2024-10-12 10:39 |

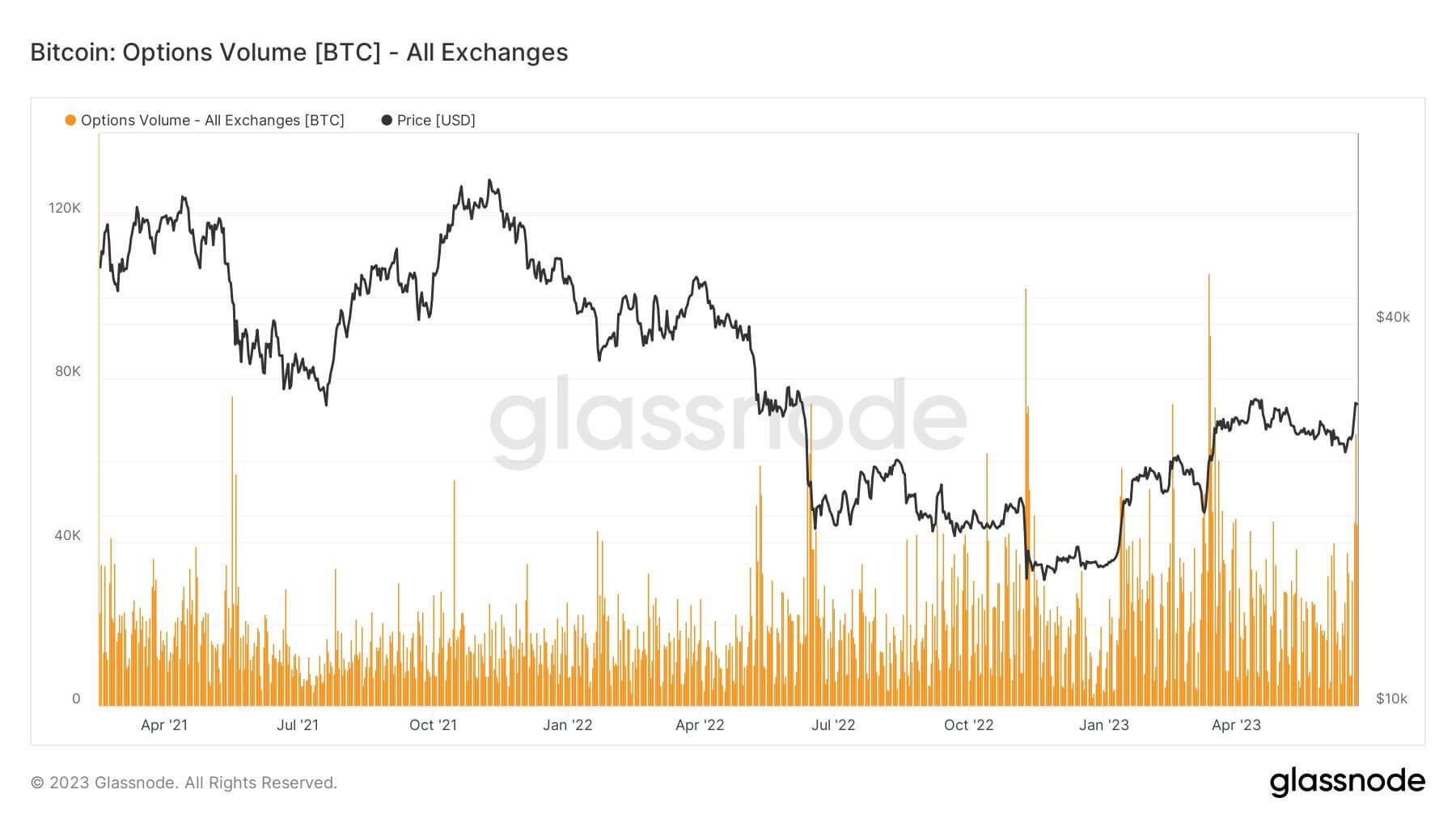

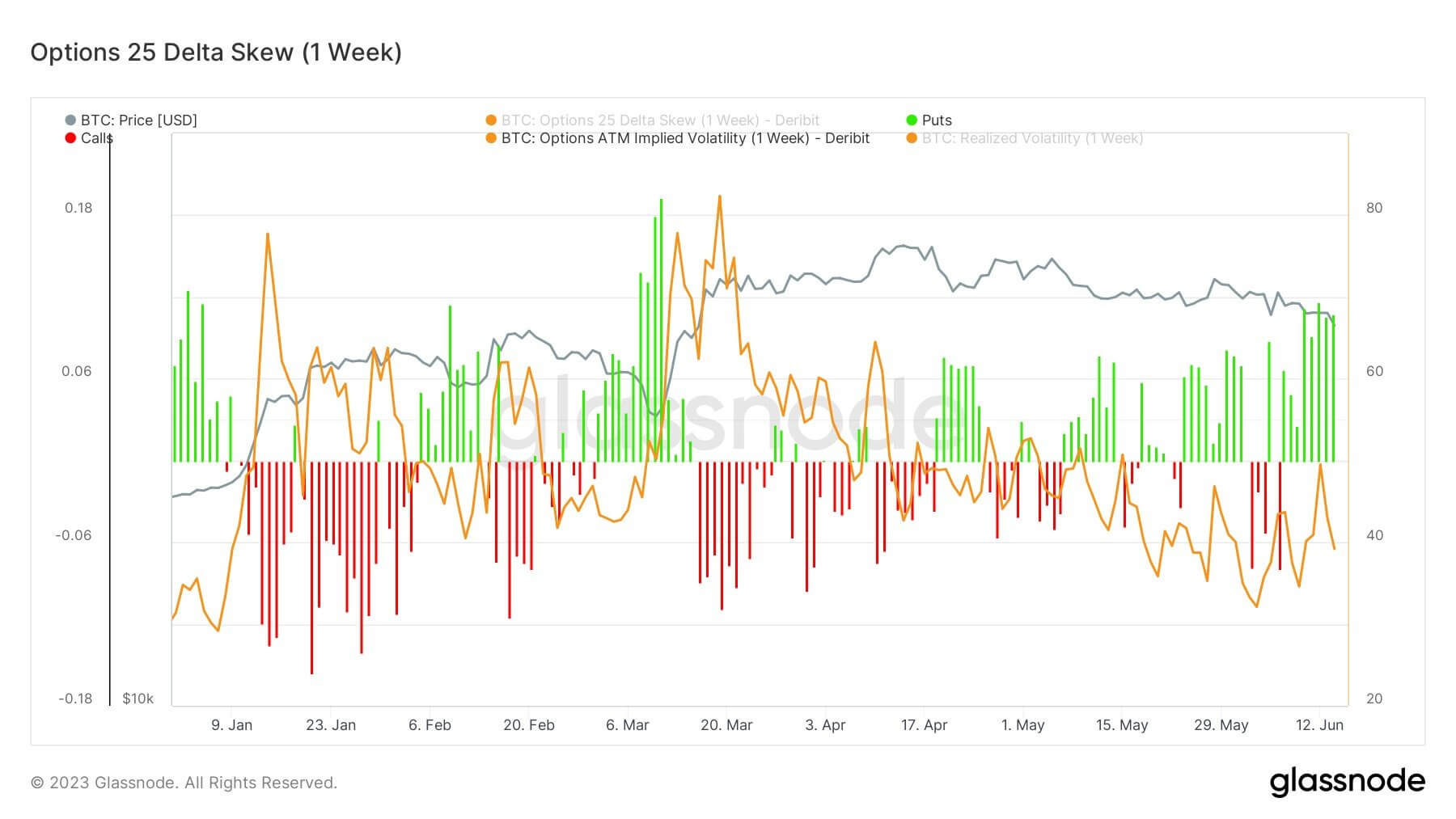

As the crypto market braces for the upcoming expiration of Bitcoin and Ethereum options, traders are closely watching pivotal price levels.

