2020-9-15 21:15 |

This past weekend, data shows the most active bitcoin options contracts were calls for $28k, $32k, and $36k by the year’s end. This means a number of options traders are betting the price of bitcoin will exceed the all-time high (ATH) the decentralized currency touched in December 2017.

On September 14, researchers from the data analytics firm Skew.com tweeted about an unusual number of call options for December 2020 that are well above the 2017 ATH.

“[December 2020] $28k, $32k, [and] $36k calls among the most active bitcoin options contracts yesterday,” Skew tweeted. All of these calls are well above the mid-December 2017 ATH, which saw BTC touch $19,600 per coin.

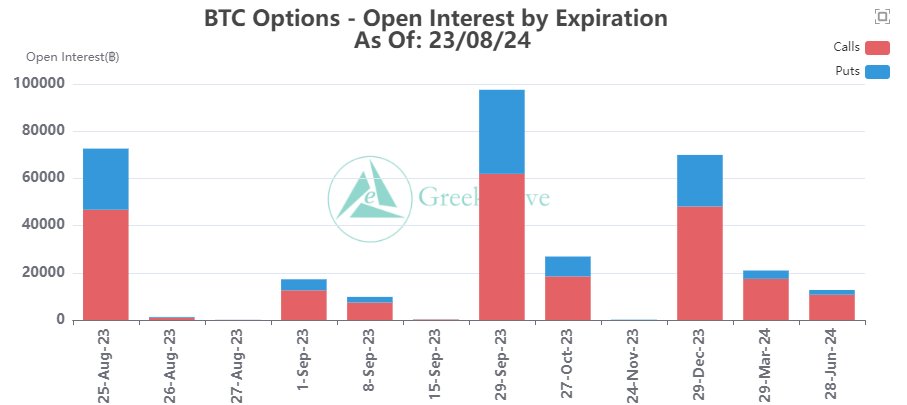

Chart Skew.com shared on Twitter on Monday, September 14, 2020.The new open positions took place on the crypto-financial derivatives platform Deribit. The action took place after $570 million (notional) of BTC options contracts expired on Deribit on August 28.

There were 752 open positions for $36k, 462 contracts for $32k, and 230 for $28k. Additionally, some $9k and $9,750 calls were set for the end of September. Responding to Skew’s December calls tweet, one individual wrote:

Without opining the possibilities to this, it will be entertaining to revisit at the end of the [fourth] quarter.

Essentially, bitcoin options are crypto-derivatives products that provide a person or group with the right, but not obligation to buy and sell the BTC at a predetermined strike price, while also leveraging an expiry date. In these examples, set well above BTC’s prior ATH, a strike price is set and the expiry ends in December 2020.

