2026-1-30 08:07 |

Roughly $8.8 billion worth of Bitcoin and Ethereum options expire today, January 30, 2026, marking the first monthly options expiry of the year.

It places renewed focus on Bitcoin’s struggle to reclaim the $90,000 level, as the pioneer crypto continues to drift further away from it.

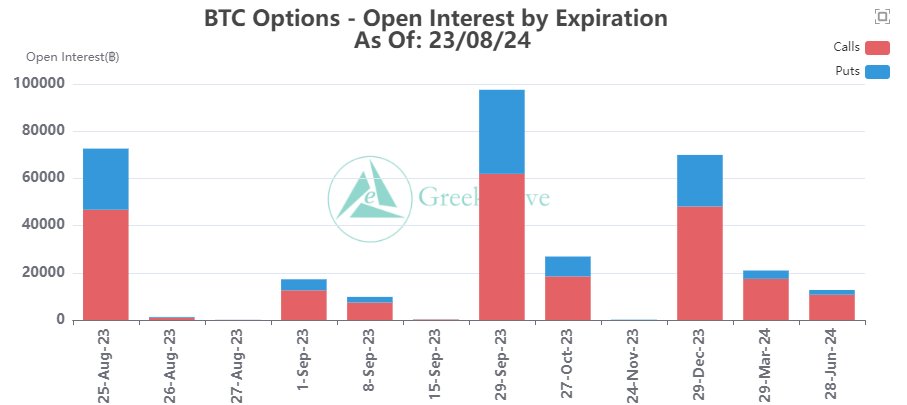

Options Market Signals Caution as Bitcoin Drifts Further Below $90,000The bulk of today’s exposure sits in Bitcoin options, which account for $7.54 billion in notional value, while Ethereum options make up a further $1.2 billion.

Bitcoin is currently trading at $82,761, well below its $90,000 max pain level. Despite the pullback, positioning remains structurally bullish.

Call open interest stands at 61,437 contracts, compared to 29,648 puts, pushing the put-to-call ratio (PCR) down to 0.48. Total open interest across Bitcoin options stands at 91,085 contracts, highlighting the scale of leverage and positioning ahead of expiry.

Bitcoin (BTC) Expiring Options. Source: DeribitHowever, beneath the surface, trader behavior is becoming increasingly defensive. Analysts at Deribit noted that while Bitcoin remains range-bound, demand for downside protection has risen sharply heading into expiry.

“…demand for downside protection has ramped up, showing that traders are cautious even as positioning is still skewed bullish,” Deribit analysts said.

They added that the options expiry could amplify moves around key levels, especially around the pain zones. This assumption holds because prices tend to gravitate toward the max pain levels as options near expiry.

