2020-3-24 15:00 |

The total amount of Ethereum (ETH) locked in decentralized finance (DeFi) platforms plunged by more than $600 million since February 16. It coincided with a 57 percent drop in the price of ETH from $280 to $120.

DeFi platforms like MakerDAO have gained significant popularity in recent months by allowing users to issue loans on the Ethereum blockchain network with relatively high yearly returns.

DeFi loans can be liquidated too when Ethereum price dropsOn a DeFi platform, borrowers are required to put up Ethereum as collateral to obtain loans. The collateral is made in Ethereum terms, which means that when the price of ETH drops, the value of the collateral declines in tandem.

When the price of Ethereum abruptly drops by a large margin, it requires borrowers to put up more Ethereum as collateral to reduce the risk of having their loans liquidated.

Related: Ethereum is down 27% in 4 days: here’s why it’s crashing harder than other cryptocurrenciesBut, when Ethereum’s value plunges by 30 to 50 percent within a short time frame, it makes it difficult for borrowers to make up for the lost value of Ethereum with more collateral.

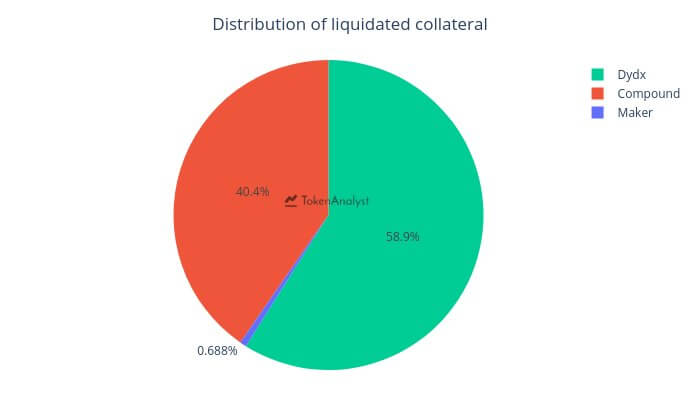

For that reason, when the unexpected drop in the price of bitcoin on March 12 to $3,600 occurred, CryptoSlate reported that millions of dollars worth of DeFi contract liquidations were recorded.

At the time, Tushar Jain, a managing partner at cryptocurrency investment firm Multicoin Capital, said that the entire DeFi ecosystem was at risk of liquidation within a 24-hour span. Jain emphasized that he is concerned if the DeFi ecosystem as a whole is sustainable.

He said:

“I am worried that DeFi cannot be sustainable if the whole ecosystem could get liquidated in less than 24 hours. That was a real risk today.”

Since around $10 million worth of loans were liquidated across major DeFi platforms, the total amount of collateral in Ethereum in the DeFi ecosystem dropped from $1.2 billion to $567 million.

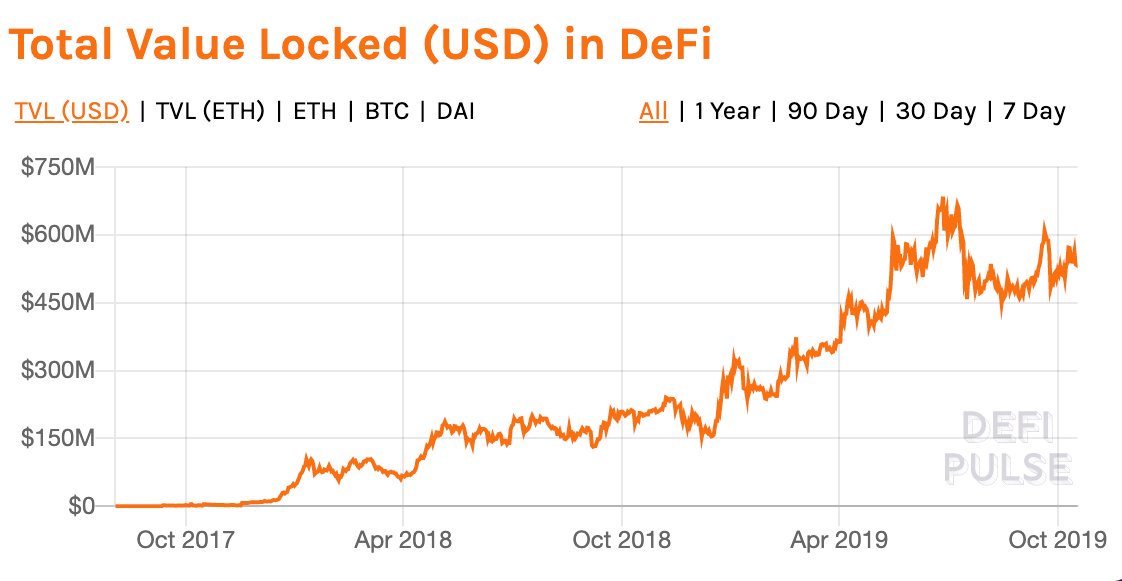

The DeFi market essentially saw an outflow of 57 percent within less than a month. It brought the total value locked in the DeFi ecosystem back to mid-2019 levels.

Ethereum locked in DeFi plunged to mid-2019 levels (source: defipulse.com) So what can be done to sustain DeFi?The single biggest merit of using a DeFi platform is that it is based on top of a decentralized protocol. All financial activities including the issuance of loans are done in a peer-to-peer manner, without the involvement of central entities.

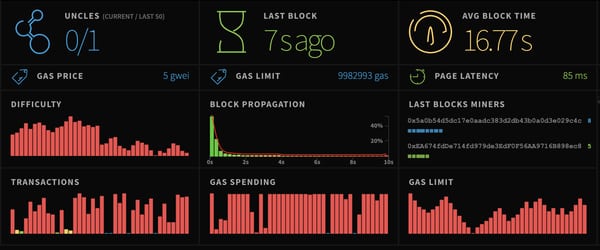

However, the advantage of DeFi could also be a real risk that could shut down the entire market upon flash crashes of major cryptocurrencies if no precautionary measures are taken.

Some prominent investors, like Jain, proposed the implementation of an industry-wide circuit breaker for that reason in case of extreme events that crashes the cryptocurrency market.

Jain noted:

“Today’s price moves in crypto are a strong argument for industry wide circuit breakers. The crypto markets structurally broke today & leading exchanges need to work together to prevent a repeat.”

Whether a severe short-term market correction as seen on March 12 would happen again remains unclear. But, during a flash crash-like pullback, the DeFi ecosystem becomes vulnerable to a cascade of liquidations.

For more news on decentralized finance, check out our DeFi section.

The post Why Ethereum locked in DeFi plunged $600m after intense 57% ETH drop appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|