2020-2-28 11:34 |

The Ethereum price dropped by 15 percent against the USD from $278 to $210 within a span of four days. The abrupt drop in the price of ETH led to the liquidation of $3 million worth of loans on decentralized finance (DeFi) platforms.

Ethereum fell too hard too fastOn DeFi platforms, Ethereum users often place ETH as collateral to obtain loans. As such, when the price of Ethereum drops substantially in a short period of time, users need to put more ETH as collateral to maintain their loans.

The DeFi Pulse explained liquidations on MakerDAO, a popular DeFi platform:

“Iif your collateral value falls, you must lock in more ETH, pay back some of your debt, or risk having their CDP liquidated. When a CDP is liquidated, the ETH held as collateral is automatically sold to pay back the debts in addition to a penalty fee for failing to keep your collateral ratio above 150%.”

As the Ethereum price began to pull back rapidly, it reduced the value of the collateral put up by users obtaining loans on various DeFi platforms.

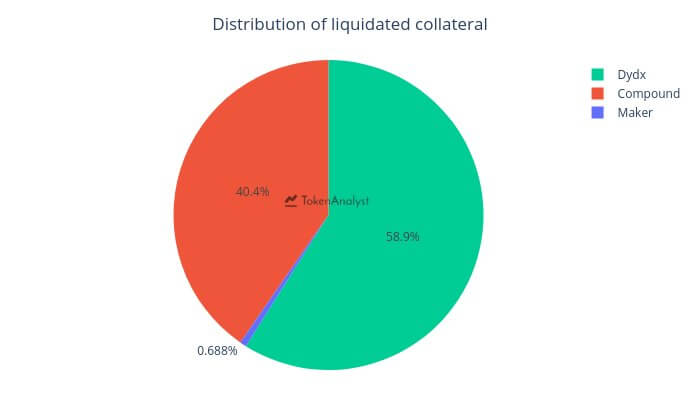

That resulted in liquidations worth of $3 million on-chain, with the majority of happening on dYdX Protocol and Compound Finance, according to TokenAnalyst researcher Ankit Chiplunkar.

He said:

“In the last 3 days ETH price fell by 20% this has been a wild time for liquidations. A total of $3M loans have been liquidated on-chain. 59% of those liquidations have happened on dYdX Protocol while 40% are from Compound Finance.”

DeFi loans liquidated as Ethereum price falls substantially (source: Ankit Chiplunkar Twitter) Risks in DeFiDue to the decentralized nature of DeFi platforms, all activities are carried out purely based on the mechanism of the system.

If the value of the collateral of a loan drops because the price of Ethereum declines, the receiver of the loan cannot avoid liquidation.

Despite high returns, DeFi platforms have glaring risks for both lenders and receivers of the loan. When an unlikely event of liquidation occurs, it creates significant risks for all parties involved.

During a market bear trend, given the tendency of major cryptocurrencies like Bitcoin and Ethereum to drop or rise substantially in a short time frame, operations that depend on the price of cryptocurrencies could be vulnerable to various risks.

With the DeFi market now crossing $1 billion, communication between DeFi platforms and users to avoid liquidations and to warn the risks involved would be critical, especially for the long-term growth of Ethereum.

The post As Ethereum crashed 15%, stagerring $3 million DeFi loans got liquidated appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|