2020-8-11 18:21 |

MicroStrategy is now taking a deep dive into the world of bitcoin.

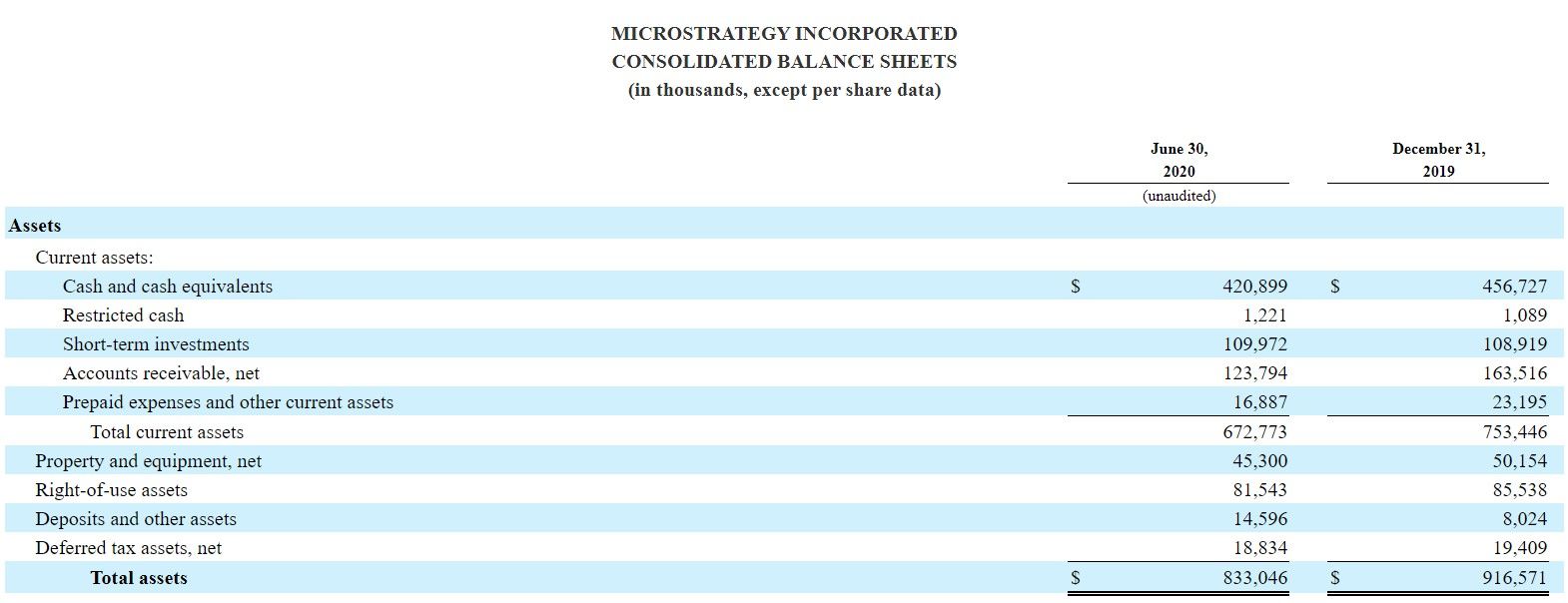

The $1.2 billion Nasdaq listed software company has officially announced its position in the largest digital asset. A fortnight after announcing to invest in bitcoin as an inflation hedge, the company has purchased 21,454 BTC at an aggregate price of $250 million, inclusive of fees and expenses.

As we reported, in its earnings call on July 28, 2020, the company shared its bitcoin investment plans as part of its two-pronged capital allocation strategy to “maximize long-term value for our shareholders,” said Michael J. Saylor, CEO, MicroStrategy Incorporated.

According to Saylor, it is their investment belief that bitcoin is a “dependable store of value and an attractive investment asset,” that has more long-term price appreciation potential than holding cash. He said,

“Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions.”

The company recognizes the digital asset as “a legitimate investment asset that can be superior to cash” as such giving it a principal holding in its treasury reserve program.

It has been after months of deliberation that the company decided to allocate its capital into bitcoin, revealed the company. The decision was in part driven by macro factors that are creating long-term risks for their investments.

Economic and public health crisis, unprecedented government financial stimulus measures including QE around the world, and global political and economic uncertainty are the factors listed by the company that have a “significant depreciating effect on the long-term real value of fiat currencies and many other conventional asset types.”

And bitcoin provides “not only a “reasonable hedge against inflation but also the prospect of earning a higher return than other investments,” said Saylor.

According to the company, the world’s leading digital asset is a digital gold that is stronger, smarter, harder, and faster than “any money that has preceded it.” The CEO said,

“We find the global acceptance, brand recognition, ecosystem vitality, network dominance, architectural resilience, technical utility, and community ethos of Bitcoin to be persuasive evidence of its superiority as an asset class for those seeking a long-term store of value.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|