2020-5-21 11:59 |

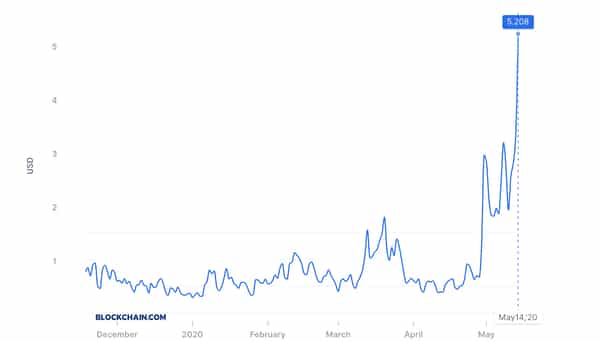

Transaction fees on Bitcoin have increased by close to 250% since the network’s third block reward halving on May 11. If this is the start of a sustained fee market, the positive impact on the network’s security outweighs the negatives for users.

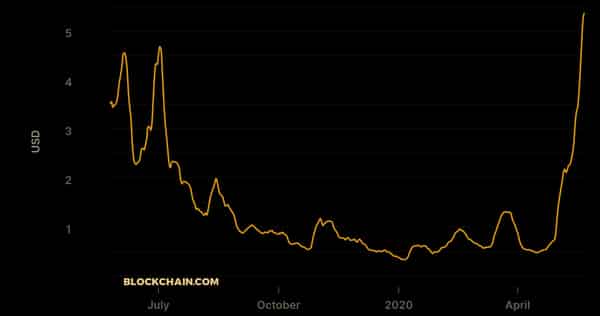

Bitcoin Makes up for Lost EarningsSince the halving occurred, the average fee required to transact over the Bitcoin network has risen from $2.5 to $6.4.

Bitcoin’s average transaction fee hasn’t crossed the $2 threshold since August 2019.

The last time average fees hit $6 was in July 2019, which was the start of a multi-month downtrend for BTC. If this is any indicator, the higher transaction fees could be the result of investors moving their coins to exchanges to sell.

Source: BitInfo ChartsBitcoin miners have collected 1,176 BTC in transaction fees over this same period. To put this in perspective, miners earned just 818 BTC in fees during April and 1,251 BTC in March, per CoinMetrics.

Moreover, this halving may be the catalyst needed for Bitcoin to realize its future as a fee market.

With the halving reducing miner revenue from block rewards by 50%, transaction fees need to pick up the slack to continue providing miners with strong near-term incentives.

Bitcoin’s sudden increase in transaction fees may be a detriment to users, but the incentive it provides is a vital force in keeping the network secure.

Whether this is a sustained increase in transaction fees or simply a rush to sell BTC will be known in a few days.

The post Bitcoin’s Transaction Fees Soar Post-Halving appeared first on Crypto Briefing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|