2026-1-21 16:00 |

Strategy continues to dominate as the largest Bitcoin treasury company. This time, the company has expanded its holdings, crossing 700,0000 BTC in the process, and currently holds over 3% of the total Bitcoin supply.

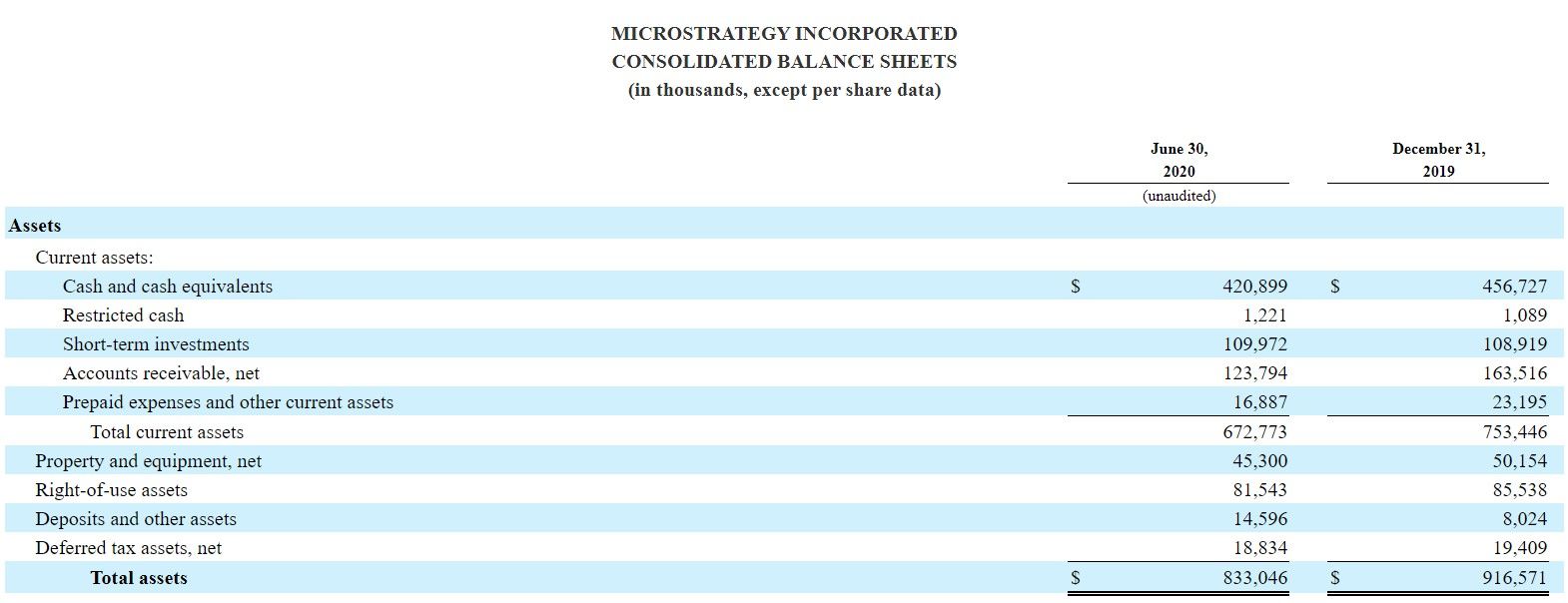

Strategy Now Holds 3.4% Of Bitcoin Supply As Holdings Top 700,000 BTCMichael Saylor’s Strategy now holds approximately 3.4% of the total Bitcoin supply as the company increased its holdings to over 700,000. In a press release, the company revealed that it acquired 22,305 BTC for $2.13 billion at an average price of $95,284 per Bitcoin last week. It now holds 709,715 BTC, which it acquired for $53.92 billion at an average price of $75,979.

This purchase was Strategy’s largest weekly announcement since November 2024 and its fifth-largest announcement ever. It also came just a week after the company announced it had acquired 13,627 BTC for $1.25 billion. Meanwhile, this latest purchase has come amid a decline in BTC’s price.

Bitcoin dropped below $90,000 yesterday for the first time since the start of the year, dragging the Strategy stock with it. MSTR dropped as much as 8% yesterday, falling to around $160. The stock is still up over 3% year-to-date (YTD). However, it is worth noting that Saylor and his company continue to dilute MSTR shares to buy more Bitcoin. The company sold 10.4 million MSTR shares last week to fund most of this latest purchase.

Reactions To The Latest BTC PurchaseMarket analyst Rob noted that Strategy no longer highlights BTC yield as a flagship metric. He further stated that even after buying over 35,000 BTC in the first few weeks of this year, the BTC yield achieved is 0.4%, which amounts to an annualized rate of about 6% to 10%. The analyst also remarked that the law of diminishing Bitcoin yield means the ability to deliver a yield decreases as the BTC stack grows.

With Strategy now holding over 700,000 BTC, Rob explained that it is harder to generate a return. According to him, this means that going forward, the play is more about squeezing the Bitcoin price itself higher rather than increasing the BTC per share. He added that this also explains why MSTR’s mNAV has collapsed to just over 1x.

Crypto commentator Ran Neuner warned that a company like Strategy buying and holding such a large concentration of a reserve asset is not healthy. He added that right now, Saylor and his company are the only ones really buying Bitcoin. Meanwhile, market expert Bit Paine said it is a market failure that Saylor is allowed to buy this much BTC at prices below $100,000.

At the time of writing, the BTC price is trading at around $90,000, down in the last 24 hours, according to data from CoinMarketCap.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|