2021-10-1 10:54 |

Decentralized finance protocol Kokoa has secured a round of venture capital investment to build DeFi features on Klaytn. Klaytn is the blockchain launched by South Korea’s largest messaging app Kakao.

In an announcement on Sept 30, Kokoa Finance revealed that it has raised $2.3 million in a seed investment round led by Silicon Valley blockchain venture firm Hashed. Other investors included Sky Vision Capital, a41 Ventures, and a number of individual angels.

Kokoa Finance will be using the funding to build the Kokoa Stable Dollar (KSD) stablecoin which will be used to accelerate DeFi adoption on Klaytn.

Klaytn was launched in 2019 largely targeting the South Korean market due to its integration with KakaoTalk and the Klip wallet. Adoption and organic growth in Korea saw its market capitalization grow to $4 billion.

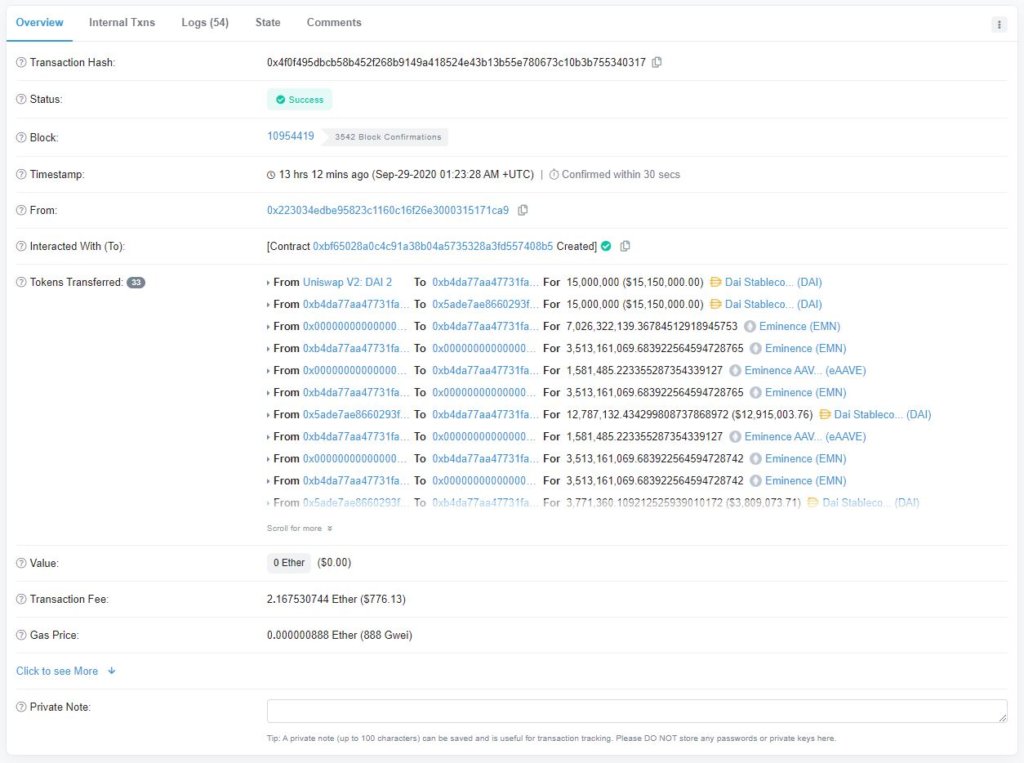

Improving on DaiThe Kokoa Stable Dollar will operate in a similar fashion to MakerDAO’s Dai which uses collateralized vaults to enable the minting and lending of the stablecoin.

It will build upon the MakerDAO model by using the collateralized debt positions (CDPs) to generate yields in Klaytn’s liquidity farms.

“This structure enables charging zero interest rates for borrowing KSD, making it comparable to an “advance” on future yield.”

The Kokoa team will implement DAO governance and add features to grow the KSD ecosystem after it launches. These will include margin trading, leveraged yield farming, a synthetic asset protocol, and a stable swap platform.

Jwon Do, Founder of Kokoa Finance, said that DeFi on Klaytn was still immature, adding “by launching Kokoa and KSD first, we expect to start the flywheel of DeFi adoption on this chain and lay the carpet for new builders and users.”

There was no mention of a specific launch date in the release, however.

The Klaytn blockchain had a minor outage in March, but normal operation resumed pretty quickly.

KLAY price updateThe blockchain’s native KLAY token has been down-trending since August and has fallen back to support at around one dollar.

There has been little movement over the past 24 hours and KLAY has lost 30% over the past month. It’s currently down 75% from its March 30 all-time high of $4.34 according to CoinGecko. DeFi farming incentives being launched on the blockchain may well reverse this trend for KLAY.

There are currently 2.5 billion tokens in circulation giving it a current market cap of $2.7 billion.

The post Kokoa Finance Raises $2.3M to Build DeFi on Klaytn appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Klaytn (KLAY) на Currencies.ru

|

|