2019-6-3 07:00 |

Bitcoin Fees On The Rise

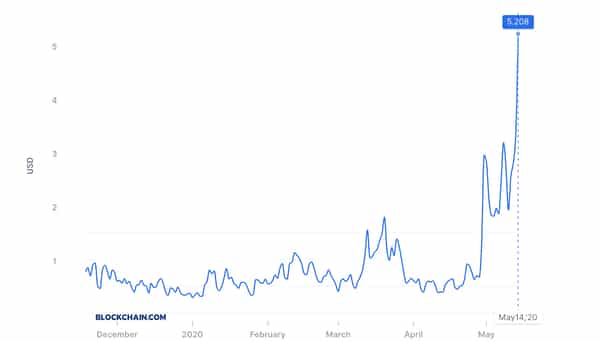

With the uptick in the Bitcoin (BTC) price, transaction fees have been on the rise again. While users could send transactions with a $0.03 fee at the bottom of the bear market, most transactions are now sent with $1 or $2 fees. Some skeptics, like the @Bitcoin Twitter handle, have been claiming that this is the end of the world, singing the praises of forks and alternatives as a way to transact value between wallets. (This shouldn’t be surprising, we saw this in the last bull run.)

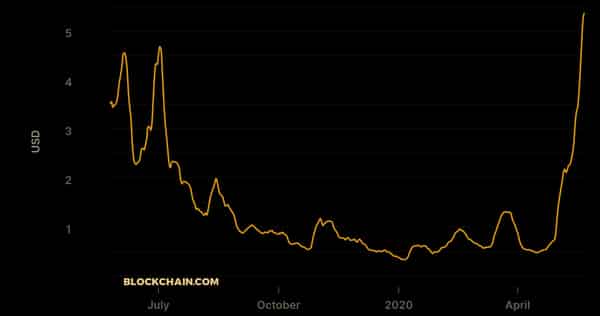

But, as put by Sergej Kotliar, the chief executive of Bitrefill, the fee situation isn’t apocalyptic yet. As seen in the graphics below posted by Kotliar, the growth in the mempool, which coincides with higher fees, is effectively not even visible on the chart. In fact, the mempool is less than 10% the size it was in late-2017/early-2018, which was when the average transaction fee for the Bitcoin blockchain was above some $20 for weeks.

Now, it's important to keep in mind that this situation is NOWHERE near what we had in December 2017. Here's a zoomed out mempool (I adjusted min fees because in 2017 transactions were overflowing the mempools). pic.twitter.com/vIGb0cA9uH

— Sergej Kotliar (@ziggamon) May 31, 2019What’s more, now everyone is aware of fees, exchanges batch transactions, and there are sidechain/second layer/other solutions in the form of Lightning, Liquid, and altcoins (namely Ethereum and Litecoin) to send value between exchanges. Thus, he concludes that:

There’s no reason to think 2017 will return any time soon. Au contraire, once exchanges turn on Lightning or Liquid these spikes will disappear as well.

Corroborating a recent report from Bloomberg, Kotliar then notes, however, that much of this on-chain activity is a result of speculative activity, as investors, presumably whales, want to send their Bitcoin to exchanges when prices toss and turn. And thus, he made a few suggestions as to how companies in the cryptocurrency space can work towards reducing fees for all.

Firstly, the San Francisco-headquartered Coinbase is not batching their sending transactions, which purportedly “eats up a significant percentage of the mempool space to no benefit.” The thing is, Brian Armstrong, the chief executive of the platform, stated in early-2018 that his team was actively working on the issue. Seeing that nothing has happened since, some have labeled Armstrong & Co. somewhat of a detriment to the Bitcoin fee economy.

Secondly and more importantly, BitMEX is also not batching their transactions. The thing is, Coinbase’s transactions occur throughout the day, while BitMEX’s are sent out all in one, massive batch. As seen below, the derivative exchange’s “comically unoptimized” transactions make often amount to over four megabytes. By optimizing these transactions by batching and using lower fees, they would shrink by 98% and would barely cause a blip on the mempool chart.

This isn’t an immediate issue per se, as fees are still manageable for most. For instance, if you’re fine waiting for two-odd hours, a $0.5 transaction fee can work. But, if the volatility continues, investors may continue to need to use the Bitcoin base chain to send value between exchanges, mandating a solution.

Second is BitMEX @BitMEXdotcom @BitMEXResearch. Every day at 9.15 AM ET they dump ~4 MB of just comically unoptimized withdrawal transactions. This is a big reason why fees are high during US office hours. Optimizing these to best practices would make these tx’s shrink by 98% +. pic.twitter.com/x1VyOgHPOa

— Sergej Kotliar (@ziggamon) May 31, 2019 Photo by Dmitry Moraine on UnsplashThe post Bitcoin Fees On The Rise, BitMEX & Coinbase Should Batch Txs: Bitrefill CEO appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|