2020-11-6 14:59 |

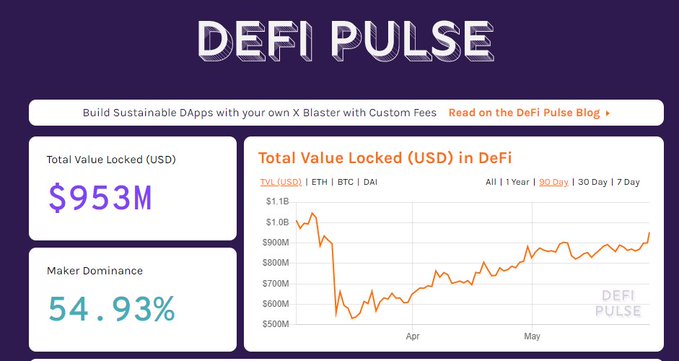

Following the latest trend witnessed in the DeFi sector, concerns that the DeFi bubble is over have been raised

The excitement around decentralised finance has slowly been waning over the past few months. The DeFi bubble is tailing off as the year nears its end. Consequently, transaction fees and confirmation times have started declining.

Elsewhere, Bitcoin’s hash rate has been subsiding lately – beckoning reduced mining power for the network. The Bitcoin network has witnessed a surge in congestion levels resulting in increased confirmation time. In turn, the network has recorded many unconfirmed transactions.

Bitcoin has continued making the headlines in the last two weeks as it attempts to post a year high that will also be its all-time high. The frenzy around the US elections on Tuesday pushed its price to above $14,000. Meanwhile, interested parties are soldiering on with mainstream corporate Bitcoin adoption talks.

Ethereum, on the other hand, has remained dormant, with the only major event around it being the release of Ethereum 2.0. Today, Ethereum Foundation released a statement regarding Ethereum 2.0 Phase 0. Its launch has been officially scheduled less than a month from now on December 1st.

The statement added that the deposit contract was live and could collect funds to trigger staking. The network went on to explain the genesis process.

“Today, we released v1.0 of the eth2 specs, including the mainnet deposit contract…To trigger genesis at this time, there must be at least 16384 32-ETH validator deposits 7 days prior to December 1. If not, genesis will be triggered 7 days after this threshold has been met (whenever that may be)“, the update read.

Phase 1 and Phase 2 transitions will follow in the future, but no exact dates have been set so far. Phase 0 will not have any effect on the current Ethereum blockchain. The deployment of the highly-anticipated Ethereum mainnet deposit address and subsequent announcement of the official launch date instantly impacted the network.

Market participants rushed to get in on the action making the crypto coin’s price surge by 7%. The token has climbed from $380 to $409, and there is a strong possibility that it can advance further to $480.

The post ETH fees dip as hype around DeFi slackens further appeared first on Coin Journal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|