2025-12-29 22:25 |

Analyst and creator of the ‘Bitcoin Quantile Model,' Plan C, just posted a bundle of charts that pushed back on the idea of repeating cycle playbooks as Bitcoin trades around $87,661.

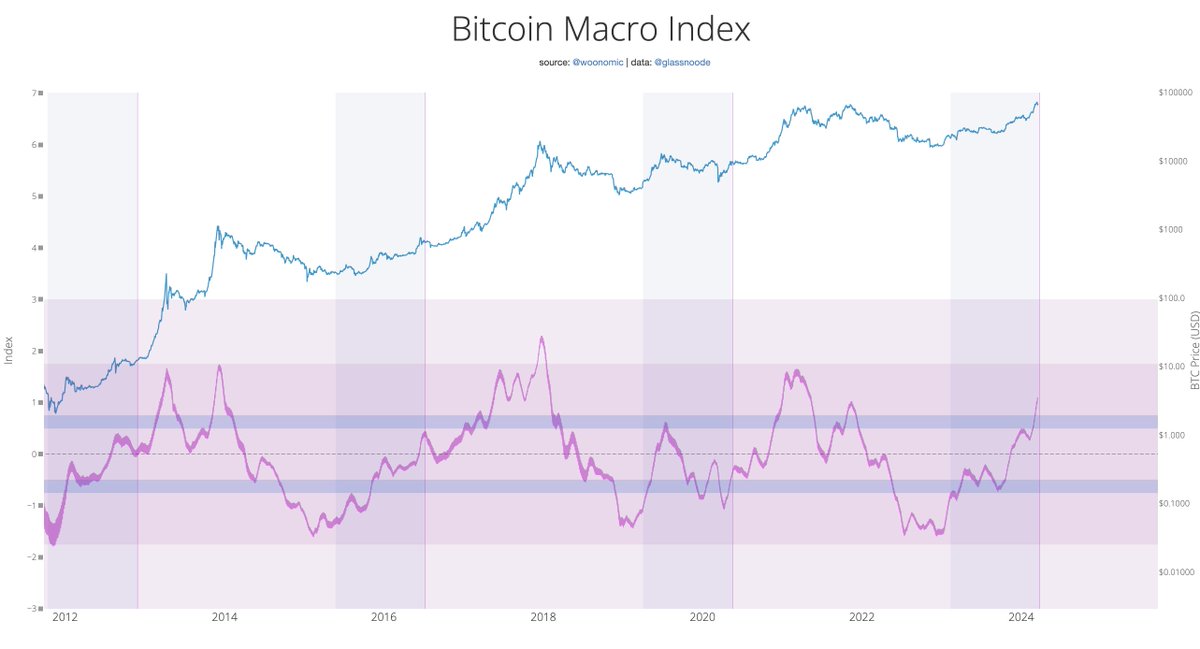

The set frames a macro mix where business-cycle gauges remain weak while hard assets, led by gold, retain demand. That combination can change the timing of rallies and pullbacks even if Bitcoin’s longer-run direction holds.

Plan C commented,

“Assuming this Bitcoin cycle must be EXACTLY the same as the previous Bitcoin bull market could be one of the biggest financial mistakes of the decade.”

Two of the charts, attributed to TechDev_52, plot Bitcoin against a PMI-style “business cycle” series. They show Bitcoin holding up while the cycle measure trends lower.

Bitcoin cycle charts (Source: Plan C)The latest U.S. ISM Manufacturing PMI reading for November was 48.2, a contraction print. The next release, covering December, is due in early January.

Related Reading Bitcoin stalled at $90,000 because that “perfect” inflation report hides a massive data error Dec 23, 2025 · Gino MatosThe report described continued softness in demand and broader manufacturing conditions consistent with a sub-50 reading.

That split sets up a test for 2026 pricingIf markets lean toward easier policy and looser financial conditions, Bitcoin can trade more like a liquidity-sensitive asset than a growth-sensitive one. That could allow strength to persist even with PMIs below 50.

