2020-10-20 20:15 |

Trends in bitcoin options markets are making it difficult for financial analysts to pinpoint BTC’s next move. Data from CME’s recently published trader report shows that institutional investors are capturing a larger number of bitcoin long contracts, while hedge funds are showing an all-time high for bitcoin short contracts.

On Tuesday, the price of bitcoin (BTC) has been attempting to capture the $12k price zone and a number of people are focused on the crypto assets’ next moves. While a number of crypto traders are extremely bullish some people believe that digital currency derivatives markets may hold prices back. For instance, in response to BTC climbing toward the $12k zone, one individual wrote:

I am betting on futures/options holding it back a bit as a major factor- but we will see.

On October 16, the research and analysis firm Skew.com tweeted about data that stemmed from CME’s recently published Commitment of Traders (COT) report. CME’s report published on the Commodity Futures Trading Commission (CFTC) website gives explanatory notes about the weekly COT.

Skew tweeted a chart from the COT and said:

[Hedgefunds all-time short [and] institutions all-time long. Who is wrong?

The digital currency analyst, Mitchell Nicholson, replied to Skew’s tweet by saying many hedge funds “are likely shorting CME futures hedged to capture the basis or providing liquidity to the institutions going long.”

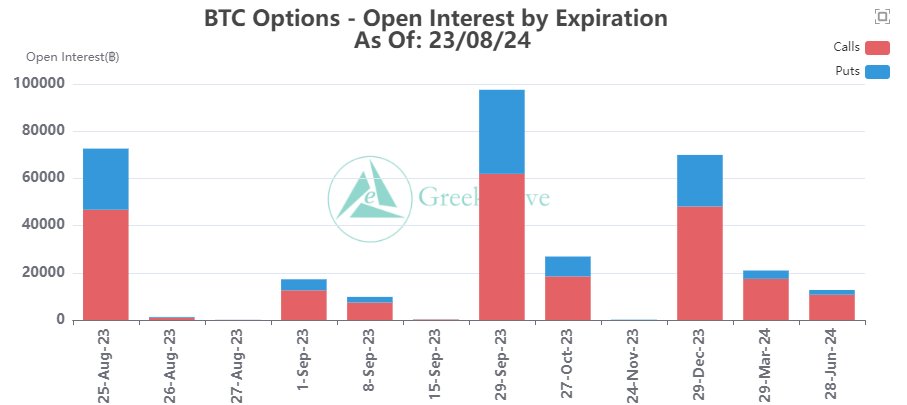

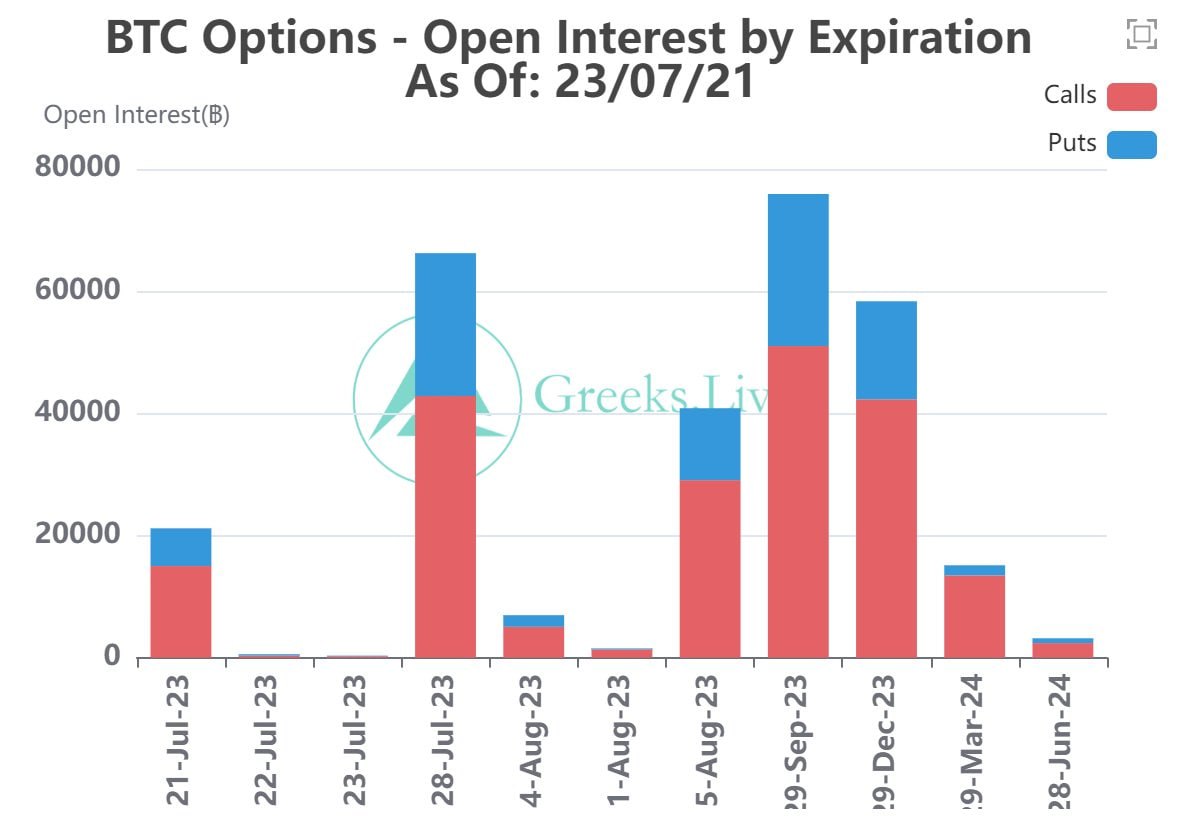

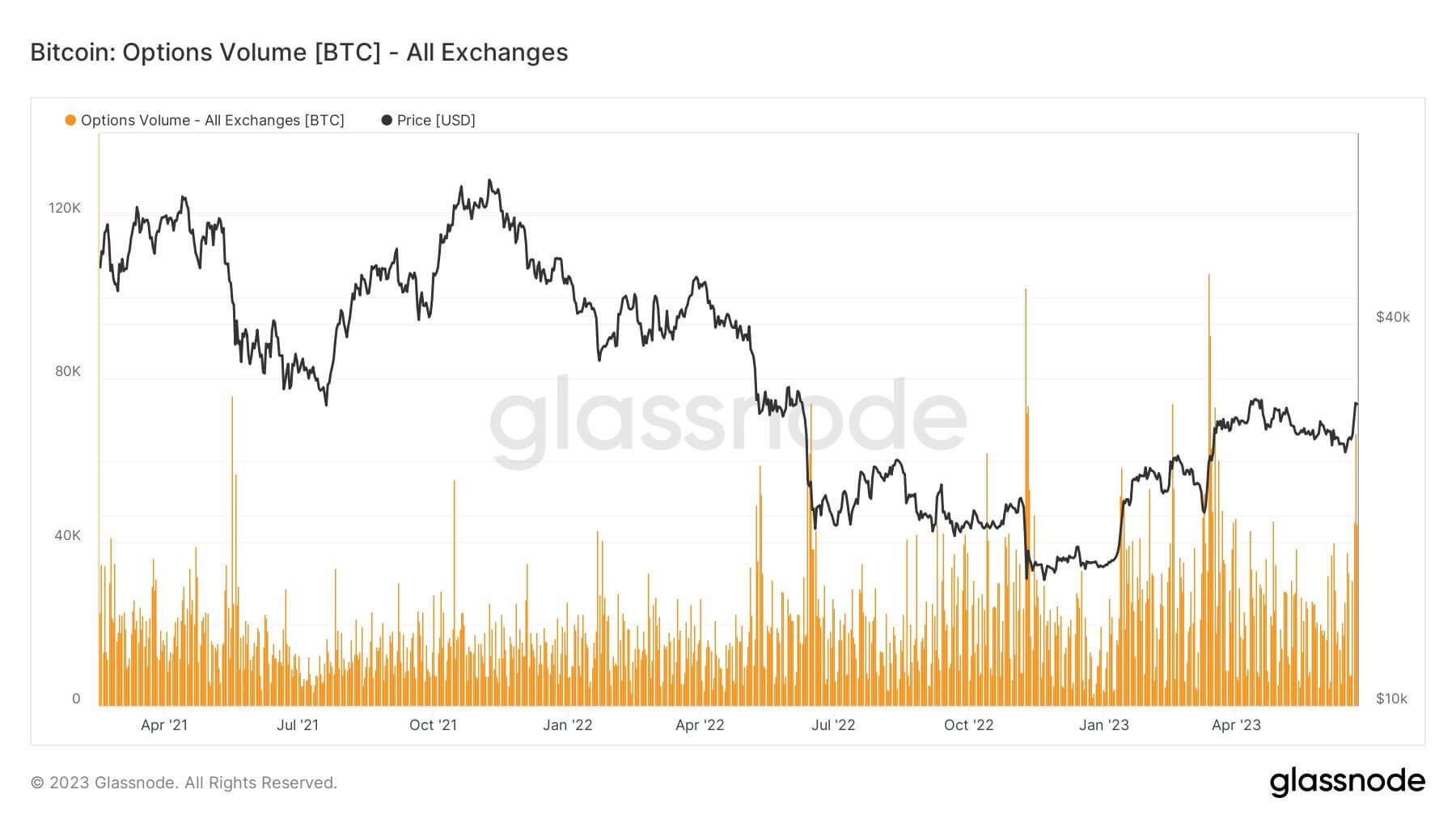

Statistics show that bitcoin options open interest stands at more than $2.5 billion on Tuesday (Oct. 20), as the trading platform Deribit dominates most of the bitcoin options action. Deribit captures $2.12 billion, while the Chicago Mercantile Exchange (CME) has around $139 million.

