2020-4-2 22:55 |

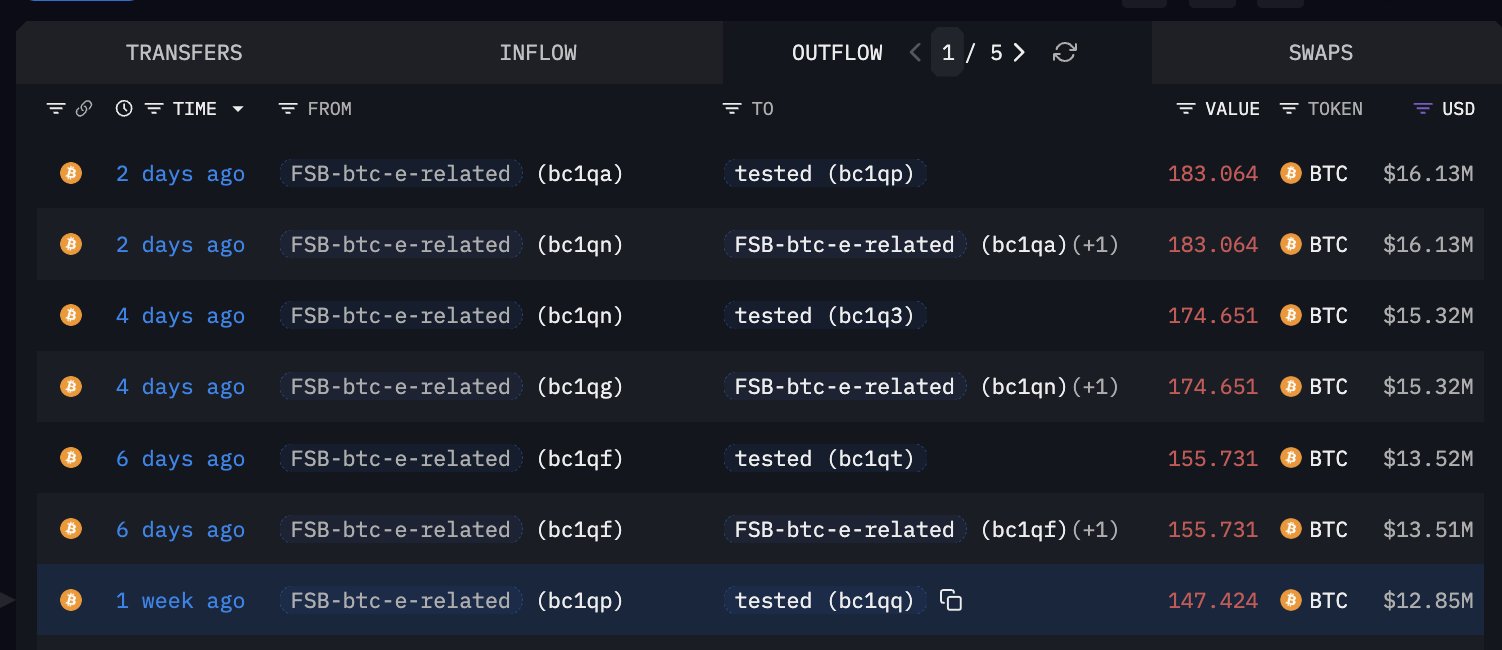

On March 31st, 800 BTC worth over $5 million was transferred from now-defunct bitcoin exchange Mt. Gox, as per Whale Alert, a live tracker of large crypto transactions from and to exchanges for cryptocurrencies.

800 #BTC (5,163,286 USD) transferred from DiscusFish/F2Pool/MtGox/FreeBitco.in to unknown wallet

Tx: https://t.co/mwBh6ImymP

— Whale Alert (@whale_alert) March 31, 2020

Investors are now fearful of another sell-off as Mt Gox gets ready to dump BTC in the market. This movement of funds came hot on the heel of the exchange’s rehabilitation plan pushed back to July 1.

Trader Jacob Canfield said Mt. Gox is one of the bearish narratives in play for bitcoins as its trustee comes “back to sell some more.”

Currently, BTC/USD is trading just above $6,200, down 3.49% while recording minus 14% returns YTD.

Deadline of the rehabilitation plan extendedThe exchange collapsed in early 2014 declaring insolvency amidst the allegations of fraud and mismanagement. The CEO of the exchange was also found guilty of tampering with financial records.

The hackers stole 850,000 BTC in 2014 and the exchange had 200,000 BTC in an old-format wallet. As per the latest count, Mt. Gox estate held about 141,600 BTC and 142,800 BCH. The trustee, attorney Nobuaki Kobayashi, sold off about $400 million worth of BTC in early 2018 causing the market to crash.

In June 2018, Mt. Gox entered civil rehabilitation. – Source: CryptoGroundAs per the draft rehabilitation plan in circulation, the head of the creditor meeting, Kobayashi laid down the details about the wind-down of the exchange. The draft further mentioned that payouts will be in the form of claims filed, that would involve Bitcoin (BTC), bitcoin cash (BCH) and because they would be insufficient, in fiat currency like Japanese yen.

“Most of these creditors are generally bitcoin specialties themselves who want to remain in the market; so to sell off BTC and pay them in fiat not only locks them into a price at exit and caps their potential upside but also would lead to a sell-off in the market, which, as happened in 2018, can get messy,” Alex Ortega, managing principal of Iverson Capital Group, the first company that bought Mt. Gox creditor claims in 2016 told CoinDesk.

The original court-ordered deadline for the rehabilitation was March 31 but because of the “matters that require closer examination with regard to the rehabilitation plan, it has become necessary to extend the submission deadline for the rehabilitation plan,” reads the notice.

Following the meeting, the Tokyo District Court granted Kaboyashi’s deadline extension which was already extended to in October 2019.

“In light of the foregoing, the Rehabilitation Trustee filed a motion to seek an extension of the submission deadline of the rehabilitation plan at the Tokyo District Court, and, on March 27, 2020, the Tokyo District Court issued an order to extend the submission deadline for the rehabilitation plan to July 1, 2020,” the notice added.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|