2021-10-19 01:52 |

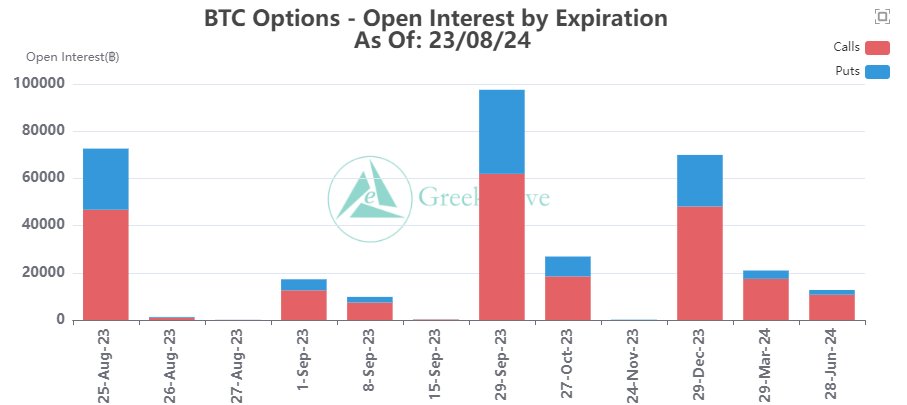

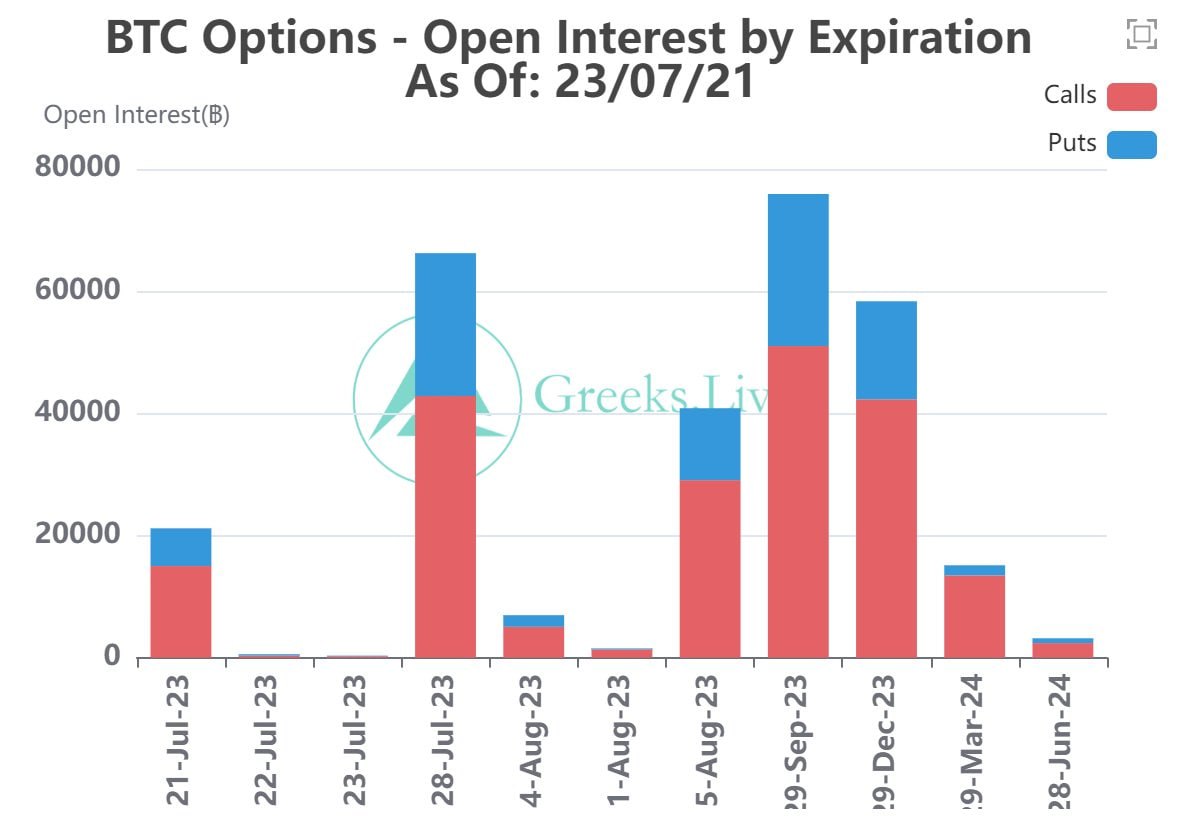

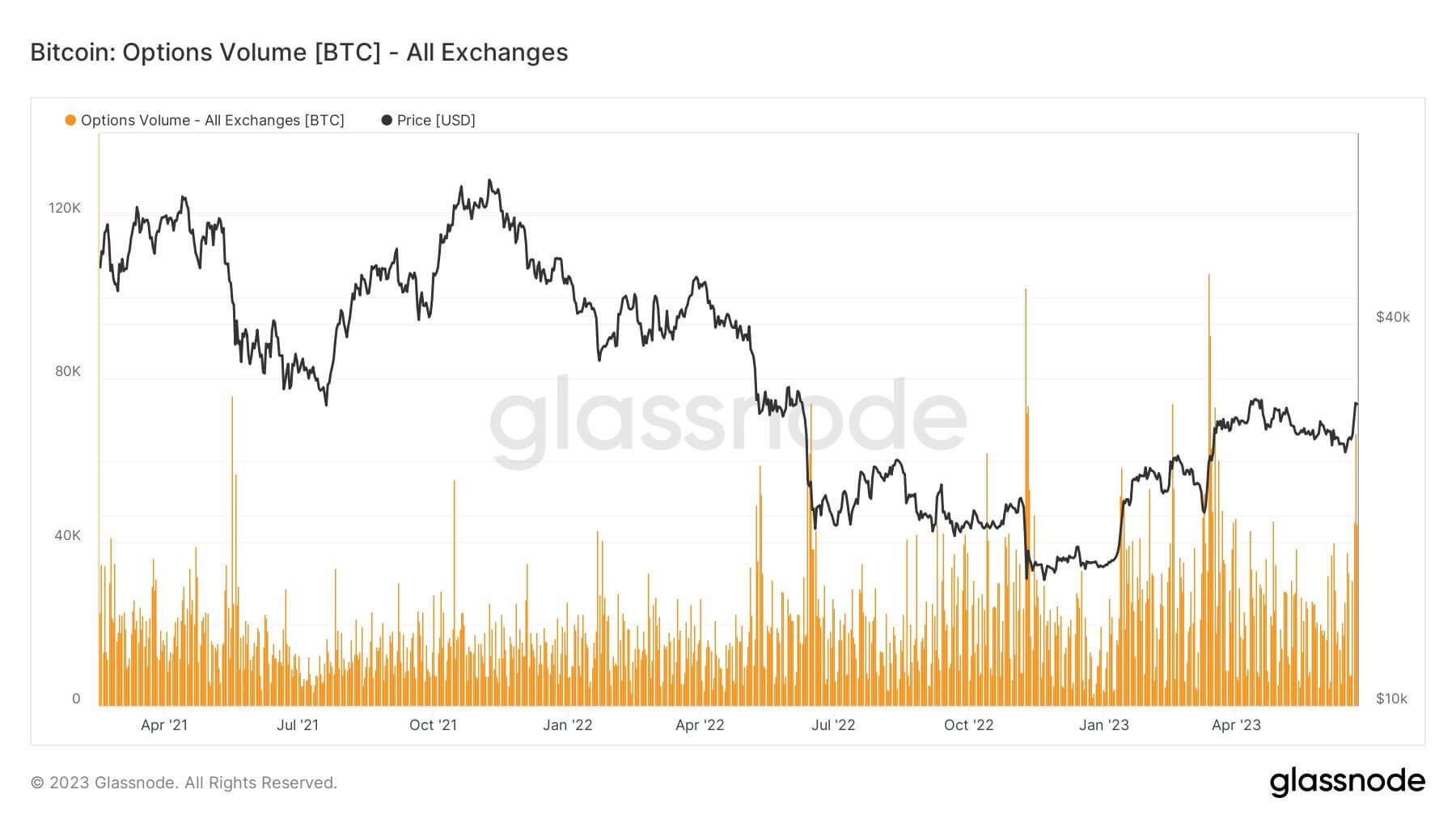

Bitcoin derivatives markets are experiencing increased enthusiasm as Bitcoin price pulled past $61,000 on Monday, with open interest in Bitcoin options increasing by 107% over October alone. This week, the weekly options volume reached $1.5B and the trend aligns with the overall bullish market sentiment according to the latest market review by Glassnode analysts.