A number of traders don’t know which way the price will go even though BTC is up 24.8% for the last 90 days and up 45.1% during the last 12 months.

The options trader Theta Seek told his 9,000 followers that it’s hard to imagine a mega pump coming at the end of the year.

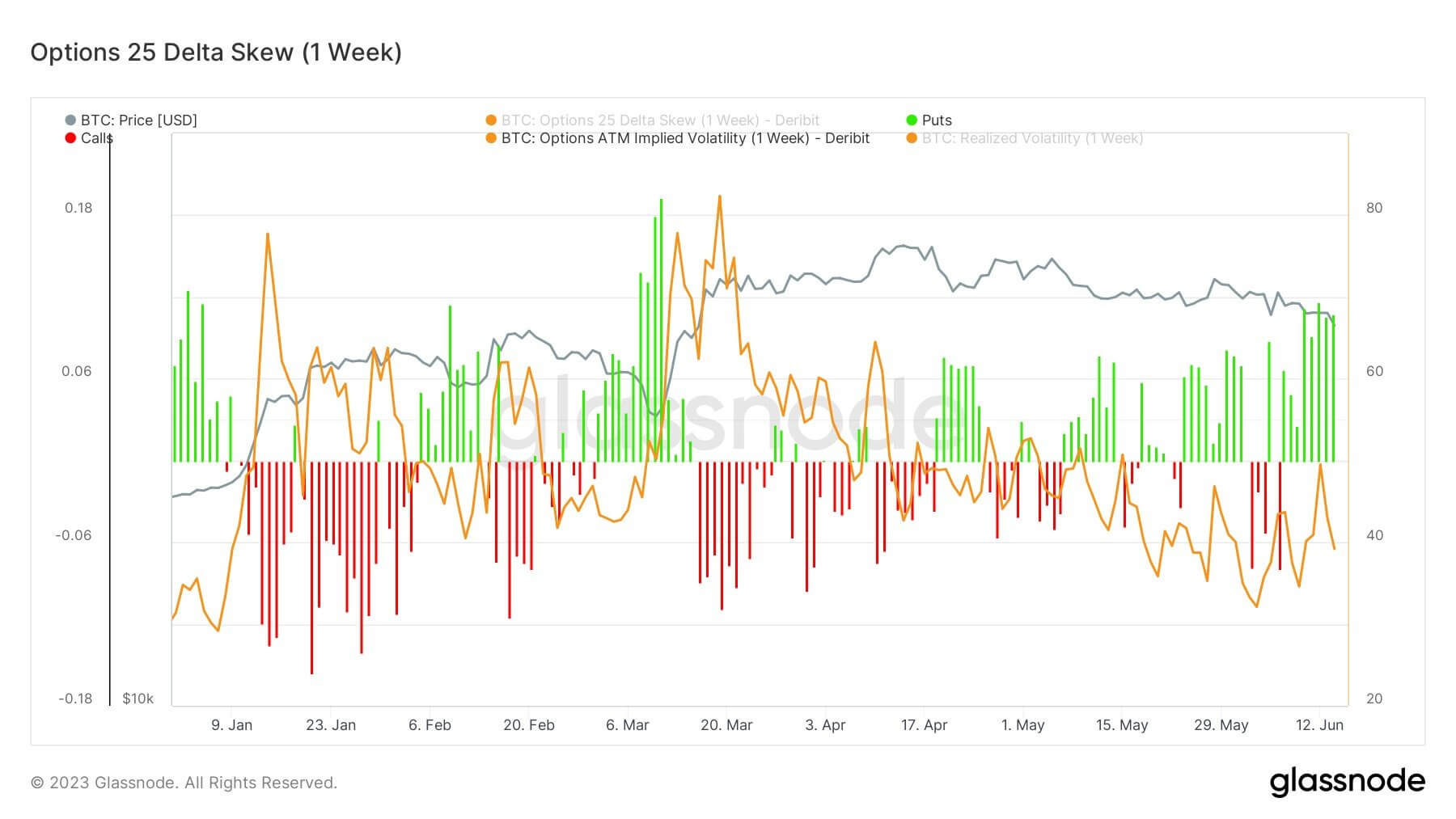

“It’s hard for me to imagine a Q4 pump mega,” Theta Seek tweeted. “All whales selling in order to prep to tax. Unless you’re telling me that the majority of crypto are in tax havens such as SG and HK. Sentiments shared amongst options market makers who are pricing monthly IV at 30%+”

The analyst Ecoinmetrics explained on Monday that traders are prepping for big moves to come in the next few months. “When you look at the distribution, traders are positioned for ‘big moves’ in the months to come. But in the meantime following the market activity is like watching paint dry,” the researcher said.

What do you think about the recent bitcoin options markets and current bitcoin price action? Let us know what you think in the comments section below.

The post Institutions Long and Hedge Funds Short: Bitcoin Options Traders Prep for ‘Big Moves’ Ahead appeared first on Bitcoin News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|