2024-7-30 11:30 |

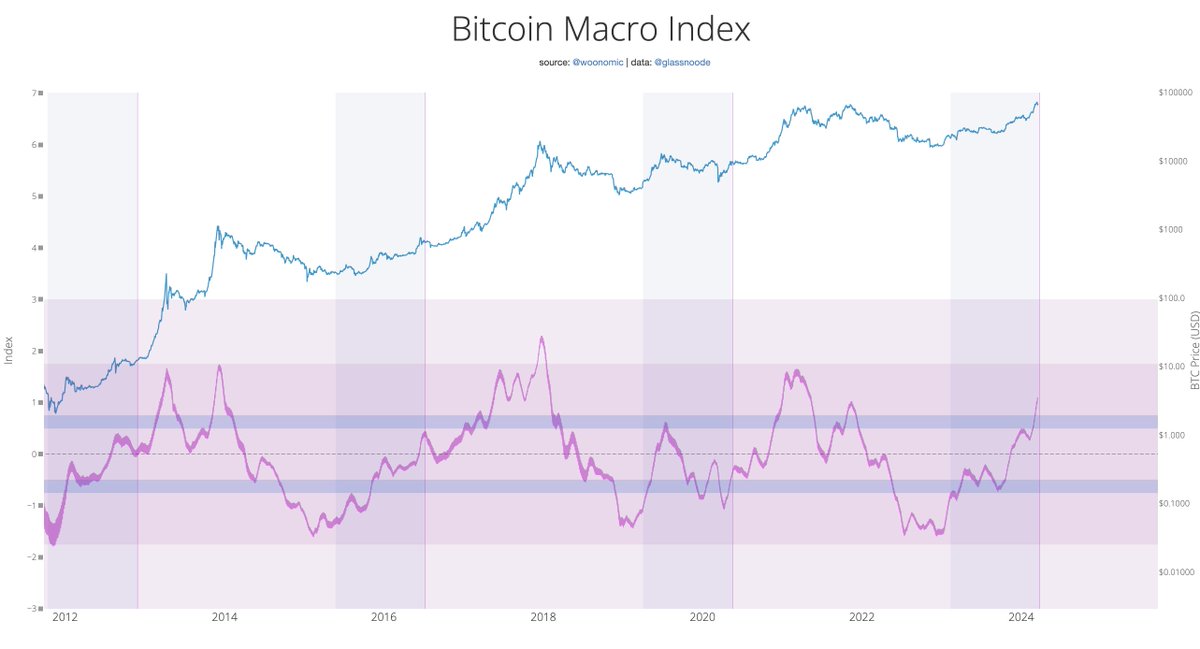

Crypto analyst Rekt Capital has shared an analysis of Bitcoin’s price action and market position. The analyst highlighted the potential outcomes of Bitcoin’s consolidation and the close of the upcoming weekly candle.

Moreover, he suggests that a weekly candle close above his identified Key level could trigger a breakout from the re-accumulation range. However, historical patterns warrant caution.

#BTC

A Weekly Candle Close above ~$71500 would probably kickstart the breakout from the Re-Accumulation Range

However, history suggests Bitcoin should consolidate inside this Re-Accumulation Range for several weeks more

Extended consolidation here would get Bitcoin closer to… pic.twitter.com/DJgw1fsCUu

According to Rekt Capital, Bitcoin’s consolidation within the re-accumulation range is crucial for resynchronizing with historical halving cycles. He notes that a weekly candle close above $71,500 might trigger a breakout from this range.

However, historical patterns suggest that Bitcoin could consolidate for several more weeks before any movement.

Rekt Capital emphasized the importance of this consolidation phase, explaining that it could bring Bitcoin closer to aligning with its historical halving cycles. He pointed out that the current cycle’s acceleration is around 110 days, a substantial improvement from the 260-day acceleration observed in mid-March when Bitcoin reached new all-time highs.

.rh-colortitlebox{margin-bottom:30px;background:#fff;line-height:24px;font-size:90%}.rh-colortitlebox .rh-colortitle-inbox{display:flex;align-content:center;padding:15px;font-weight:700;font-size:110%; line-height:25px}.rh-colortitlebox .rh-colortitle-inbox i{line-height:25px; margin:0 10px; font-size:23px}.rh-colortitlebox .rh-colortitle-inbox svg{width:25px;margin-right:10px}.rh-colortitlebox .rh-colortitle-inbox-label{flex-grow:1}.rh-colortitlebox .rh-colortitlebox-text{padding:20px}.rh-colortitlebox-text>*{margin-bottom:20px}.rh-colortitlebox-text>:last-child{margin-bottom:0} Next Big Airdrop?.rh-toggler-open{height:auto !important} .rh-toggler-open .rh-tgl-show, .rh-toggler-open .rh-tgl-grad{display:none !important} .rh-toggler-open .rh-tgl-hide{display:block !important} .rh-tgl-show, .rh-tgl-hide{cursor:pointer} .rh-contenttoggler *{box-sizing: border-box !important} .rh-toggler-wrapper{overflow: hidden;transition: all 0.5s ease; padding-bottom: 35px; margin-bottom:30px;box-sizing: content-box !important;position: relative;} .rh-toggler-wrapper p:last-of-type {margin-bottom: 0;}Notcoin airdrop on Telegram made millions to people. Don’t miss out on the next TG airdrop by the same team – Dogs on Ton!

Show more +Show less –Read also: XRP Price Surges: Ripple Analysts Predict Bullish Rally—Here’s Why

Short vs. Long Bull Runs: Investors’ DilemmaRekt Capital’s analysis presents a dilemma for investors. A breakout above $71,500 would likely signal an accelerated cycle, leading to a shorter but intense bull run, with BTC maybe setting new highs.

Conversely, extended consolidation within the re-accumulation range could result in a longer bull market, consistent with historical patterns.

The analyst suggests that there is no right or wrong answer in this scenario. Both potential outcomes are bullish, but they differ in terms of duration and intensity. While a breakout may appeal to those seeking quick gains, a prolonged consolidation could offer more sustained growth over time.

Captain just hit his first 100x among a lot 2-5xs. Want to be a part of a profitable community?

Get all our future calls by joining our FREE Telegram group.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

eToro offers staking for certain popular cryptocurrencies like ETH, ADA, XTZ etc.

The post Bitcoin Eyes $71.5k Close: Will It Ignite BTC Surge to New Highs? appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|