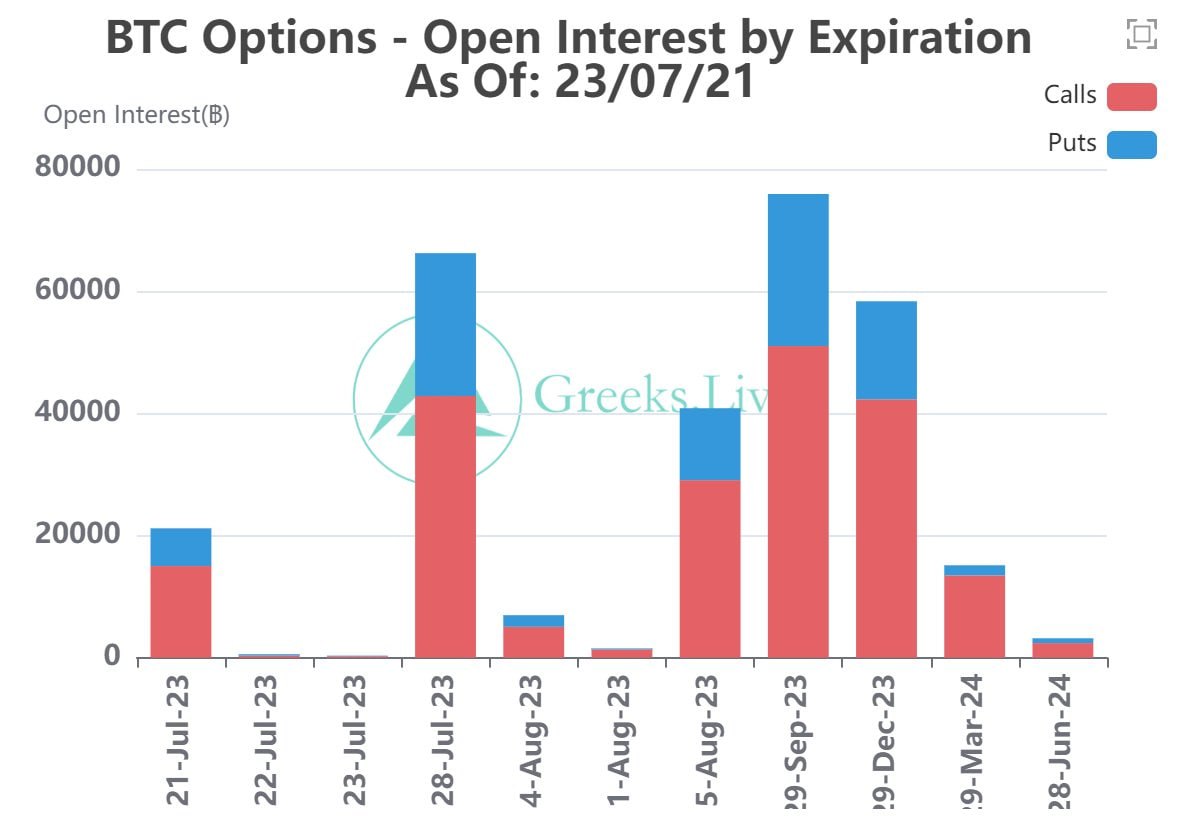

Data from Deribit shows there are over 87,000 BTC options that are set to expire this Friday. The exchange also details that 67k worth of those options (77%) are held on Deribit. Moreover, 459k worth of ETH options are set to expire on the same day and 414k or 90% is also held on Deribit.

The other three competitors, that pale in comparison to Deribit’s numbers, include; CME Group, Okex, and Ledgerx respectively.

On Monday morning (ET), Deribit’s Head of Risk and Product, Shaun Fernando, spoke about BTC’s volatility and the coin’s price action this month. “In the month of September, we have seen the BTC price trading between USD $10k and $12k,” Fernando said.