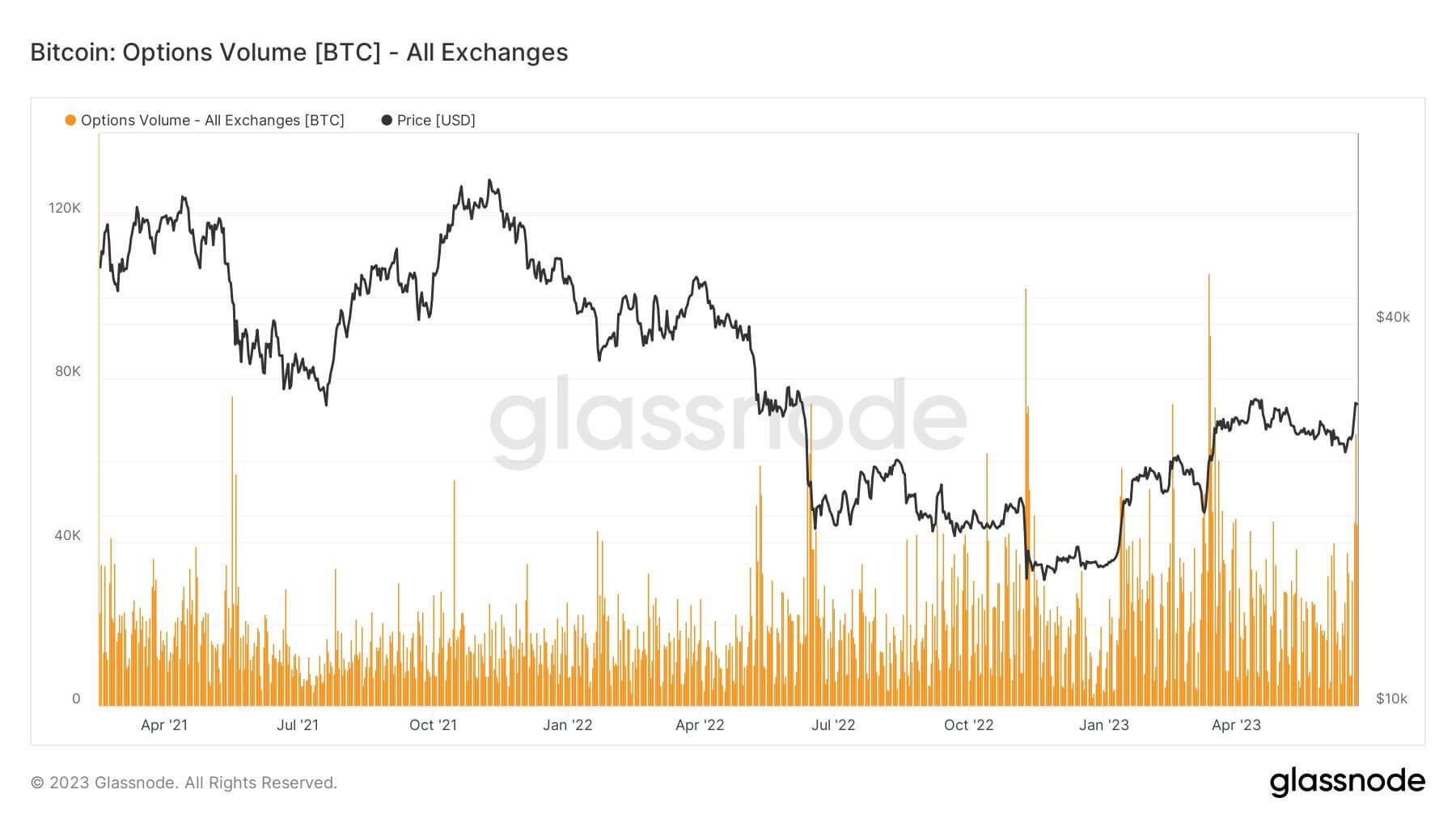

In the August 2020 Deribit newsletter, the exchange said “even though competition has been picking up, Deribit remains the leader with ~79% of the total BTC Options OI held.”

