2020-9-25 12:18 |

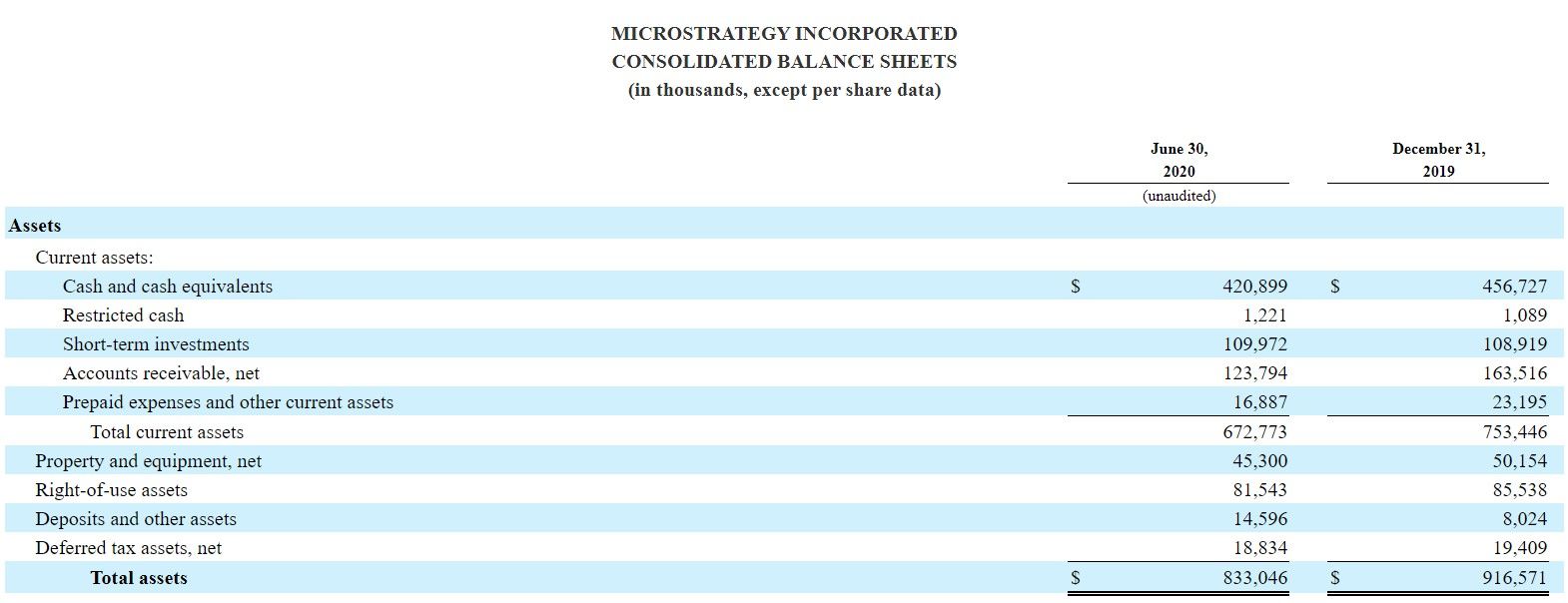

MicroStrategy recently rocked the crypto world with its blockbuster bitcoin purchase. The Delaware-based software company indicated that bitcoin was a suitable store of value that has a “more long-term appreciation potential than holding cash.”

But despite the company’s massive bitcoin bet, the CEO, Michael Saylor maintains that he’s no crypto fanatic. This means the company can liquidate the BTC it currently owns anytime they see fit.

Why MicroStrategy Could Easily Dump Its BTC HoldingsIn an interview with Bloomberg on September 22, MicroStrategy CEO noted that he was prompted to convert the firm’s cash holdings to bitcoin by the FED’s decision to let inflation run hot. He reiterated his belief that bitcoin is less risky than holding cash or even gold.

However, he stated that his company would not hesitate to sell the cryptocurrency at any time if bond yields skyrocket.

“We can liquidate it any day of the week, any hour of the day. If I needed to liquidate $200 million of Bitcoin, I believe I could do it on a Saturday. If I took a haircut, I believe it would be 2%.”

Unfortunately, bitcoin has plummeted ever since the company acquired it. Saylor, however, clarified that they are not planning to sell in the foreseeable future, despite the asset’s wild volatility. He posited: “Volatility isn’t really a reason to sell. Right now this is the only thing we can find with a positive real yield.”

More Companies Will Soon Jump On The Bitcoin BandwagonWorth mentioning that after Saylor announced the purchase of another $175 million worth of bitcoin, the company’s stocks surged nearly 10%. Additionally, during his interview with Bloomberg, he revealed that he had discussions with the large shareholders and a majority of them complimented his decision to invest in the flagship cryptocurrency.

Saylor further forecasted that other companies will follow in their footsteps and buy bitcoin in the near future.

“It will probably be private companies first because they don’t have as much inertia. The public companies our size, then mid-sized companies.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|