2020-10-17 19:10 |

Key Takeaways:

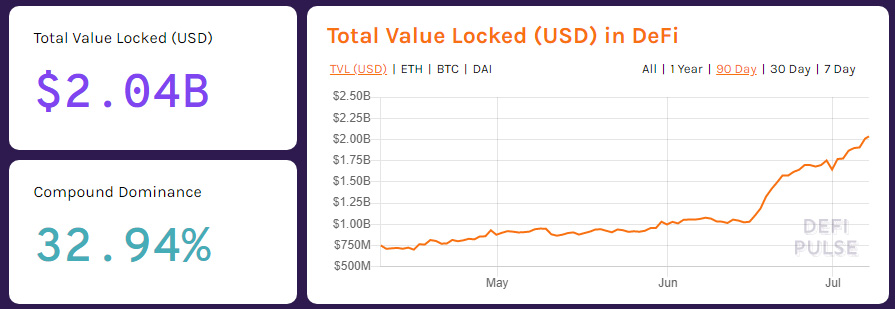

– Decentralized finance (DeFi) has witnessed staggering growth in 2020.

– There is now more than $11 billion locked in Ethereum DeFi platforms and more than 100,000 users.

– Open lending platforms, decentralized exchanges, and digital asset staking are among the most common use-cases, but new tools and platforms are emerging regularly.

– Though many DeFi platforms provide true utility to users, there are also numerous scams. Due diligence is highly advised before interacting with DeFi protocols.

Decentralized finance, or DeFi for short, is a rapidly emerging sector that promises to disrupt the traditional financial industry with blockchain-based tools and services that mimic banking, investing, and trading services. Now, there is a DeFi alternative for many traditional finance services, and more are emerging rapidly.

With DeFi, you can manage your own digital asset finances without relying on centralized financial institutions, potentially helping to bank the unbanked and unlock new revenue streams — but it also has its fair share of potential risks. With more than $11 billion locked up in Ethereum-based DeFi protocols and well over 100,000 users, the industry has grown considerably in the last year.

Here, we cover the most popular DeFi use cases, helping you get up to speed on the rapidly changing DeFi in no time. As with all things crypto, due diligence is heavily advised before interacting with any DeFi platform and protocol.

Open Lending PlatformsOne of the most common use-cases for DeFi is open lending platforms. These are usually simple decentralized applications (DApps) that allow you to either lend your digital assets out to other users to earn interest or borrow digital assets from other users — paying interest on top.

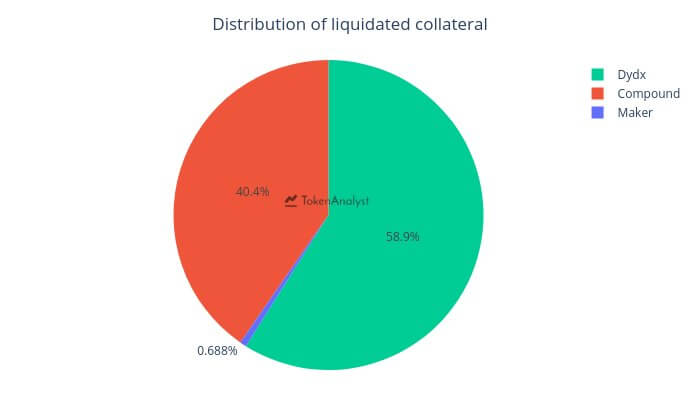

Borrowers typically need to deposit collateral worth substantially more than the loan amount and maintain this collateral above a certain value threshold to protect the borrower. Failing this, the collateral will usually be sold to reimburse the lender if the collateral falls below a certain threshold, known as a loan-to-value (LTV) ratio.

StablecoinsStablecoins are a type of digital asset that have their value pegged to another asset in order to reduce volatility and keep the price as stable as possible. These can be pegged to fiat currencies like the US dollar (USD) or Euro (EUR), or to other assets like gold or a mixed basket of assets — like Facebook’s upcoming Libra stablecoin.

Stablecoins are intimately weaved into the DeFi space and are popular among lenders, borrowers, liquidity providers, and traders due to their stability. Looking to avoid volatility as best as possible while still remaining liquid? Stablecoins are generally the way to go.

Decentralized ExchangesDecentralized exchanges, or DEXs, are digital asset trading platforms that operate without a centralized authority. These may take the form of automatic market makers (AMMs) like Uniswap or Curve which use simple mathematics to set the price of tokens in a liquidity pool, or they might have a bid/ask system, where traders set their own order prices.

DeFi marketplaces like OpenSea are similar to decentralized exchanges, but instead, allow users to trade digital goods or non-fungible tokens (NFTs) in a trustless manner — usually using a smart contract-based escrow system.

Decentralized InsuranceJust like how you can take out insurance against practically any unfortunate or unforeseen event using traditional insurance brokers, there is now a range of DeFi platforms that offer similar functionality — like Nexus Mutual.

These can be used to hedge against rare or potentially devastating events like a market crash, hack, smart contract failure, or almost anything else. Unlike with traditional insurers, decentralized insurance allows a pool of investors (known as underwriters) to share the risk among themselves in return for the insurance premium.

These platforms are built using publicly visible smart contracts, which means the terms of payout are available for all to see — no more getting stung by some obscure fine print!

Synthetic Asset IssuanceSynthetic asset issuance is one of the more complex DeFi use-cases. This is essentially the process of creating a digital asset token that mimics the properties of something else, similar to how a stablecoin closely matches the value of the currency or asset it is pegged to.

These synthetic assets can represent almost anything, including simple assets like precious metals and other commodities, digital assets, or more complex financial instruments, like stocks and derivatives. These synthetics can generally be bought, traded, and sold, allowing holders to gain exposure to previously illiquid or difficult to obtain assets, for example.

Yield FarmingYield farming (also known as liquidity mining) is one of the more recent DeFi use-cases. This is the practice of locking up digital assets in return for rewards which are usually automatically delivered by a smart contract.

For example, OKEx recently launched yield farming on its Jumpstart platform, allowing users to stake their OKB tokens to mine various new digital assets.

In many cases, yield farming projects will require that you stake liquidity provider (LP) tokens that are received after providing liquidity at certain decentralized exchanges, like Uniswap. These tokens are then used to mint a new type of token that can either be sold or used.

Yield farms are generally considered high risk/high reward since locked assets can be lost if there is a backdoor or loophole in the farm smart contract, while the assets generated may be worthless.

StakingStaking is one of the simpler DeFi use-cases and is often one of the first ways many digital asset holders gain exposure to decentralized finance. This is the process of helping to participate in the network governance of Proof-of-Stake (POS) blockchains, by either delegating digital assets to a validator node or by simply holding these digital assets in a compatible wallet.

When you help to secure the blockchain by staking assets, you earn rewards that are automatically delivered by the network. Some of the more popular stackable assets include Tezos (XTZ), Tron (TRX), and Cardano (ADA).

ConclusionWhether you are looking for insurance, exchanges, staking solutions, or most other financial tools and services, odds are you will be able to find a DeFi platform that has it covered. But bear in mind that not all DeFi platforms have been rigorously tested or have been audited by third parties, and many are still considered experimental.

This should be considered before interacting with any DeFi platform, since financial losses can occur in some cases.

Disclaimer: Trading cryptocurrencies includes risk. Ledger does not provide financial advice, and cannot be held liable for any losses as a result of using DeFi services.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|