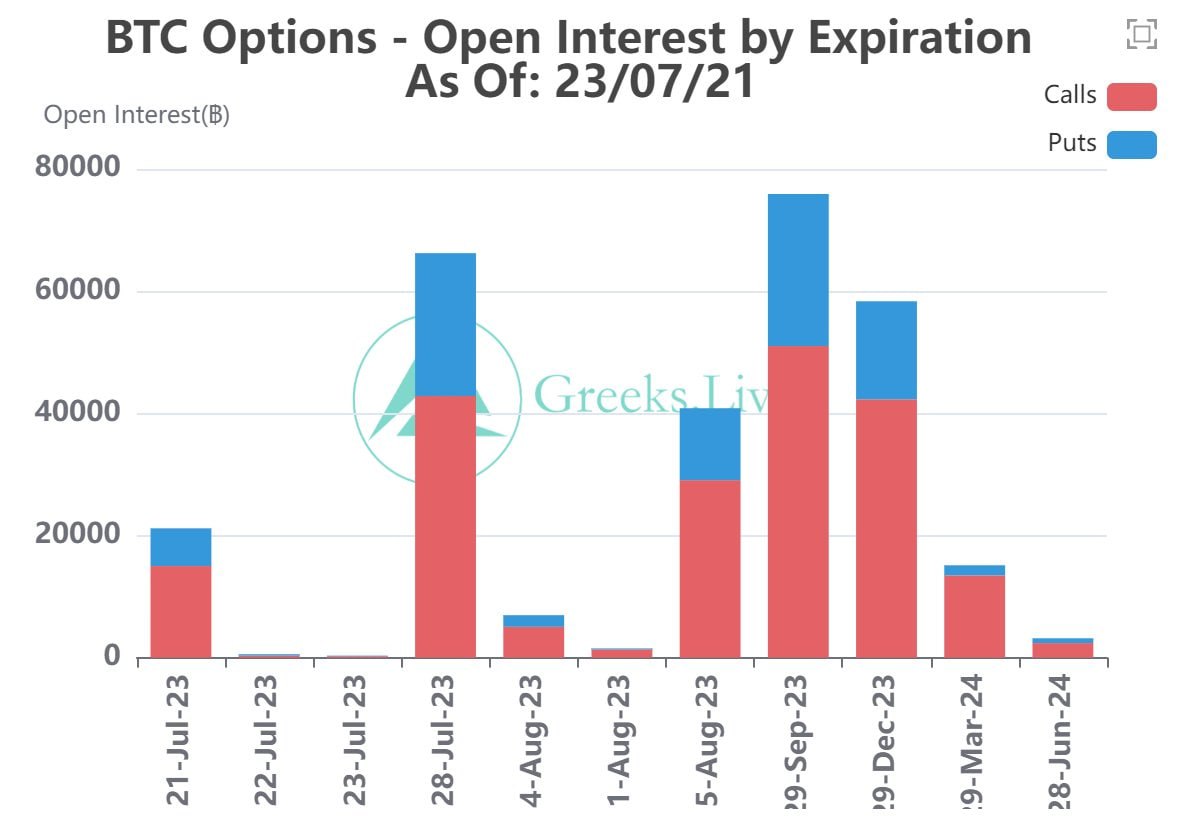

Chart Skew shared on September 10, 2020.Sharing a chart of the total BTC Options OI by expiry positions two days before the weekend, Skew said the traders are “Gearing up towards a pretty chunky bitcoin options expiry at the end of the month.”

“Already $750 million in open interest outstanding,” the crypto analytics firm Skew further tweeted.

The bitcoin data and insights researcher from Ecoinometrics has also been discussing bitcoin options markets stemming from CME Group.

While studying a number of markets and CME’s derivatives action, Ecoinometrics said that he doesn’t believe market sentiment has turned. “I don’t think so,” the blog post notes.

“If you think from a technical perspective what we are getting right now is Bitcoin flipping a former resistance level at $10,000 to become a support. From May to the end of July, Bitcoin was desperately stuck below $10k. But for [seven] days now $10,000 is holding strong.”