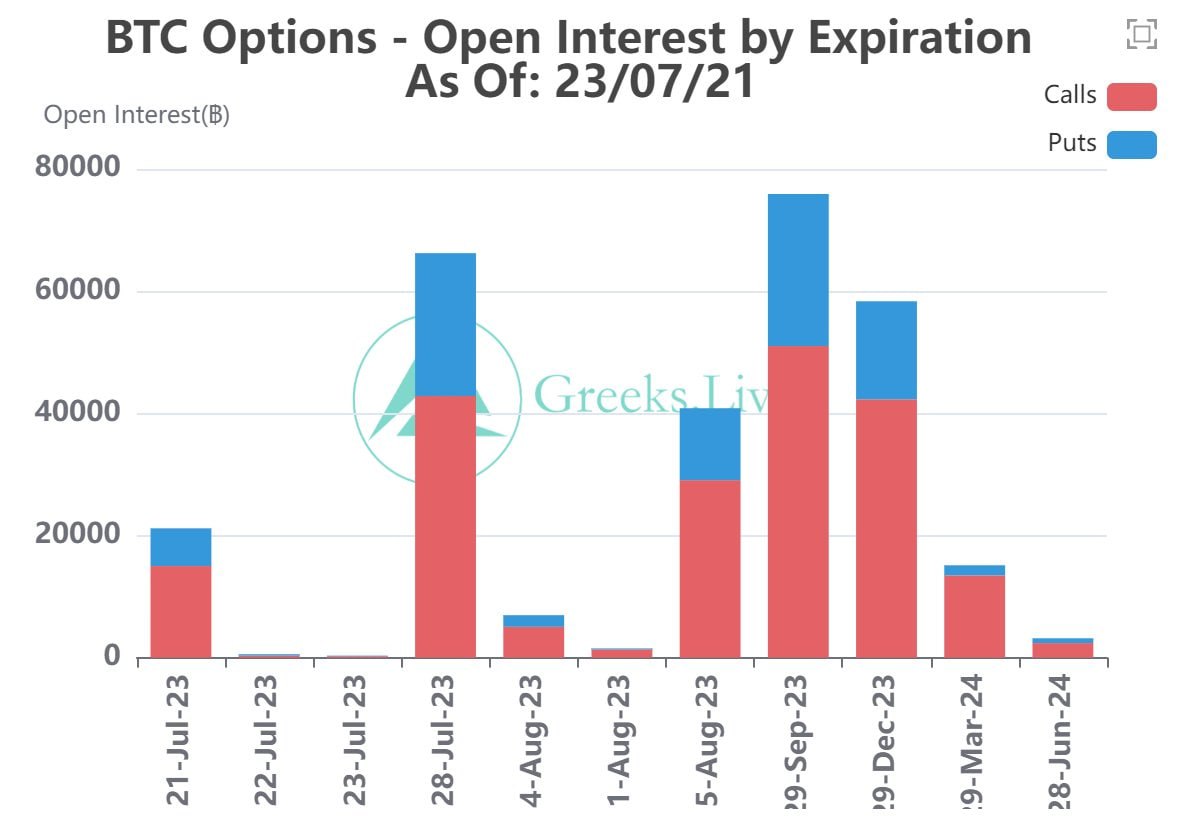

Ethereum reflects a similar, though slightly more balanced, setup. ETH is trading at $2,751, below its $3,000 max pain level. Total open interest in Ethereum options stands at 439,192 contracts, with call open interest at 257,721 and put open interest at 181,471. The resulting put-to-call ratio of 0.70 suggests more two-sided positioning compared to Bitcoin, but still points to caution rather than outright bearishness.