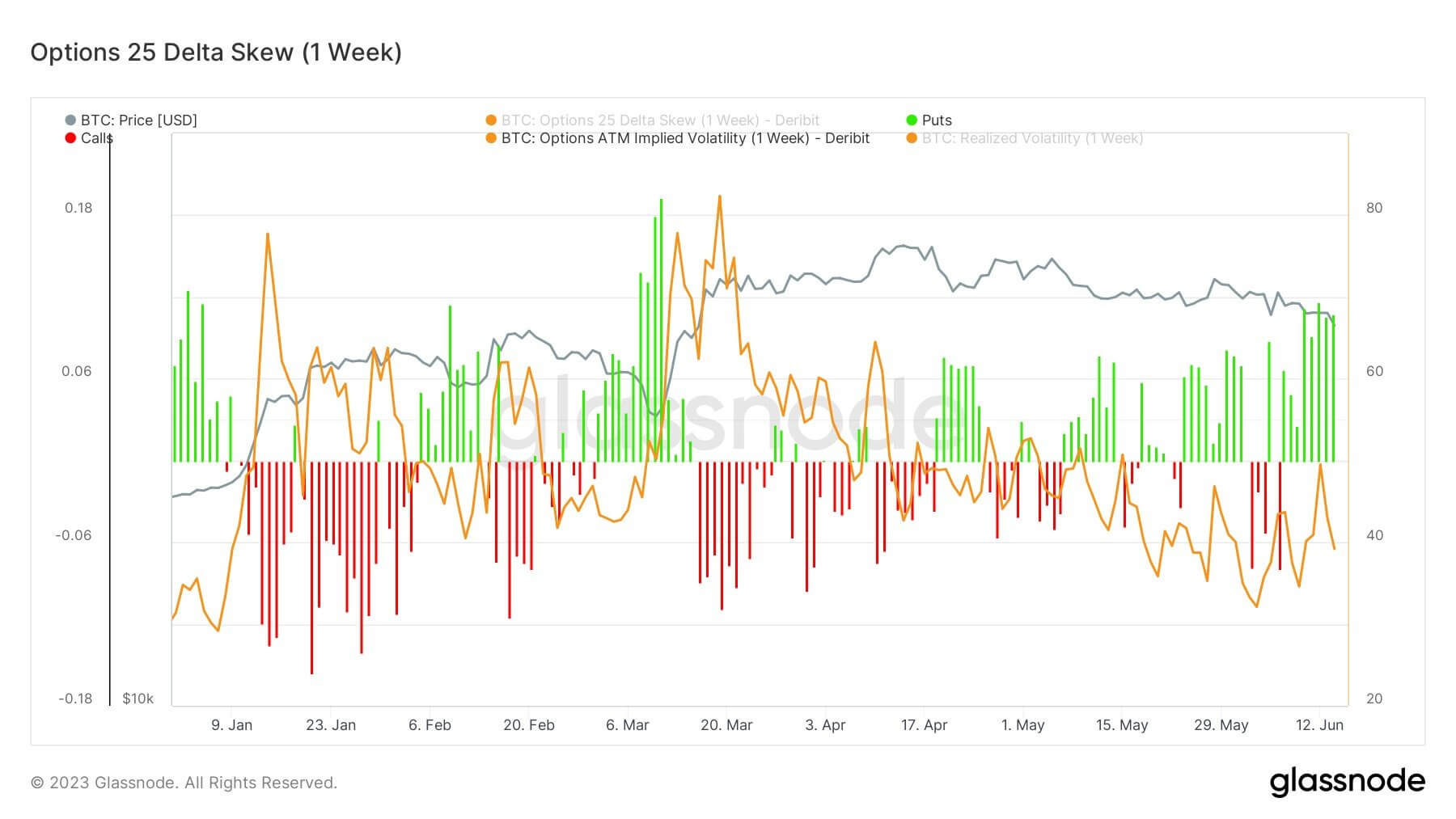

“The 1 month ATM volatility hit a high of 70% before falling to its level of 46% and we have seen volatility in the skew.”

Fernando further added:

The Deribit Index is currently trading more than 2.5% below the settlement of nearly 4 hours ago which could suggest some interesting realised vs implied strategies. If the trend carries, expect a run on vol. If we bounce back, we could see some interesting moves around the 11k strike where over 10% of the Sep open interest is stacked.

The researchers from Skew.com spoke about the cryptocurrencies implied volatility as well on Twitter. “Some capitulation in bitcoin,” Skew wrote. Options market as trading remains rangebound, one-month implied vol

There’s been a number of occasions where crypto derivatives produced volatile crypto spot markets, while other times expiry dates can be lackluster.

What do you think about the number of BTC and ETH options that are set to expire on Friday? Let us know what you think in the comments section below.

The post Turbulent Crypto Markets Expected – 87K Worth of Bitcoin Options Set to Expire on Friday appeared first on Bitcoin News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|