2019-2-12 23:03 |

Diar Releases New Report Discussing Topics Related To Bitcoin Fees, Binance And Coinbase

The institutional publication and data resource analyzing digital currencies Diar released a new report in which they discuss different issues including Bitcoin (BTC) fees, Coinbase’s economic model and Binance’s decision to bet on Initial Coin Offerings (ICOs), among other things.

The first topic is related to Coinbase. During a conversation with Dan Romero, the Vice President of Coinbase, they discuss the expansion plans for the future.

Coinbase is one of the largest and most popular crypto platforms around the world. The company has been working with different financial regulators in several countries in order to be able to reach new users. One of these countries is Japan.

Coinbase has been trying to obtain a license provided by the Financial Services Agency (FSA), which is required for crypto exchanges to operate in the country. The crypto platform has already closed a partnership with one of the largest banks in Japan, MUFG.

However, they do not only try to reach developed markets but also developing economies and countries where users experience economic fluctuations and instability in their currencies.

Regarding this issue, Dan Romero commented:

“Use cases in developed markets will be different to those in emerging markets as the US and Europe have a fairly well-developed financial system. Our mission is to build out the ecosystem so that we can move away from the narrative of crypto only being a speculative investment. We need to move the technology into the Utility Phase.”

This is similar to what Binance is also trying to do. The popular crypto exchange is trying to expand to new countries. The company allows users in Uganda to trade virtual currencies against the Ugandan Shilling. In the future, the firm expects to reach new developing markets.

At the moment, Coinbase did not explain which are going to be the countries they want to reach. According to him, what users will see in 2019 is a “big push” to expand the number of countries with an easy on-ramp into crypto. Some of the regions they are exploring are Latin America, Africa, and South East Asia.

In developing economies such as Venezuela or Zimbabwe, users are starting to use virtual currencies in order to survive or pay for goods and services.

The second topic discussed by Diar is Binance betting on Initial Coin Offerings (ICOs) second coming. Binance is the largest digital currency exchange in terms of trading volume in the market. As Changpeng Zhao explained a few days ago in a Periscope Live Stream, the exchange is focusing on building their decentralized exchange (DEX).

During the last years, decentralized exchanges have been expanding in the market. The intention is to provide an alternative to centralized platforms that control users’ private keys and can be hacked at any moment. However, they have failed to attract a large number of users due to a lack of a good user experience.

Binance wants to change that by offering a new DEX that is user-friendly. The company decided to build the exchange using the Cosmos Tendermint blockchain rather than Ethereum (ETH). AT the same time, the company is going to launch its own Binance Chain.

Some time ago, a demonstration of how the Binance DEX platform works showed that the user experience seems to be improved compared to other DEX in the market.

Binance is also allowing companies to create and launch their own Initial Coin Offerings in a platform called Binance Launchpad. The intention is to help companies release their ICOs to the market and raise funds. However, projects will have to pay a listing fee of $100,000.

Just a few weeks ago, BitTorrent launched the BitTorrent Token (BTT) using the Binance Luanchpad platform. The ICO ended in 15 minutes and it gathered $7 million.

