2020-7-8 19:09 |

The decentralized finance (DeFi), also popular as open finance, world is growing to unseen proportions with the total value locked (TVL) on DeFi apps setting an unprecedented $2 billion mark on Tuesday. The top DeFi platform leads the charge, Compound, which has seen explosive adoption since launching its governance token, COMP, in mid-June, which led to a “yield farming craze.”

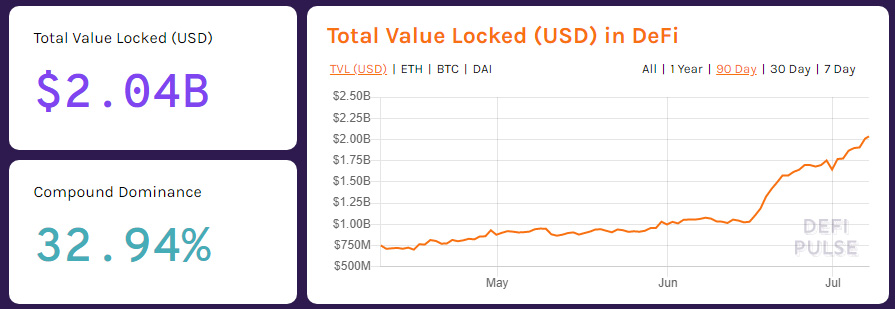

A DeFi craze cashing in Source: DeFiPulseThose yet to understand the magnitude of DeFi’s growth would do well to check the TVL charts provided by DeFi Pulse. The first billion locked in DeFi took close to 30 months to build up as decentralized exchanges tried to build up the industry’s values. In less than a month, the DeFi space has gained its second billion with the introduction of ‘yield farming’ playing an important role.

The committed value in DeFi protocols exponentially grew from approximately $50 million locked at the start of January 2018, reaching a peak of $1.275 billion in mid-February this year. However, the March 12th crash heavily affected the field, wiping off 56% of the value locked.

In mid-June, the launch of Compound (COMP) and Balancer (BAL) governance tokens re-sparked the DeFi craze, rising from $1.031 billion on June 16th to a current value of $2.022 billion in TVL.

[Read more: Techemy Capital plans to launch Compound (COMP) investment portfolio for yield farmers]

Compound leads DeFi resurgence.It seems “yield farming” is the cause of the recent resurgence of the DeFi market, Compound leading the charge. Currently, the platform has the highest TVL, dominating 32.82% of the total value locked on DeFi platforms.

Using technical strategies on the borrowing and lending of digital assets on Compound, users earn higher yields, which has seen crypto enthusiasts dive into the market in huge numbers. In light of borrowing and lending, users are able to gain COMP tokens, which experienced a huge demand once launched.

Maker, a lending platform that prints DAI, is second on the log with a total locked value of $594 million; Synthetix, Balancer, and Aave close out the top five with $321 million, $157.8 million and $157.1 million locked respectively.

A burgeoning DeFi market capWhile the TVL shows the appetite for DeFi products in the market, the metric lacks to account for some areas such as the volumes transacted on decentralized exchanges (DEXes), transaction volumes across DeFi, etc.

The market, however, shows signals of surpassing the $10 billion dollar mark, with DeFi Market Cap, a data aggregator for the top 100 DeFi tokens, showing the total market cap of these tokens is at $7.4 billion.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|