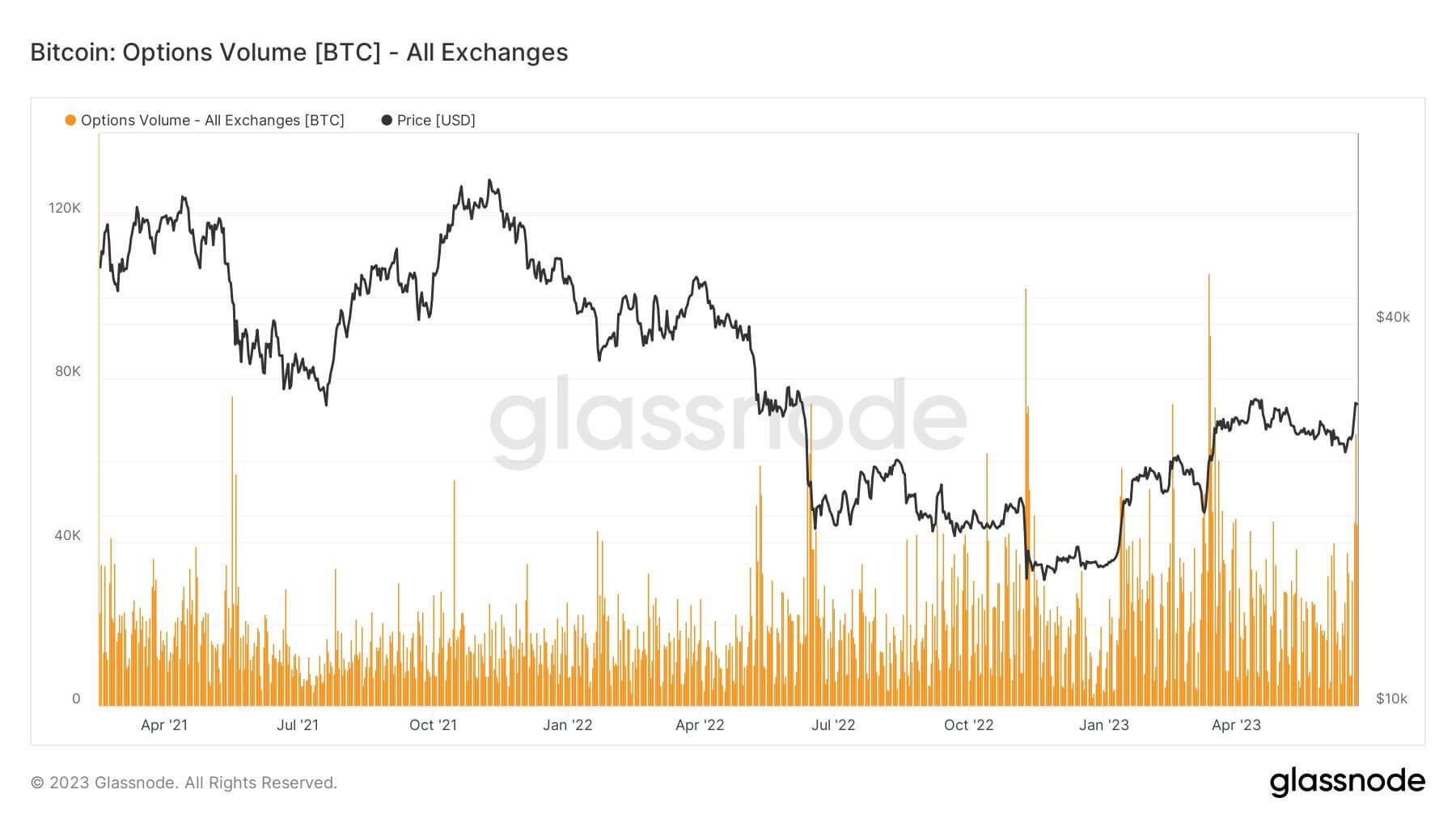

Ethereum (ETH) Expiring Options. Source: Deribit Fading Volatility and Growing Liquidity Risks Set the Stage for January Options ExpiryAt the macro level, volatility expectations continue to fade. According to analysts at Greeks.live, implied volatility (IV) has been grinding lower, reinforcing a broader consolidation across crypto markets.

“[Today] marks the first monthly expiration date of 2026, with over 25% of options positions set to expire,” Greeks.live said.

As expected, the Federal Reserve did not cut interest rates, and with no major events on the horizon, the market remains remarkably stable, with implied volatility (IV) continuing its downward trend. Bitcoin’s price action reflects that stability.

Greeks.live noted that Bitcoin has “retreated back into its consolidation range in the latter half of the month,” with $90,000 acting as firm resistance.

“No decisive factors appear imminent to break this stalemate,” the analysts added, suggesting that the options expiry itself may become one of the few near-term catalysts for price movement.

Still, risks are building beneath the calm surface. Greeks.live highlighted recent large-scale institutional outflows into exchanges, which have increased liquidity pressures across the crypto market.

Crypto-related US equities have also weakened, contributing to a sentiment shift that is gradually turning pessimistic. Amid broader geopolitical tensions and rising fear, uncertainty, and doubt, negative sentiment has continued to intensify.

