2020-8-11 21:25 |

MicroStrategy Inc, a Nasdaq-listed public company, has turned a majority of its reserves into bitcoin. The purchase of over 20,000 bitcoin cost more than $250 million.

The Real DealMichael J Saylor, CEO of MicroStrategy, announced today that his company has purchased a massive amount of bitcoin. He sees it as a hedge against inflation. He summed his belief in Bitcoin via a press release:

This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash.

After months of discussion, Saylor said, the company decided that Bitcoin was superior to cash as a reserve holding. He cited inflation and dollar devaluation due to Covid-19.

The company found that Bitcoin had “brand recognition” and “global acceptance.” He also called Bitcoin “digital gold,” even though some influencers in the crypto community, like Gemini’s Tyler Winklevoss, deny that this is the case.

Bitcoin and Gold have both surged beyond analyst forecasts in recent months, providing more impetus for major acquisitions like this.

Bulls at the BTC GateJason Yanowitz of the Blockworks Group commented on the significance of this event.

A public company just bought $250M in Bitcoin as part of their capital allocation strategy.

MicroStrategy’s CEO said they bought Bitcoin to avoid inflation.

Eventually every public company will do the same.

— Yano (@JasonYanowitz) August 11, 2020

He added in an article that this amounts to 60% of the company’s capital.

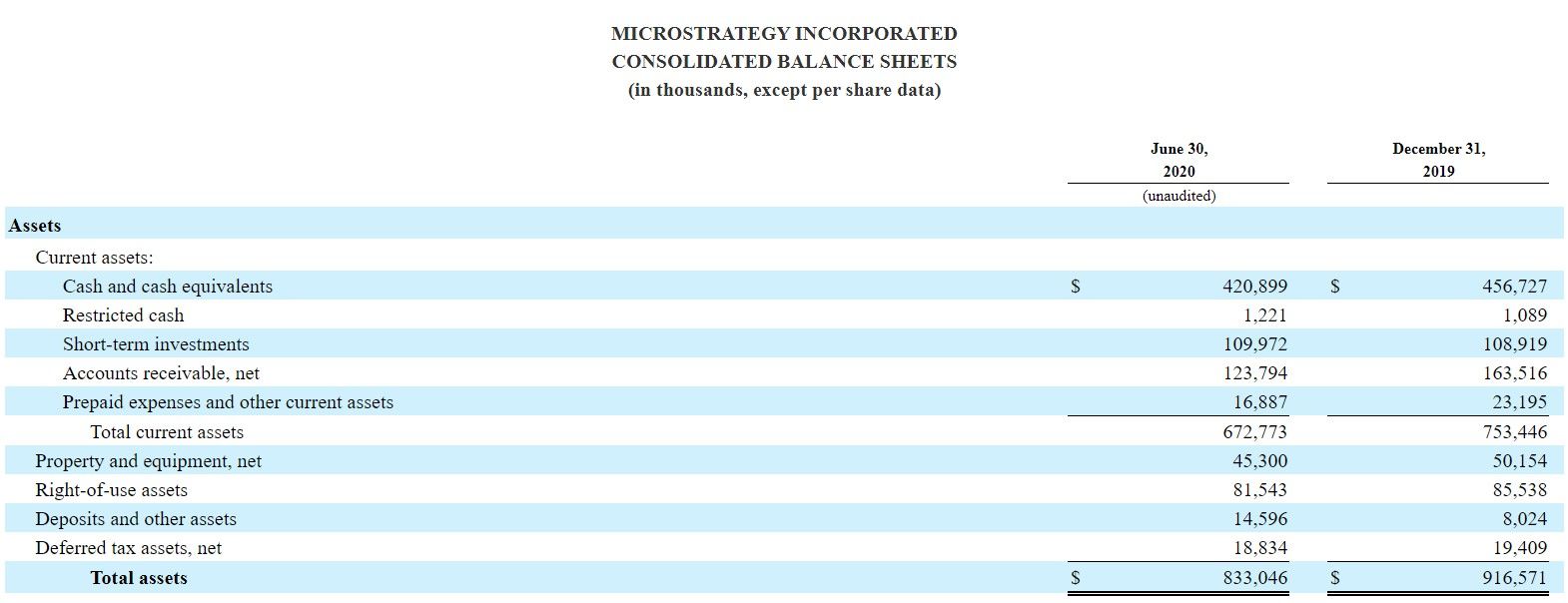

Indeed, balance sheets taken from the most recent quarterly SEC filing show that the company’s treasury contains about $420 million. With $250 million worth of BTC on the books, Bitcoin is now a majority of the reserves.

Microstrategy balance sheets | Source: SEC“We are starting to see businesses owning bitcoin as marketable strategy,”

said Preston Pysh of the Investor’s Podcast Network.

As I suggested 6 months ago, we are now starting to see businesses owning Bitcoin as a marketable security on their balance sheet. MicroStrategy Adopts Bitcoin as Primary Treasury Reserve Asset. Just. Getting. Started. https://t.co/dVUOr8Loac

— Preston Pysh (@PrestonPysh) August 11, 2020

Some are not so optimistic, though. Even if it is bullish, there’s no guarantee the move will attract additional investors. David Z. Morris, a Fortune magazine writer, worried such a move would upset stakeholders. Even though investors could bail, he still thought the move was a mistake.

Oh wow, I stand semi-corrected.

Now it just seems like a bad investment for stockholders compared to either buying Bitcoin themselves or buying a company with expansion plans.

— David Z. Morris (@davidzmorris) August 11, 2020

The Next StepOpinions aside, MicroStrategy stock was up almost 13% at the time of writing.

MicroStrategy stock rose 13% in morning trade | Source: GoogleMicroStrategy calls itself the “largest independent publicly-traded business intelligence company.” Since business intelligence is a data-driven field, it’s no surprise that such a company would be the first to buy into BTC.

In short, this is a big step toward adoption. Coca Cola bottlers recently announced they will trial Ethereum for the supply chain. These companies may have just opened the floodgates. A simple question now remains: how long before other companies follow suit?

The post Wall Street Company Buys a Massive $250 Million in BTC appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|