2024-10-29 03:00 |

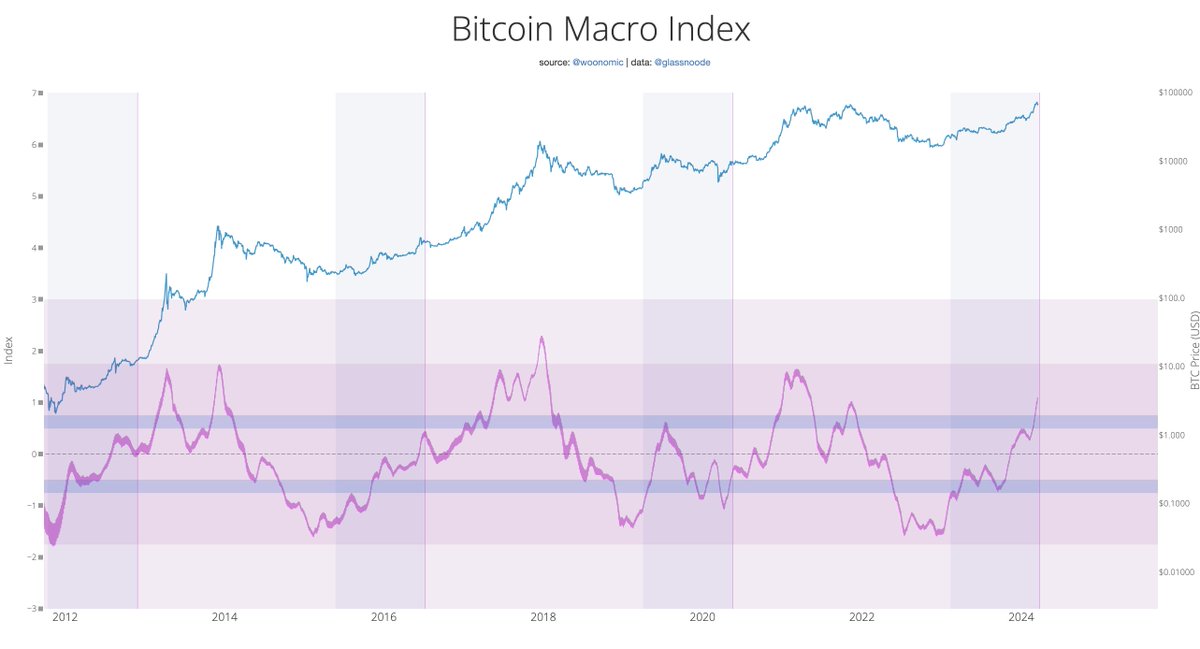

An analyst has explained why it could be the time to get ready for a new Bitcoin bull run, based on the pattern developing in this on-chain metric.

Bitcoin US To The Rest Reserve Ratio Has Seen A Reversal RecentlyIn a CryptoQuant Quicktake post, an analyst discussed the recent trend in the BTC US to The Rest Reserve Ratio. This indicator tells us, as its name suggests, the ratio between the total Bitcoin reserves of the US-based centralized platforms and that of the global ones. Platforms here refer to not just the exchanges, but also other entities like banks and funds.

When the value of this metric is rising, it means the asset is currently moving from offshore platforms to American ones. Such a trend can be a sign of demand from the US-based investors. On the other hand, the indicator going down suggests the foreign platforms have higher demand for BTC right now as the American exchanges are losing dominance to them.

Now, here is a chart that shows the trend in the 100-day Exponential Moving Average (EMA) of the Bitcoin US to The Reserve Ratio over the past year and a half:

As displayed in the above graph, the 100-day EMA Bitcoin US to The Rest Reserve Ratio had been declining earlier in the year, but during the past couple of months, its value has bottomed out and shown a reversal to the upside. This would mean that a transfer of BTC is now occurring from global platforms to the US-based ones. In the chart, the quant has marked the last instance of the indicator displaying this trend.

It would appear that the previous turnaround in the metric had occurred in the last quarter of 2023 and had accompanied a BTC rally that would eventually take the asset to a new all-time high (ATH). The sharpest part of this increase in the indicator had come in the first quarter of 2024. The reason behind this acceleration had been the introduction of the spot exchange-traded funds (ETFs) in the US, which had quickly gained popularity among the investors.

From the graph, it’s also visible, though, that a while after the price had reached the ATH, the metric had topped out and witnessed a reversal in direction. Thus, the spot ETFs couldn’t keep up the same level of interest.

The analyst notes that BTC’s sustained consolidation this year can be traced back to this decrease in the reserve of the US-based platforms. Since the indicator has once again shown a turnaround recently, it’s possible that Bitcoin could see the return of bullish momentum, if the previous pattern is to go by.

BTC PriceFollowing a 2% jump during the last 24 hours, Bitcoin has returned back to the $68,700 level.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|