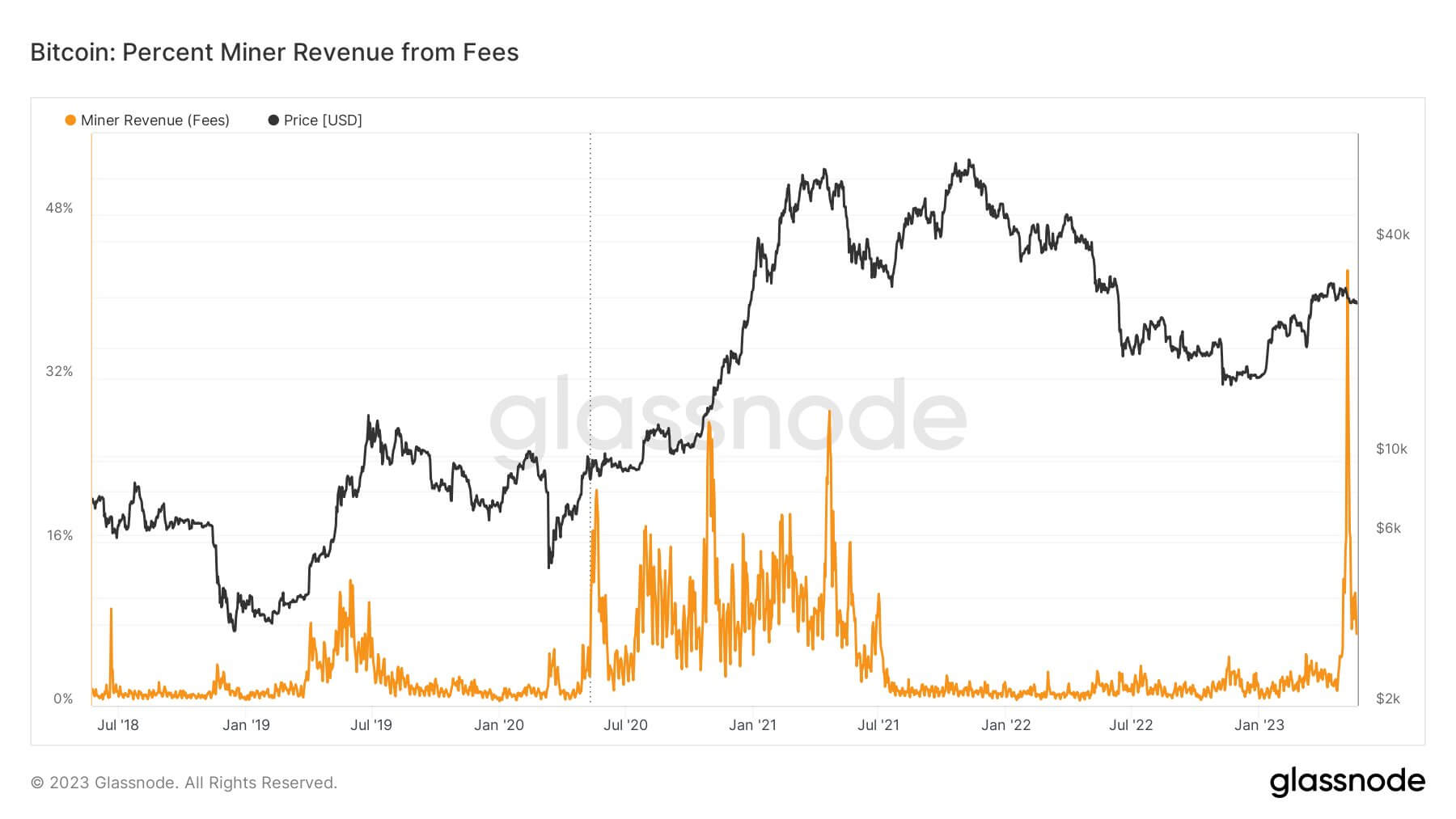

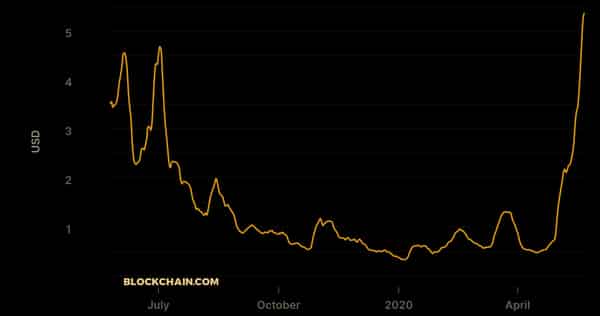

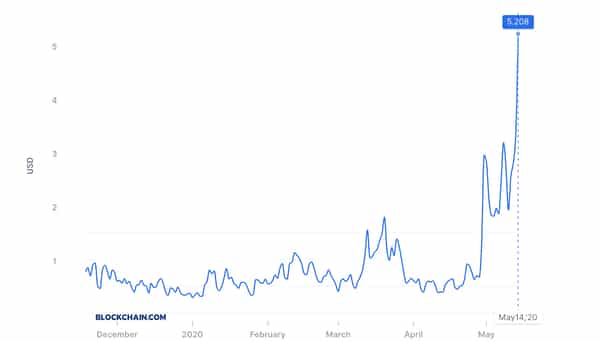

The third topic that Diar discusses is related to Bitcoin and the fees to process transactions. Bitcoin transactions reached a new yearly high short time ago, similar to levels seen only in 2017, which is very positive. At the same time, with a similar transaction level as in 2017, the network currently has the same fee level as in 2015. Thus, this is very positive, showing that Bitcoin is being able to scale as time passes.

There are two reasons behind this. The first thing to mention is that the Segregated Witness (SeGwit) implementation grew during the last year. Although the price of the popular digital asset dropped, companies started to implement this solution to reduce the size of each BTC transaction.

The Lightning Network (LN), which is a second layer scaling solution for Bitcoin, continues to grow. In 2018, the number of nodes, channels and capacity increased substantially. At the time of writing this article, the LN has a capacity of 650 BTC(~$2.4 million), more than 6,150 nodes and over 24,600 channels.

Finally, the last topic mentioned by Diar is related to the cryptocurrency startup Abra and its decision to offer fractional stocks. The firm announced that users will be able to take positions in traditional stocks, commodities, and Exchange Traded Funds (ETFs) using Bitcoin.

At the moment, the company is available in 155 countries. Although this can be a positive announcement, there are some issues regarding its legality in the United States. The Securities and Exchange Commission (SEC) deem the trading mechanism as a COntract for Difference (CFD) which is illegal in the country. At the same time, the lack of know-your-customer (KYC) procedures could also play an important role in calling the attention of the regulator.

The SEC has been taking a more active stance in the market after several ICOs and projects started to steal users’ funds all over the world.

Bitcoin (BTC), Ethereum (ETH), XRP (Ripple), and BCH Price Analysis Watch (Feb 12th)

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|