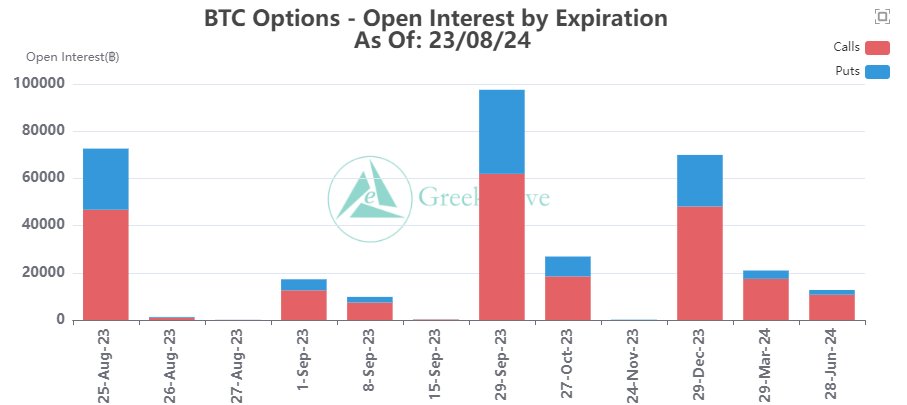

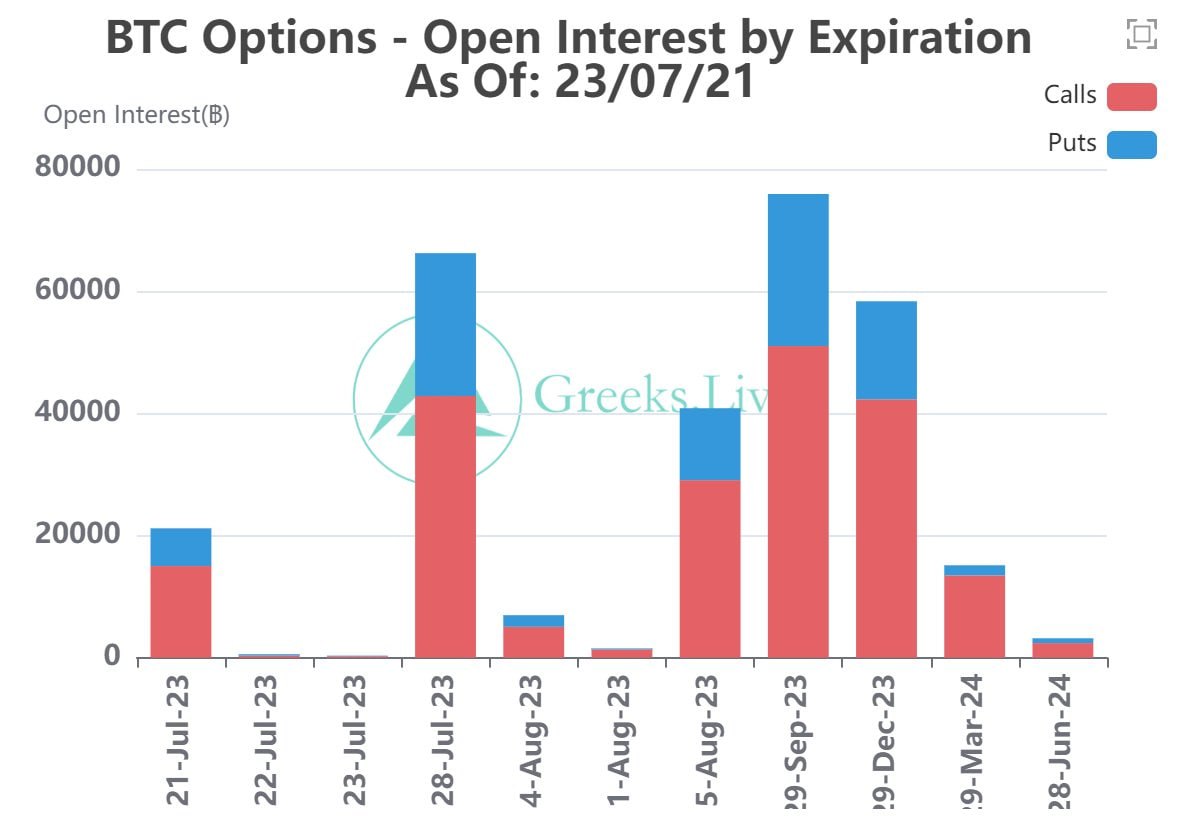

A significant $1.10 billion in Bitcoin options and $466 million in Ethereum options are set to expire, bringing the “max pain” price into focus—$62,000 for Bitcoin and $2,500 for Ethereum.

These price points are critical, as they represent the level at which the largest number of options contracts could expire worthless, drawing strong market intrigue.

$BTC and $ETH options are set to expire, spotlighting a hefty $1.10 billion in Bitcoin and $466 million in Ethereum.

The max pain price hits $62,000 for Bitcoin and $2,500 for Ethereum, signaling strong market intrigue at these pivotal strike points. pic.twitter.com/UXZln8KtH7

— Kyledoops (@kyledoops) October 11, 2024

Ethereum’s key support zone is currently at $2,300, where around 2.4 million addresses have purchased a total of 52.6 million ETH. If the price dips below this level, it could trigger a wave of selling pressure as investors seek to minimize their losses, potentially leading to a further decline. This support level is seen as crucial for Ethereum’s short-term stability, and market participants are keeping a close eye on this zone.

The key support level for #Ethereum is $2,300, where 2.4 million addresses purchased 52.6 million $ETH. If this demand zone fails, it could lead to a sell-off as investors might look to minimize losses. pic.twitter.com/boQLSS5iE1

— Ali (@ali_charts) October 11, 2024

Institutional Players Adjust Their Portfolio As ETFs Data Comes To LightMeanwhile, institutional players like BlackRock are actively adjusting their crypto portfolios. Recently, BlackRock sold 182 Bitcoin, worth approximately $11.34 million, reducing its Bitcoin holdings to 369,640 BTC, valued at $23.02 billion. At the same time, the asset management giant has increased its Ethereum holdings, purchasing 7,574 ETH for $18.52 million. BlackRock now holds a total of 414,168 ETH, valued at over $1 billion.

BlackRock sold $BTC and bought $ETH!

BlackRock sold 182 $BTC($11.34M) and currently holds 369,640 $BTC($23.02B).https://t.co/kqNUqHBiTn

BlackRock bought 7,574 $ETH($18.52M) and currently holds 414,168 $ETH($1.01B).https://t.co/sefS6WTlHz pic.twitter.com/ljZW1Nn1xc

— Lookonchain (@lookonchain) October 11, 2024

Additionally, on October 10, Ethereum spot ETFs saw a net inflow of $3.06 million, indicating growing interest from institutional investors despite the recent market volatility.

On October 10, the total net outflow of Bitcoin spot ETF was $121 million, and the net inflow of Ethereum spot ETF was $3.06 million. https://t.co/59u0BnEqLG

— Wu Blockchain (@WuBlockchain) October 11, 2024

With these key events unfolding, the next few days could bring heightened volatility to the crypto market, as traders and investors alike monitor these crucial price levels and the impact of options expiration on the broader market.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news!

Image Source: promesaartstudio//123RF // Image Effects by Colorcinch origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|