2020-5-22 20:30 |

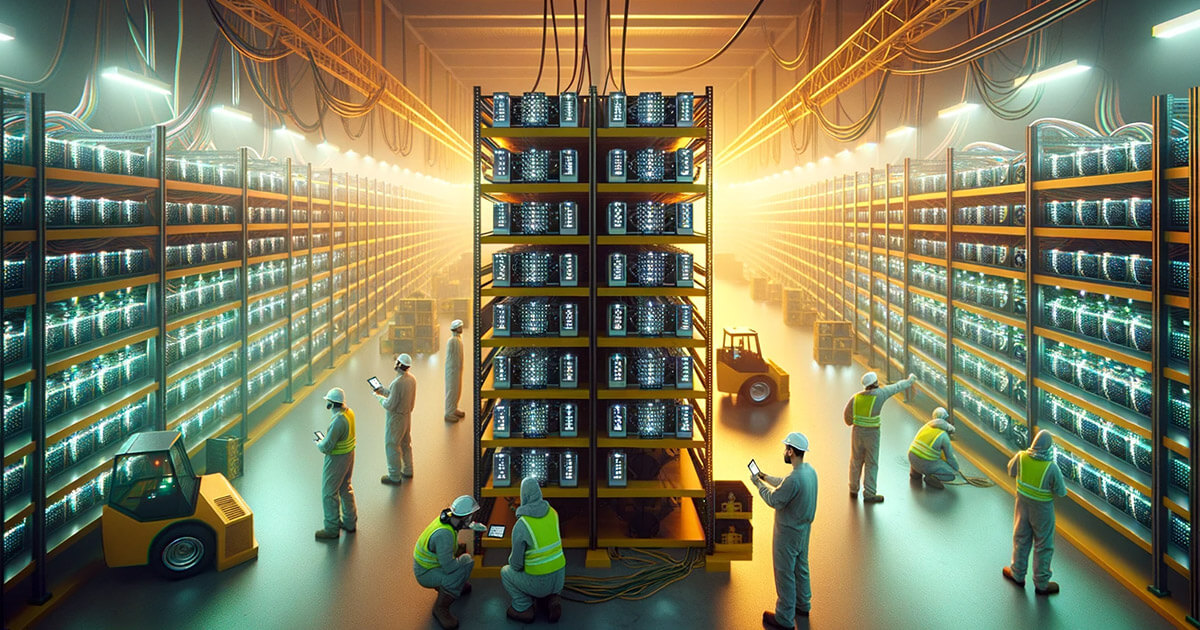

Because of Bitcoin‘s speculative nature, the asset potentially reaching prices of $1 million per BTC is just as feasible as the cryptocurrency falling to zero. And while Bitcoin has shown resiliency in the past against all odds, a new controversial contract has lead to a heated debate on if it could lead to the untimely death of the first-ever cryptocurrency. Is the Bitcoin Killer Finally Here? United States politicians have come out and explicitly said, there’s effectively no way to kill Bitcoin. The decentralized nature of the asset means it exists outside of the control of third-parties. Hundreds of obituaries have been written about the first-ever cryptocurrency, and from the ashes it regularly rises again. Related Reading | Crypto Altcoins Risk Dangerous Collapse As Three Year Triangle Resolves Bear markets haven’t been able to kill it. Chinese miners that may have the motivation to kill it haven’t been able to do so, either. Not even the Black Thursday crash caused by the coronavirus outbreak could put the crypto asset to its death. But a new “leveraged, fiat-settled” contract focusing on Bitcoin hashrate futures, could be the first thing that actually has a chance to kill Bitcoin. Leveraged fiat-settled hashrate futures, like offered by @FTX_Official, could kill #Bitcoin. If a big enough miner can pull their hashrate enough to make a leveraged short more guaranteed-profitable than mining, and miners are indiscriminately profit-oriented… — notsofast (@notsofast) May 20, 2020 It’s led to a heated debate across the cryptocurrency community. Does This Controversial New Contract Have Potential To Destroy Crypto? A new type of futures contract that allows traders to make bets on Bitcoin‘s hashrate from the rapidly growing derivatives platform FTX, has been said to have the potential to send the cryptocurrency to its doom. Because rising or dropping hashrates can lead to profits depending on which side of the bet the trader has made, it could potentially influence miners to pull their hashrate to make a leveraged short on the hashrate that much more profitable. Related Reading | Who Is Satoshi? Rounding Up The Usual Suspects After Today’s 50 Bitcoin Transaction For example, a short position on this contract from a large enough miner who pulls their hashrate would immediately profit from the hashrate drop. It could incentivize large enough miners to let greed convince them to destroy the cryptocurrency for profit. Crypto enthusiasts are calling it a “serious vulnerability.” The derivatives platform’s CEO who is an active member of the crypto community chimed in on the debate to clarify the economic feasibility of such a thing. If you have 1% of hashrate, and decide to throw it away for 3 months, you're losing about $7m. If you wanted to *break even* on a futures hedge you'd need a position of size *$700m* without having any impact. It's not economical. — SBF (@SBF_Alameda) May 21, 2020 He claims that someone who controls just 1% of the hashrate would lose $7 million over three months if they shut down their machines to try and influence their positions. Just to “break even” on a futures hedge it would require a position size of roughly $700 million. Therefore, influencing the contract is simply “not economical.” While this likely isn’t the dangerous situation for the cryptocurrency that the community first feared, it does expose a potential vulnerability in Bitcoin that may not have been thought of before. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|