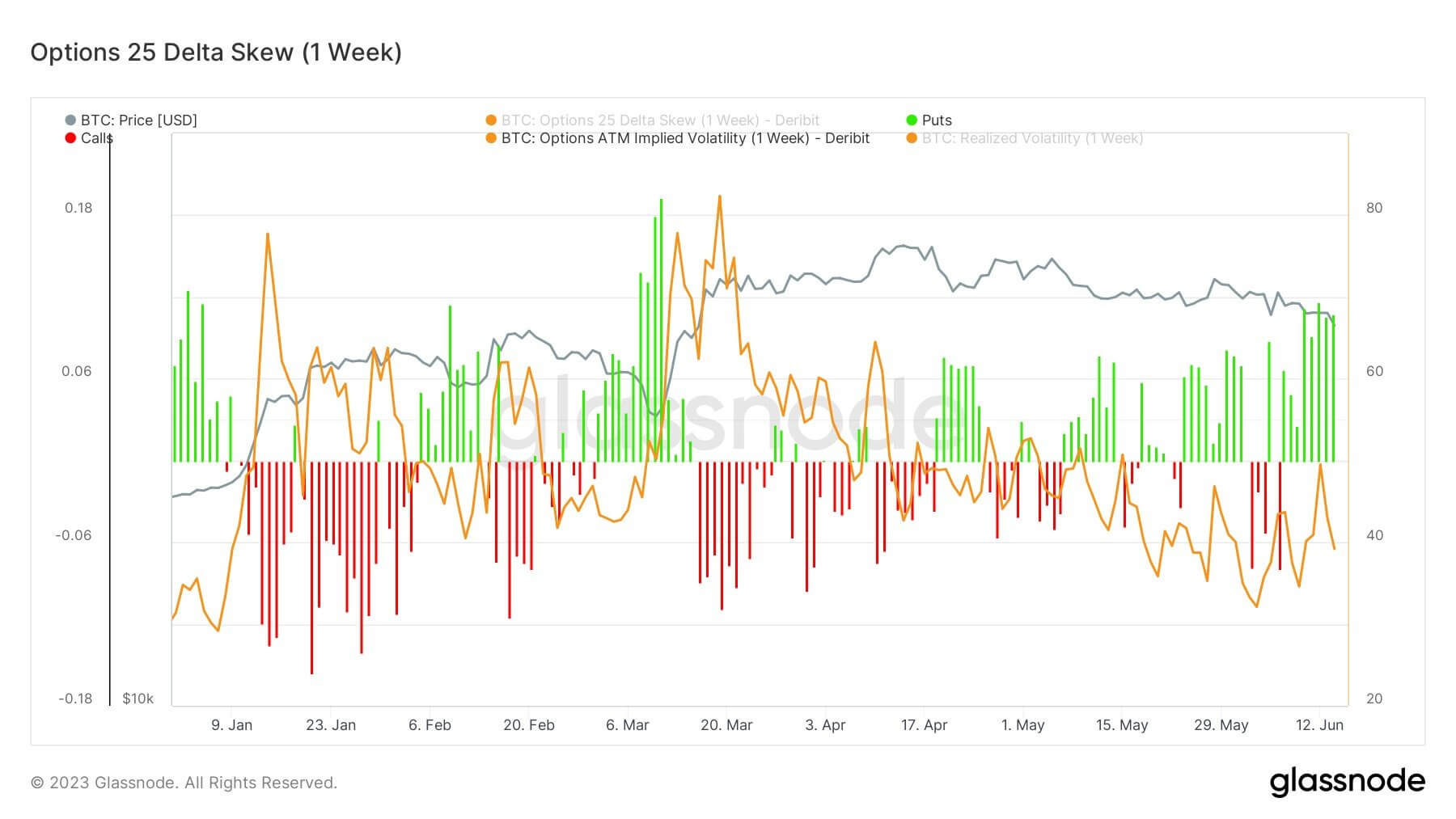

Ahead of the Federal Reserve’s rate decision, some traders had already moved to hedge short-term volatility by purchasing downside protection, a trend that has persisted even after the central bank opted to hold rates steady.

With no clear macro catalyst on the immediate horizon, traders now appear braced for potential short-term dislocations around the options expiry, hedging against downside risk while waiting for a decisive break from Bitcoin’s $80,000 to $90,000 range.

The post $90,000 Loses Its Pull on Bitcoin as $8.8 Billion Options Expiry Approaches appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|