2020-8-19 19:01 |

After billionaire investor Paul Tudor Jones and MicroStrategy, now a small company, a restaurant called Tahinis that specializes in middle eastern cuisine has jumped into Bitcoin.

The company took to its Twitter account to share that they have converted their “entire” cash reserves, originally used as savings, into Bitcoin.

The Ontario, Canada-based restaurant operates in four corporate locations with further plans to open three franchises.

The decision was made by the owners in the aftermath of the March coronavirus crisis during which they tried to keep the restaurants afloat amidst the expansion phase.

Here came the central bank assistance in the form of money printing that has not only the company owners but also the employees, some of them were also partners, making “a lot of money.” The tweet reads,

“Our Cash reserves swelled and business was booming again. But it was apparent to us that cash didn’t have the same appeal. That eventually with all the excess cash circulating the economy that cash would be worth less.”

Already aware of cryptocurrencies, one of the company owners went into the bitcoin rabbit hole while expanding his financial knowledge, although his investor idol Warren Buffett called it “rat poison squared.”

Given that in the current rallying markets is outperforming Buffett who has been selling his banking holdings to jump into gold now, it is best to not take the Oracle of Omaha’s word about bitcoin. Not just gold, but Buffett has been late to the party when it comes to the internet and Apple as well.

More Returns & a Lot More…So, first, the Tahini restaurant owner started accumulating in his personal account and from there “we as a company decided to store all of our excess cash reserves into bitcoin as it offers a much better alternative to saving cash.”

They are planning to “continue to do that over the coming years and maybe forever if we don't have a need for the fiat.”

Given the fact that in 2020 so far, Bitcoin outperforms S&P 500, gold, Treasuries, and oil, it makes sense to move into Bitcoin. However, industry experts caution on going all-in in Bitcoin, rather advise investing a certain percentage as the crypto market is extremely volatile.

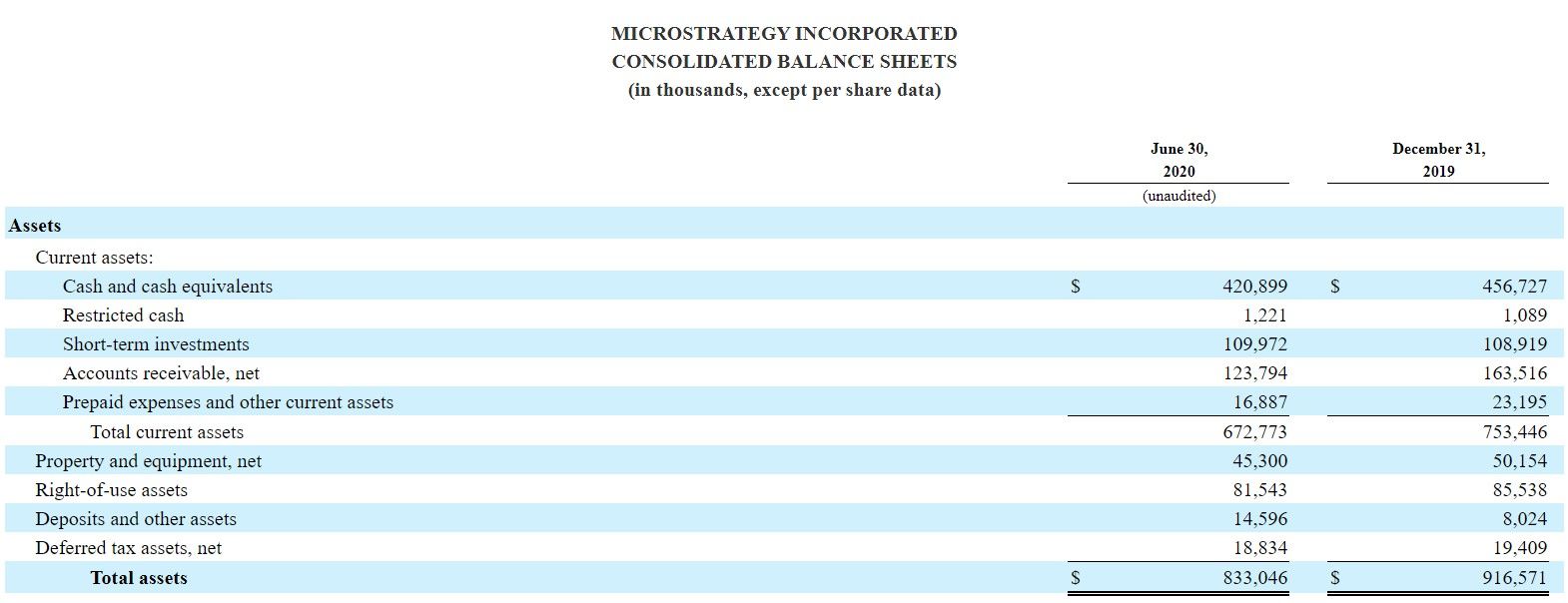

Besides being an attractive investment asset and becoming a store of value, embracing bitcoin also helps the companies in attracting interest. MicroStrategy stock has jumped 20% following the announcement.

Moreover, owning cash on the balance sheet is “quite onerous,” as it requires keeping multiple global checking accounts that involve time, expensive fees, and delayed settlement, said Jeff Dorman, chief investment officer at Arca.

Meanwhile, owning Bitcoin means reducing reliance on third parties, lower transaction costs, potentially increasing yield, and increasing payment flexibility — “a nice byproduct of a corporate finance department entering the digital world.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|