2023-6-6 23:35 |

Decentralized Finance (DeFi) is reshaping the financial landscape by providing individuals with direct access to financial services without intermediaries. This article explores the transformative power of DeFi, highlighting key aspects such as smart contracts, automated market makers (AMMs), yield farming, challenges, and the future of finance.

DeFi democratizes financial services by leveraging blockchain technology to eliminate the need for traditional banks. Smart contracts, self-executing agreements encoded on the blockchain, enable a wide range of innovative financial services without intermediaries. This includes lending, borrowing, decentralized exchanges, and yield farming.

AMMs, a crucial component of DeFi, provide liquidity to decentralized exchanges by algorithmically determining token prices. This eliminates the reliance on traditional order books and promotes continuous trading without centralized intermediaries.

Yield farming has become popular within DeFi, enabling users to earn passive income by lending or staking their assets in liquidity pools. However, it is important to evaluate associated risks and carefully choose projects before participating. Despite its potential, DeFi faces challenges in scalability, security, regulatory frameworks, and user experience. Collaborative efforts from developers, regulators, and industry players are essential to build a robust and sustainable DeFi ecosystem.

Looking ahead, DeFi has the potential to revolutionize the financial landscape globally. By providing transparent and secure access to financial services, regardless of location or financial status, DeFi fosters financial inclusion and innovation. The future of finance is decentralized, where individuals have control over their funds and can participate in a transparent and inclusive financial ecosystem.

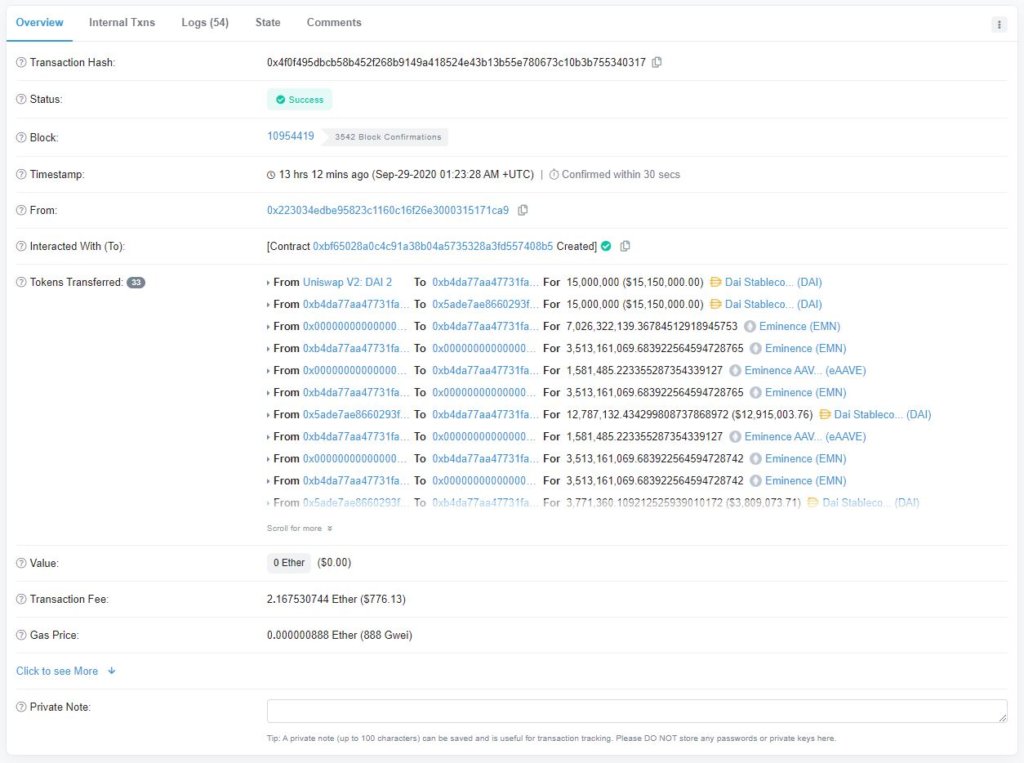

On-chain trading is another important category within the realm of decentralized finance (DeFi). It involves the direct exchange of cryptocurrencies between traders without the need for intermediaries such as banks or brokers. To facilitate this type of trading, decentralized exchanges (DEXs) play a crucial role. Well-known examples of DEXs include Uniswap and Sushiswap, both operating on the Ethereum blockchain. These DEXs employ smart contracts to determine prices and execute trades, settling transactions directly on the blockchain.

DEXs utilize two types of order books: on-chain and off-chain. On-chain order books maintain a comprehensive record of all orders and require miners to confirm each transaction. In contrast, off-chain order books store transaction records in a centralized entity and utilize relayers to manage these books, making them somewhat decentralized.

Within the realm of DEXs, perpetual DEXs offer traders the ability to retain control of their private keys while participating in trading activities. This feature enhances security, reduces fees, and provides greater autonomy for individual traders. However, decentralized protocols for perpetual contract trading face challenges such as significant slippage, high costs, and limited tool support. To address these issues, platforms like Palmswap have emerged as decentralized perpetual contract trading protocols. Palmswap leverages a proprietary pricing model called dvAMM and is built on the Binance Smart Chain.

In summary, on-chain trading represents a decentralized approach to trading conducted on blockchains through the use of DEXs, smart contracts, and order books. Perpetual DEXs offer enhanced security, reduced fees, and increased control for traders. However, they face challenges such as high slippage and costs, which can be mitigated by adopting specialized pricing models and utilizing foundations like the Binance Smart Chain.

The post DeFi – Reshaping the Future of Finance with the power of Blockchain appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|