2018-10-22 21:58 |

Crypto Industry in Shock as Ethereum Reportedly Bottoms Out

Genesis Global Trading, the crypto investment company targeting institutional investors, recently reported that the short interest for Ethereum had substantially declined by September 2018. According to the CEO, Michael Moro, the lending out of ETH and subsequent short selling did not cause the significant price decline.

Since March of this year, the firm has loaned out over $500 million in altcoins, including Ethereum and Bitcoin, to investment companies and hedge funds. Bitcoin accounted for 60% of the loans while Ethereum accounted for the remaining balances. The CEO added that most of the hedge funds and investment firms that received Ethereum loans used the funds to short the altcoin.

How Ethereum Was Successfully ShortedHere’s how large-scale and rich hedge funds managed to short Ethereum:

• First, they borrowed ETH loans worth millions of dollars

• They then bet on the fact that the asset would drop in price

• Once they caught the downtrend, the loaned out the ETH assets again

• Consequently, the earned more Ethereum coins as the prices continued falling.

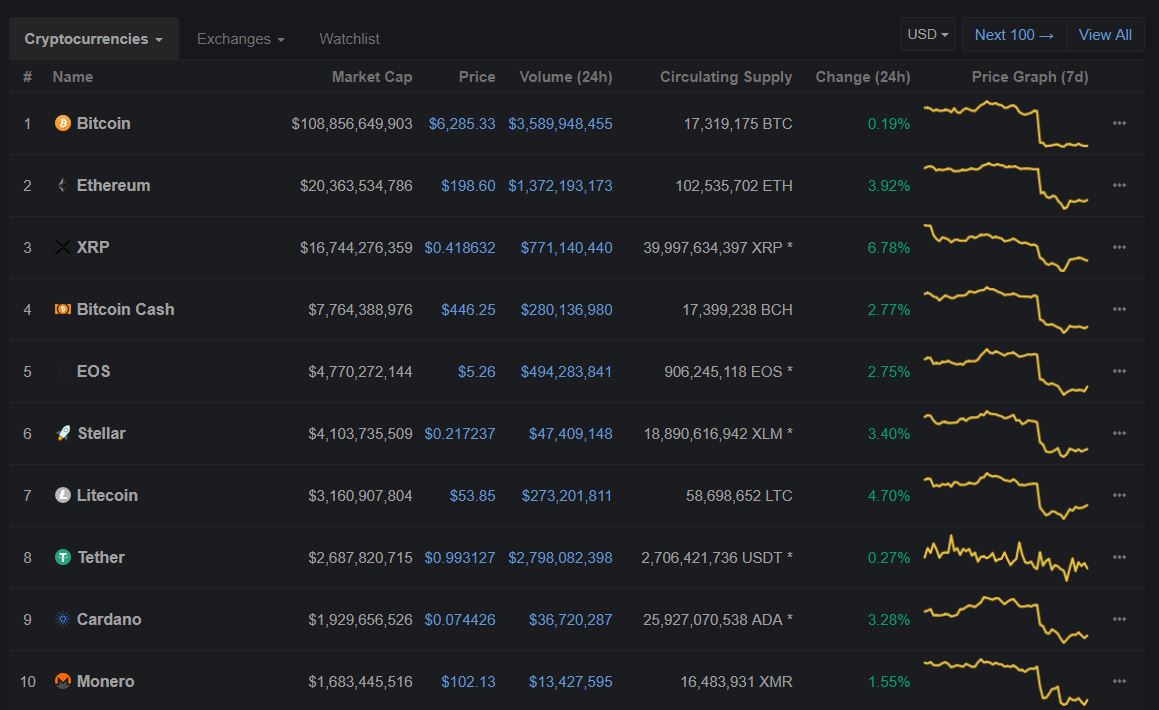

Nevertheless, over the last few months, Moro mentioned that interest in Ethereum shorting had declined steadily and by September it only accounted for 4% in their asset composition. ETH had experienced some decent momentum during the first quarter of the year when it recovered from selling at $400 back in April to double its value at $831. This two-fold price increase at a time where many altcoins were losing value with high volatility and sell-offs, pushed many retail traders and hedge funds into shorting ETH.

Like other cryptocurrencies, ETH continued to show consistently lower highs as the year progressed, unable to keep defending vital support areas in a bear sell-off. It explains why by September, ETH had reached an all-time low value of $170, which it had last attained in May 2017

Developer Interest Still HighDespite trading data showing that the cryptocurrency sector is bottoming out with low prices, especially for major altcoins, Ethereum continues to see increased progress and improvement in its blockchain layers. Recently, GETH, a large scale ETH implementation, was widely recognized together with other major open source projects together with Microsoft Azure, Spyder, and Wix.

ConclusionAccording to Joseph Lubin, ETH co-founder, each bubble and bear market will likely spur more market and developer activity in the long term. All these factors, along with positive regulatory frameworks could be critical for breaking ETH out of this bear market.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|