If that liquidity support does not materialize, resilience that is not echoed by the business-cycle series leaves less room for error. Retracements can arrive faster.

Plan C’s “Bitcoin Quantile Model” shifts the discussion away from analogies and toward a statistical “where are we in history?” approach. Rather than issuing a point forecast, the model places today’s price inside Bitcoin’s long-run distribution and maps quantile bands across horizons.

In the snapshot aligned with spot near $87,620, Bitcoin sits near the 30th quantile. It is below the model’s median lane despite trading near prior-cycle highs in dollar terms.

The quantile bands also provide a structured way to talk about paths rather than targets.

Related Reading Bitcoin misses $95k Christmas price target revealing critical signal for traders Dec 26, 2025 · Liam 'Akiba' WrightUsing $87,661 as the reference level, the chart’s 3-month bands span roughly $80,000 at the 15th quantile and $127,000 at the median. Upper bands sit around $164,000 (85th) and $207,000 (95th).

The 1-year bands shown are about $103,000 (15th), $164,000 (50th), $205,000 (85th), and $253,000 (95th).

Bitcoin Quantile Model (Source: Plan C)These levels are distribution waypoints, not hit-rate claims. Still, they anchor how far price would need to move to change its placement within the framework.

Distribution waypoints Horizon Quantile band (from chart) Level Move vs $87,661 3 months 15q $80,000 -8.7% 3 months 50q $127,000 +44.9% 3 months 85q $164,000 +87.1% 3 months 95q $207,000 +136.2% 1 year 15q $103,000 +17.5% 1 year 50q $164,000 +87.1% 1 year 85q $205,000 +133.9% 1 year 95q $253,000 +188.7%A separate PMI-linked panel in the set standardizes Bitcoin and the cycle series into z-scores. It emphasizes that Bitcoin strength has not been matched by an upswing in the business-cycle gauge.

For the next few prints, that creates a regime test with three outcomesPMI can rebound and align with Bitcoin. PMI can remain weak while Bitcoin holds and keeps the liquidity framing in focus.

Or PMI can weaken further alongside a Bitcoin pullback as positioning shifts toward risk reduction.

The other anchor is relative performance against gold, highlighted in a BTC-gold chart credited to Gert van Lagen.

Bitcoin/Gold Chart (Source: Gert van Lagen via Plan C)Spot gold traded around $4,458 an ounce, according to Kitco. That puts Bitcoin at about 19.7 ounces of gold per coin, close to Bitbo readings updated hourly.

A BTCUSD rally can coexist with a falling BTC-gold ratio if gold advances faster. That changes how outperformance is defined for portfolios comparing Bitcoin with safe-haven exposure.

Related Reading Bitcoin vs. Gold: Does October's near zero correlation shatter ‘digital gold' myth? Oct 22, 2025 · Andjela RadmilacThe chart focuses on whether the ratio holds a structural area while momentum measures, including RSI, remain under pressure. That setup can flip if the ratio stabilizes and the momentum line turns.

Gold’s 2025 run has been tied to expectations for easier policy, dollar moves, geopolitics, and central-bank demand.

Markets are also watching the path toward pssible 2026 rate cuts.In that context, BTC-gold becomes a second scoreboard alongside PMI.

A ratio that holds and begins forming higher lows would show Bitcoin improving on a relative basis even if gold stays firm. Further deterioration would keep safe-haven preference concentrated in gold.

Taken together, the charts frame three forward paths over the next 6 to 12 months.

A reflation rebound would pair improving PMI data with a firmer BTC-gold ratio and a drift toward the quantile model’s median bands. An easing-into-weakness regime would keep PMI below 50 while liquidity expectations support Bitcoin. Outcomes could cluster between the 15th and 50th quantile lanes as gold remains competitive. A deeper contraction would keep hard-asset demand tilted toward gold. It would also increase the chance of price mapping toward the lower quantile bands over shorter horizons.The next ISM Manufacturing PMI release in early January is the first near-term checkpoint for whether the business-cycle gauge begins to turn.

The post Bitcoin analyst warns of “biggest financial mistake of the decade” for those still using this common theory appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|