![Crypto Startup dYdX Lets You Short Ethereum [ETH], Raises $10 Million](http://blokt.com/wp-content/uploads/2018/10/Gold-ethereum-coin-isolated-on-black-background-with-reflection-and-stock-candles.-Cryptocurrency-trading-stock-concept-with-copy-space.-300x205.jpg)

2018-10-22 17:59 |

A five-person company dYdX recently raised $10 million from investors. The crypto-based company has developed a new margin trading protocol on the Ethereum network and allows people to create new financial products. These products could be used to short sell, leverage long positions and create interest-generation loans as well. The startup’s protocol ecosystem works without the need for a broker.

New Protocol Removes BrokersMargin lending services are still being offered by brokers in the cryptocurrency industry. The new protocol developed by dYdX erases the need for a trusted intermediary. Therefore, the products developed using the protocol may not demand a broker for starting peer-to-peer lending services.

DYdX founder Antonia Juliano talked to Fortune about his startup’s unique offerings, saying that decentralized finance will be the first real-world application of blockchains. He noted that the beginning of blockchains was via decentralized money, i.e., Bitcoin. It enabled decentralized exchanges to be created like 0x and Kyber.

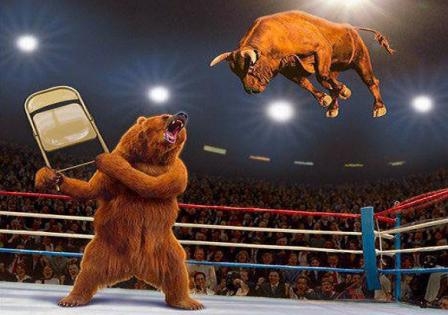

He said that the next “logical thing is derivatives.” Juliano is a former engineer at Coinbase and Uber, two companies following the traditional highly centralized infrastructures. He believes that creating further decentralization in the market via derivatives will help to remove volatility in the crypto markets and remove the “primitive” way that cryptocurrency is traded today.

The Unique Features of dYdXThe project marries the smart-contracts of the Ethereum blockchain with the trade settlement features of decentralized exchanges like 0x. The new derivatives platform will be helpful to traders in hedging risk and speculating during bearish crypto markets.

DYdX allows anyone to build a product on top of their unique protocol. The company developed its first product using the protocol called Expo which helps users in shorting Ethereum. The product was unveiled earlier this month. The product allows users to bet on the declining prices of Ethereum. All they have to do is buy a virtual token called “short Ethereum token.” In theory, as soon as the price of ETH goes down, the value of the short Ethereum token will increase by an equal amount.

Juliano explained Expo:

“Basically, Expo abstracts a lot of complications of margin trading away from the user. People don’t have to worry about getting a loan.”

Crypto Startup dYdX Lets You Short Ethereum [ETH], Raises $10 Million was originally found on [blokt] - Blockchain, Bitcoin & Cryptocurrency News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|