2024-9-19 11:30 |

An analyst has explained how Bitcoin will likely continue the latest bullish swing, at least in the short-term.

Bitcoin Spot Exchange Supply Has Been On The Decline RecentlyIn a new post on X, analyst Willy Woo has discussed the short-term and medium-term trajectories that BTC could follow. For the former, the analyst says the bullish trend would continue, with “likely 1 week left in play.”

In the medium term, things appear to be more complicated, as Woo has pointed out the trend forming in the Bitcoin inventory sitting on centralized exchange platforms.

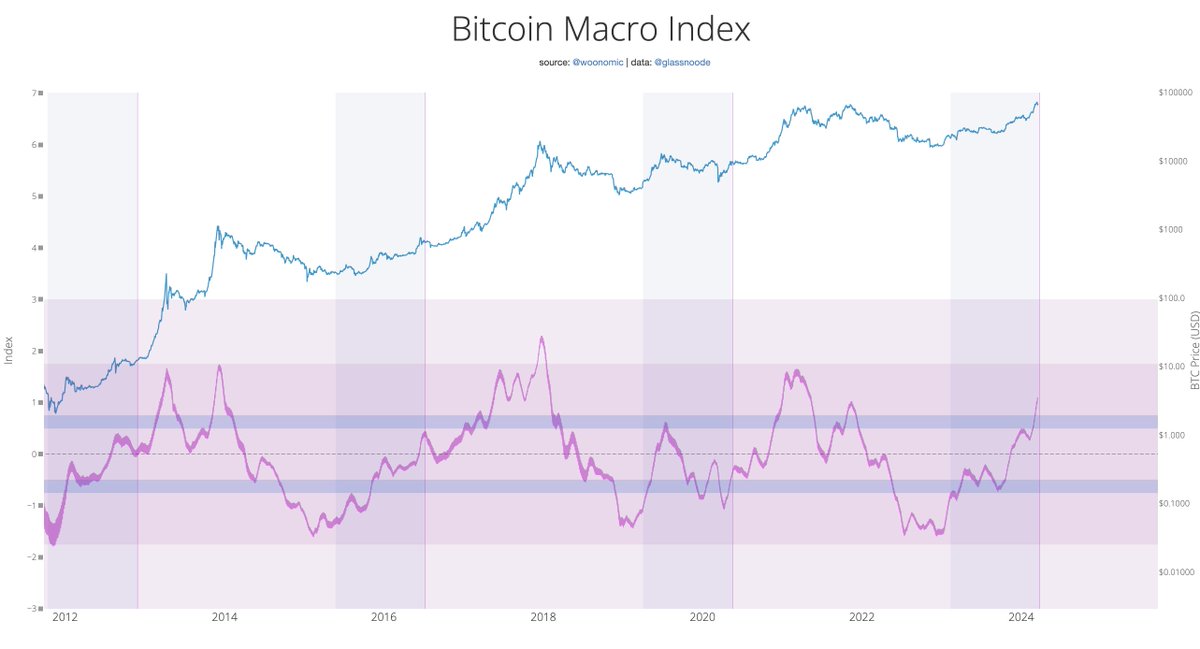

Below is the chart shared by the analyst that shows the trajectory in the value of this metric over the last few years.

As is visible in the above graph, the Spot Bitcoin exchange supply (the blue line) has declined recently, suggesting that investors have been withdrawing their coins into self-custodial wallets.

Generally, one of the main reasons investors keep their coins on spot platforms is for selling purposes, so the Spot BTC inventory can be viewed as an estimation of the available sell supply for the cryptocurrency. As such, the investors taking their coins out of this supply can naturally be a bullish sign for Bitcoin.

In today’s era, however, the Spot BTC isn’t the only factor affecting the asset’s price, as another form of exchange supply has gained popularity in the last few years: Paper BTC.

Paper BTC refers to the derivatives contracts related to the cryptocurrency that don’t require users to own any tokens themselves. With Paper BTC gaining more dominance, its influence on the market has become quite apparent.

In the chart, the purple line corresponds to the total BTC exchange inventory; that is, it shows the sum of the Spot and Paper BTC present on the various platforms.

It would appear that while the Spot BTC itself has declined recently, the same hasn’t been true for the combined Spot and Paper BTC supply, which has continued to move sideways. This would imply that Paper BTC is being printed at about the same rate as Spot BTC, which the investors are withdrawing.

A rise in Paper BTC is generally not a good sign for Bitcoin, so it could hinder BTC’s upward push. Woo notes, however, that things could change quickly if a short squeeze occurs in the market.

A “squeeze” refers to an event where a mass amount of liquidations occurs at once, so a short squeeze in particular, would naturally be the occurrence of a mass amount of short liquidations.

“Current demand and supply is neutral bearish, but signs of moving into a bullish structure if we get some liquidations,” says the analyst.

BTC PriceBitcoin had recovered beyond the $61,000 mark yesterday, but it appears to have slipped up today as its price is now floating around $59,600.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|