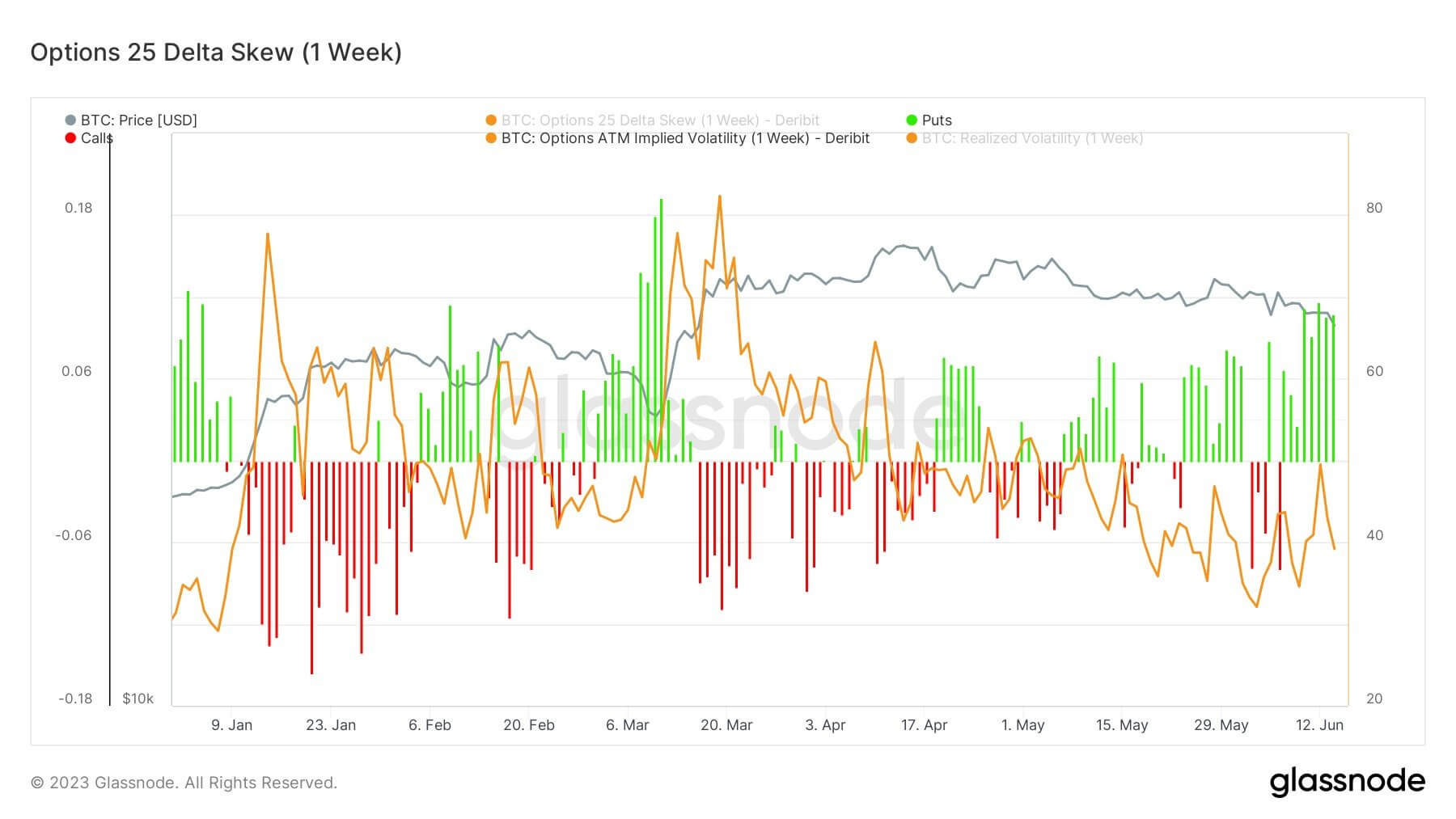

As far as the CME Bitcoin options market, the post highlights that “calls continue to dominate the scene with [five] calls for every [two] puts.”

The post further adds:

[It is] pretty clear option traders are buying puts on the front month to protect themselves or benefit from what they might perceive as a short term drop. But for the long term, the bullish sentiment is pretty much unchanged.

Monday’s BTC spot markets have been on a tear, rising more than 4% during the afternoon (ET) trading sessions inching toward the $11k zone again.

The jump in value has happened amid a number of uncertainties and macroeconomic events like the upcoming Federal Reserve meeting scheduled for Tuesday and Wednesday. Investors may be eying other unsettled events like the U.S. election and the country’s tumultuous dollar.

What do you think about bitcoin options traders betting on BTC prices surpassing 2017’s ATH? Let us know what you think in the comments below.

The post Bitcoin Options Traders Bet the Price of BTC Can Touch $36K by December appeared first on Bitcoin News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|