2020-9-22 18:26 |

Up until the mid of last week, Curve clone Swerve was enjoying a record $942 million in deposits, or total value locked (TVL), as per Debank.

But today, the protocol has just $69 million of funds left in it, suffering a loss of 92.6%. It took less than half of the days for Swerve to lose $873 million than it took to gain these funds.

But what exactly was behind this crash? Two words: Incentive rewards.

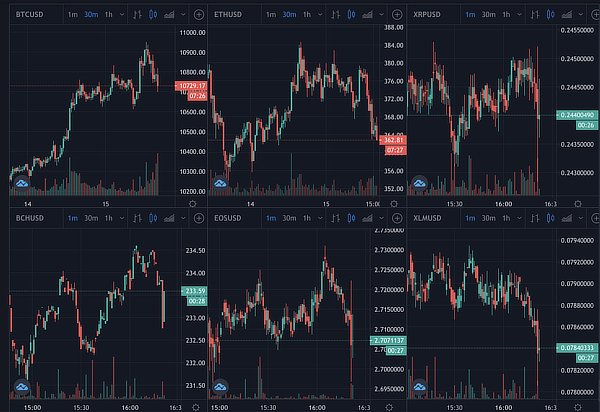

Over the weekend, SWRV issuance was reduced to 9 million SWRV per year from the previous two weeks. With this new chapter, the users fled the scene, and the price of SWRV lost the bulls. It is currently trading at $1.9, after having been on a downtrend since Sept. 9 high of $7.

On Sept. 19, the volume on the platform was at its highest at $220.6 million, which also tanked to $25 million the next day.

“Swerve's liquidity was just mercenaries searching the highest yield,” said Ryan Watkins of Messari. “Forking is easy, building is hard.”

Addressing The A Parameter Change:

There was about a ~0.085% IL (less than one tenth of one percent) with the A factor change in Swerve today with a pool size of $200M. This was to be expected with the parameter change, and by no means did any LP's get "rekt".

— Swerve Finance (@SwerveFinance) September 19, 2020

On the other hand, the original DEX Curve is the third-largest DeFi project currently with a TVL of $1.26 billion, which over the weekend, nearly hit a new record. The volume on the platform also continues to grow, registering $419 million the same day Swerve tanked, which means Curve has taken back all the liquidity from its fork.

Although SushiSwap isn’t experiencing as much loss as Swerve, things aren’t better for this Uniswap copycat, either.

Since hitting $1.58 billion record TVL at the beginning of September, the crypto deposits on the platform have been on a downtrend, hitting $453 million today. The same is the case for its volume, which has continually decreased to $41 million from the high of $265 million on Sept. 10.

This DEX is also set to lock up SushiSwap rewards for six months to decrease circulating supply and further hard cap the supply at 250 million tokens.

The original Uniswap, meanwhile, was all the rage this week with the launch of its governance token UNI. This helped the protocol become the largest DeFi project with $2 billion in TVL.

The post These 2 DeFi Forks Take a Harsh Beating As The Originals Reclaim Their Dominance first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Circuits of Value (COVAL) на Currencies.ru

|

|