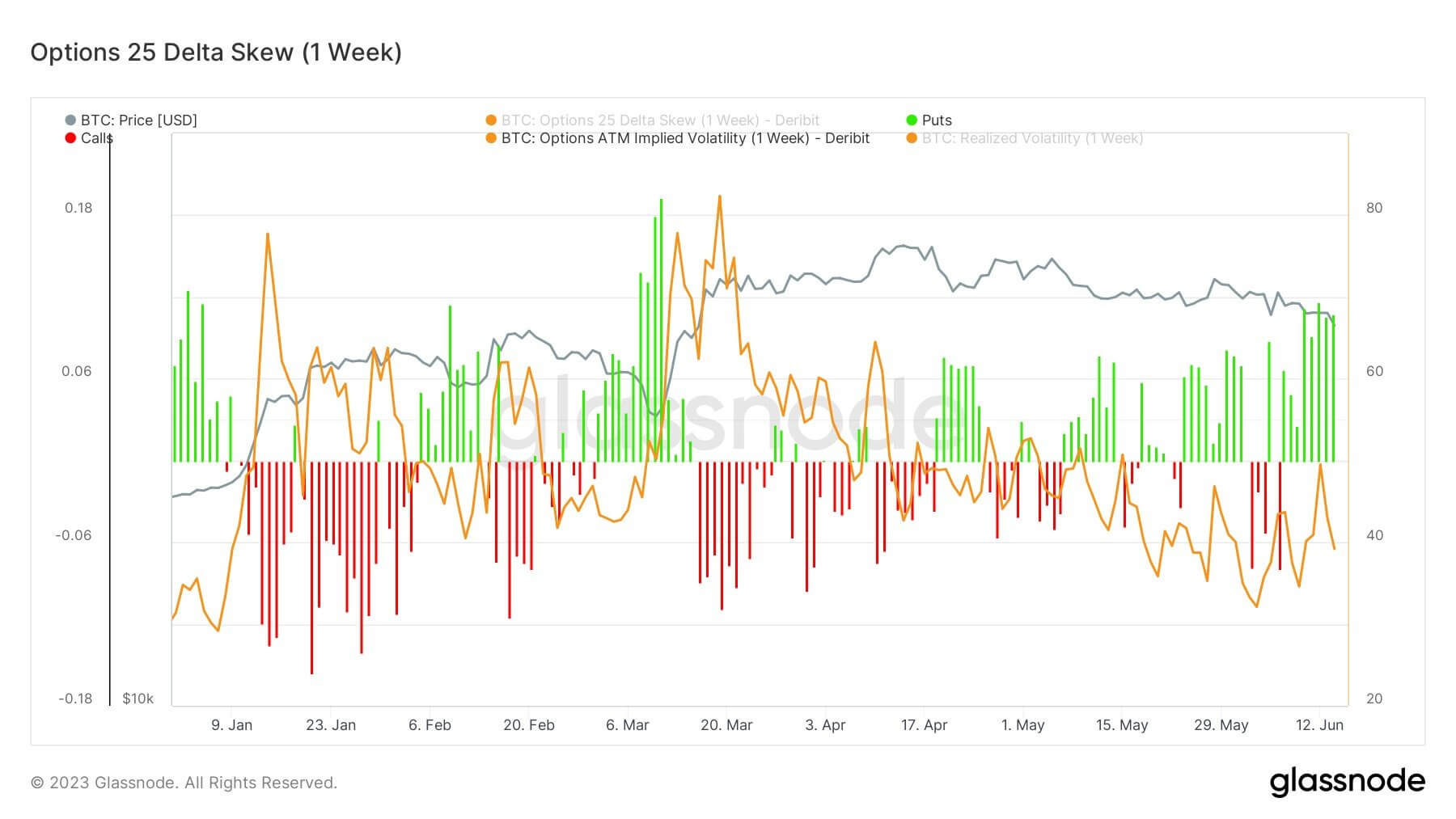

“The favored options contracts appear to be call options with strike prices above $100,000 with a typical open interest of $250 million to $350 million for call options expiring at the end of the year. The open interest in call options dwarfs that in the put options, aligning with the overall bullish market sentiment.”

Options are derivative contracts in which the trader has the right but not obligation to buy or sell an asset at a given future price. Therefore, with Bitcoin options, you can continue speculating the price without having to buy or sell it at the expiry date. A put option is made to short Bitcoin while a call is a buy trade done in expectation for the price to increase. Unlike them, futures must be bought or sold at a given price on expiration.

Increased interest in options and futures markets also means more people are interested in leveraged trading. Bybit puts the total estimate of open interest in Bitcoin options at $13.9 billion as of today. The data also shows that majority of these options are being traded on Deribit, CME, and LedgerX exchanges.

Since most of what is being traded currently are buy options, the current increase in open interests in options may also be tied to the expected price pump after a possible approval of a Bitcoin ETF in the United States. There is no doubt that the increased interest signifies good days ahead in crypto markets, both in spot and derivative markets. More participants keep entering the market.

Meanwhile, as part of the increased attention to the futures market, the perpetual market open interest clocked 225,000 BTC this week according to Glassnode analysts, which brings with it some memories of long liquidations that followed after the huge spikes in open interest recorded in April, May, and September. In fact, according to the analysts, there may be an impending hefty liquidation given that the heightened futures open interest is not supported by substantial volumes.

“Despite futures open interest approaching ATHs, the volume traded appears to be declining on a macro scale and has been since the sell-off in May. In a high open interest but low volume environment, it could set the stage for heightened probabilities for a liquidation cascade, as volumes may be insufficient to support the flush out once it gets going.”

However, like the options open interest, Bitcoin futures open interest is not yet at its highest levels seen in March and April.

origin »Bitcoin (BTC) на Currencies.ru

|

|