2020-7-26 20:43 |

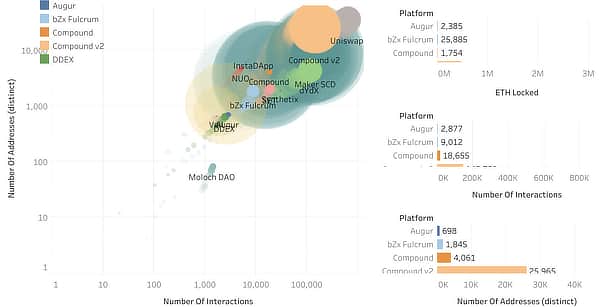

Across all existing decentralized finance platforms, there has been a monumental speed in utilization. Despite other digital currencies underperforming, DeFi tokens have outperformed and this is being credited to how high network activities have been.

This was reflected in transaction fees on the Ethereum network, which took a spike a few days ago. According to metrics from Coin dance, the hype surrounding DeFi has been a booster for Ethereum, and ETH transactions were nearing one million ETH. ($242.5 million) in a single day.

DeFi’s unmatched run is starting to bolster confidence within the crypto space and many industry players are iterating that DeFi will play a significant role in the future of digital currencies.

In the early hours of yesterday, Weiss Ratings, a cryptocurrency rating site threw its weight behind this motion, asserting strongly that DeFi’s ability to command a collateral pledge of $1 billion insinuates that the platform is still blazing hot.

The collateral pledge is a commitment made by investors. The locked-in collateral is used to make multiple bets on both complex derivates and simple loans, across various protocols.

Oracle plays a major role in championing DeFi reignThe second-generation digital currencies in this context include Neo, Lisk, QTUM, etc. These are called the second generation because unlike the first generation currencies whose sole purpose was to store and transfer value, second-generation digital currencies as listed above, are typically built on decentralized applications (dApps) platforms.

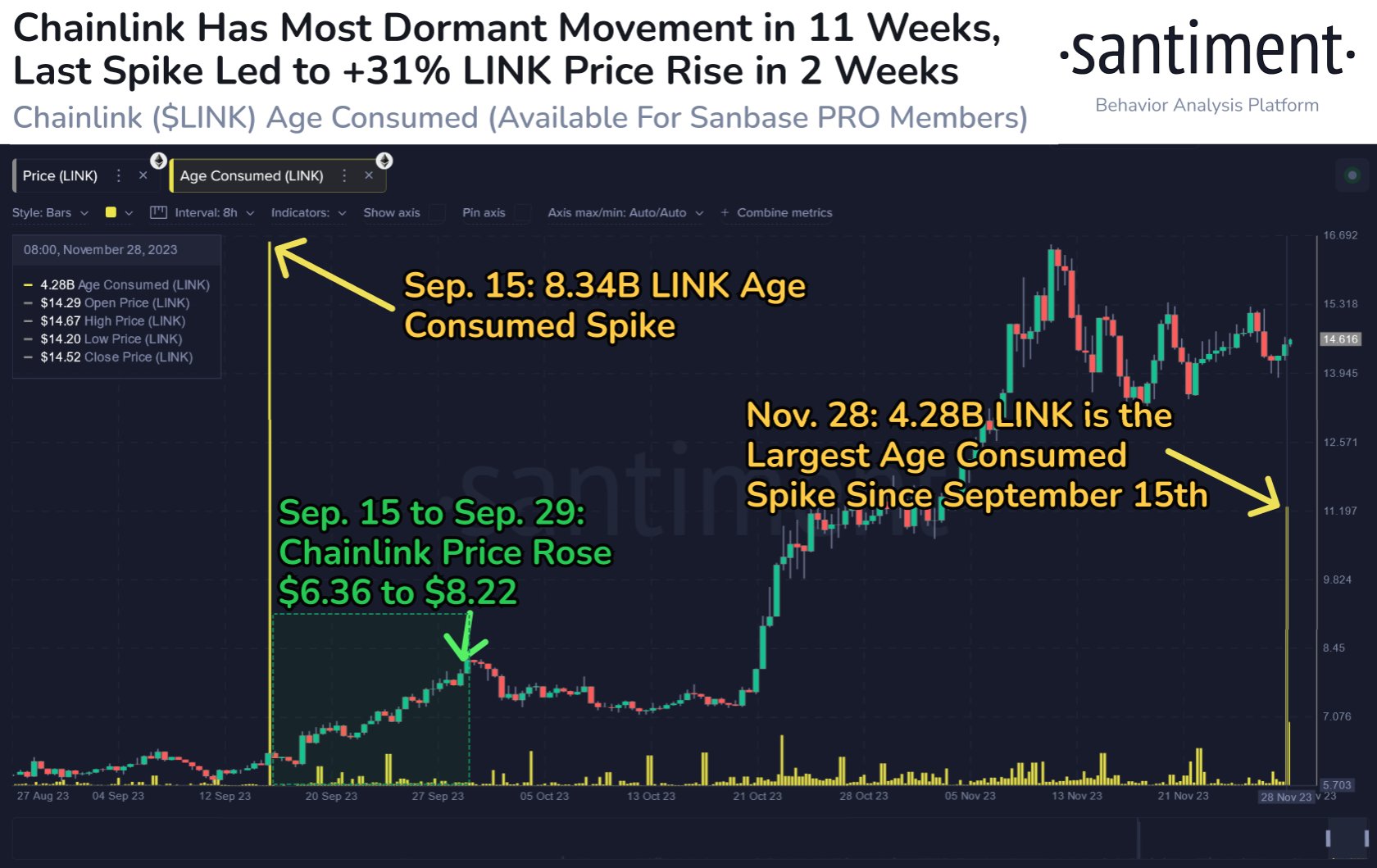

As Weiss said, the oracle network is picking up the tabs for these currencies, for this reason, Chainlink will be at the center of the cryptocurrency revolution, which is basically the next phrase of digital currencies. Usually, on a Blockchain, the only data that can be accessed is that which is on the chain, i.e on-chain data.

To obtain data and interact with the real world, Blockchains now depend on oracles i.e Off-chain. Both software and hardware can use oracles. But it has its limitations, however, Chainlink is attempting to solve some of the biggest problems. This places oracle as the perfect middleman between smart contracts, and traditional data sources.

To put it simply, oracles will benefit the crypto space while simultaneously depending on Chainlink to provide useful solutions. The end product? Chainlink will be DeFi’s flagship and take up a leadership position in the evolution of digital currencies.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|