2020-3-19 20:58 |

Black Thursday had been one of the worst days for the crypto community that recorded the violent sell-off across the market. But not only did the prices crash severely, for Ethereum it also resulted in Network congestion, a rise in fees, increased gas price, and liquidation issues with decentralized finance (DeFi) products.

As per cryptanalysis firm Glassnode’s latest insight report, this resulted in triggering unintended consequences for the MakerDAO ecosystem, so much so that it allowed some liquidators to buy a huge amount of DAI for $0.

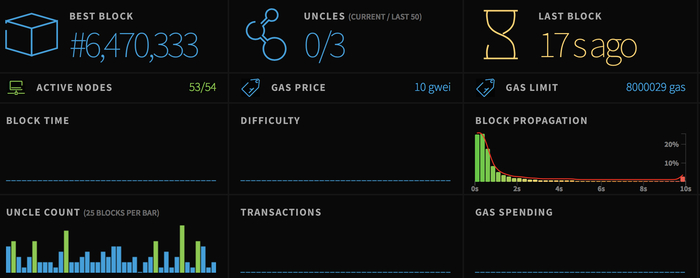

Chaos EverywhereOn March 12, the price of Ether dropped 43% resulting in the on-chain volumes to spike dramatically as users scrambled to react to the falling prices in the broad market. Not just exchanges, but Ethereum dapps also recorded their highest ever daily activity, both of which overwhelmed the network, which wasn’t the first time.

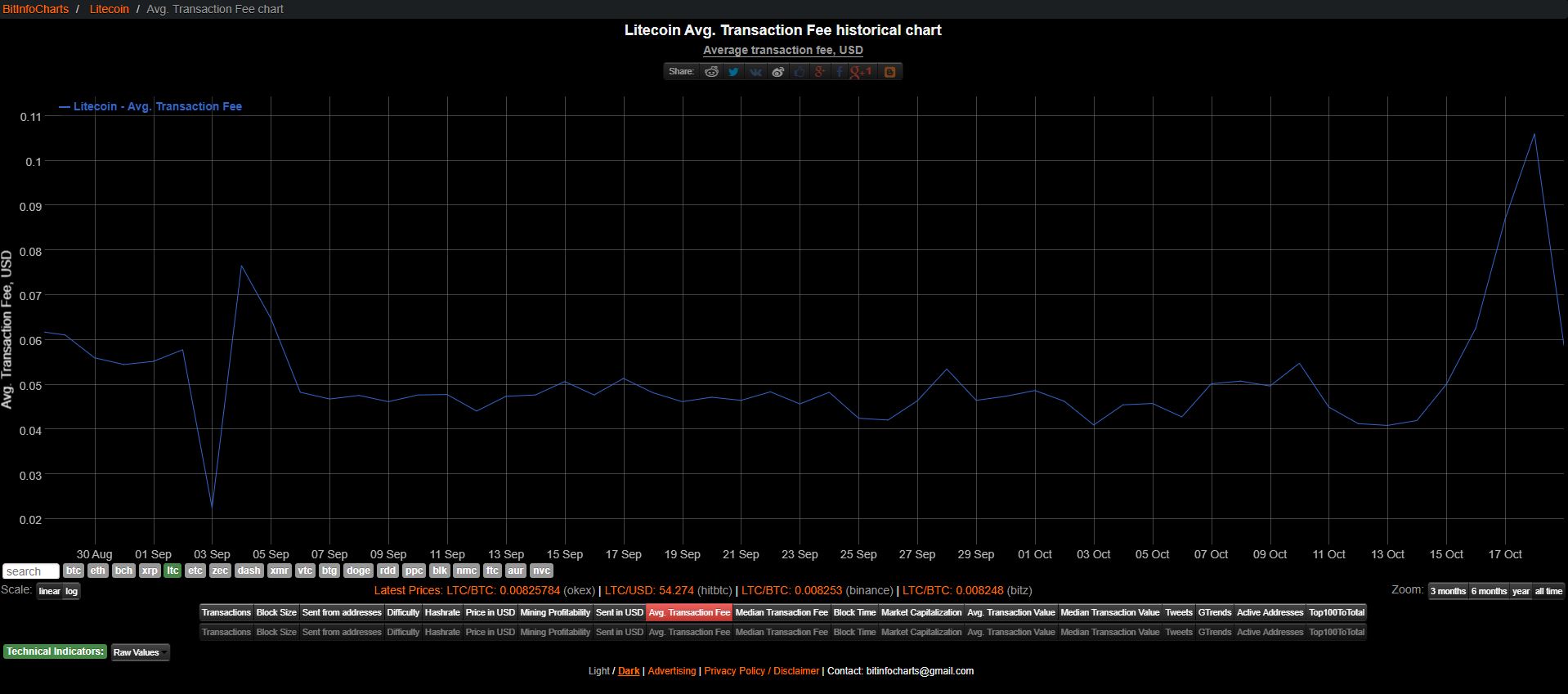

The network congestion saw the mean gas price for the day surging 6x. Meanwhile, the increase in on-chain activity was,

“especially significant for DeFi apps, which were overwhelmed by the radical spike in demand.”

With gas prices so high, from 80 to 200 Gwei and transactions to be confirmed piling up, the pricing oracles of MakerDAO and Chainlink were unable to update their prices quickly enough to keep up with the rapidly decreasing price of Ether.

Maker’s Medianizer oracle showed a difference of $30, on the higher side, in price. Now, this gave some network participants time to pay off their Maker CDPs which otherwise would have been liquidated. These participants paid high gas fees and rescued their CDPs. And when the price was finally updated, many CDPs got liquidated suddenly en masse.

Amidst this chaos, those that had safeguards in place still got liquidated because safeguards relied on accurate and regular updates price data while some were liquidated notwithstanding if the collateral was purchased yet.

Exploiting the SituationWhen Maker CDPs are liquidated, their collateral is auctioned off by the Maker to pay back the CDP owner’s debt with a 13% liquidation penalty. However, on that day, because gas prices were so high and the queue of transactions so long, bids that offered “regular” gas prices weren’t processed fast enough.

A liquidator, likely a bot, took advantage of the situation and won these auctions with a bid of zero DAI, which is buying bundles of 50 ETH for free, only for others to join and take advantage of the situation as well.

As per Glassnode, over $8 million in ETH was liquidated for zero DAI. This resulted in net loss for MakerDAO system, with at least $4.5 million worth of DAI left unbacked by any collateral. But Maker wasn’t the only one undercollateralized.

“Because CDPs are overcollateralized by default, these users should have received the total ETH value of their CDP minus their debt and the 13% liquidation penalty. However, because their ETH collateral was sold for zero DAI, they were left with nothing.”

The largest one has been of 35,000 Ether, equivalent to about $4 million.

After the exploit, MakerDao conducted a vote and decided on increasing the maximum lot size from 50 to 500 ETH and the duration of auctions was also raised.

The Maker Community is now considering printing and auctioning of new MKR tokens for the re-collateralization of DAI that will dilute existing MKR holders. They are also proposing a reduction of Dai Savings Rate (DSR) and the Global Stability Fee to bring DAI’s price close to 1 USD peg.

origin »Bitcoin price in Telegram @btc_price_every_hour

Santiment Network Token (SAN) на Currencies.ru

|

|