2020-1-13 14:00 |

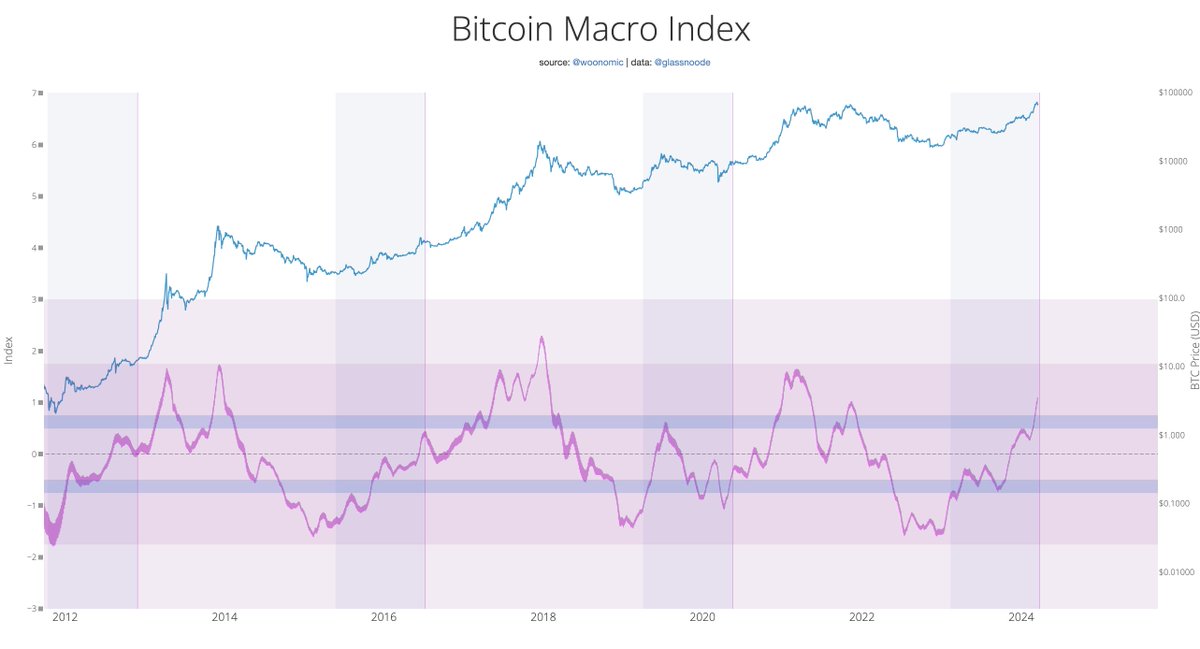

There is no doubt that sentiment has turned bullish for bitcoin. It has remained above the psychological $8,000 barrier for the weekend and institutional investors are starting to go long again. Bitcoin Market Cycles Lengthening Analyst Benjamin Cowen has taken a different way of looking at price data in his latest video. He has essentially removed the irrational short term price moves over the past year to average them out. The aim was to estimate how much longer the current accumulation phase will last. The suggestion is that a continuation of the current trend would take prices slowly upwards over the next market cycle. The cycles are lengthening so it is likely that the current phase could last another year or so. Cowen makes several references to the twenty-week moving average which BTC price is currently below indicating that the bull market has not arrived yet. It is currently serving as resistance at just below $8,400. A long term trading signal turned bullish this week for the first time since March 2019 and BTC just closed its largest green weekly candle since late October. Institutional Interest Increasing Another measure of market sentiment is institutional interest and this appears to be slowly turning bullish also. Trader ‘Cantering Clark’ has noted that asset managers are starting to go long in a pattern that is similar to that in the first quarter of 2019. Similar pattern to what we saw in early 2019. Commitment of Traders Report for the CME. Dramatic increase in longs by Asset Managers. Highest since July. These are not "fast money"$BTC pic.twitter.com/RviHA4W9ZW — Cantering Clark (@CanteringClark) January 11, 2020 According to that data, longs are the highest they have been since July last year, just after the price peak. He added that this was not ‘fast money’ indicating that these positions are from meaningful money and not high leveraged trading for quick returns. “What I am referring to is the net increase leading to the mark up. Leveraged funds were very short, different from Asset Managers. Leveraged funds are fast money.” Another potential positive signal is that options call for bitcoin are also climbing with some price predictions of $12k a month after the halving appearing on some exchanges. Crypto investor ‘Ceteris Paribus’ has been observing one exchange where contracts are being opened for a 50% move in the next five months. Today also marks the launch of another institutional bitcoin product in the form of CME options contracts. It has been described as ‘highly anticipated’ by JP Morgan managing director as the exchange is way larger than Bakkt. If bitcoin can hold above $8k and keep the bears at bay it will not be long before another sustained move higher occurs, confirming that the bull market is back in play. Will bitcoin move higher this week? Add your thoughts below. Images via Shutterstock, Twitter: @CanteringClark The post appeared first on Bitcoinist.com. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|