2020-5-17 20:50 |

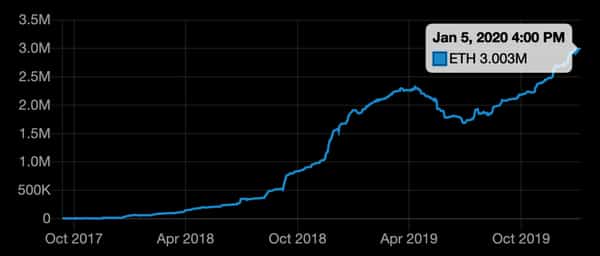

The amount of Ether locked in decentralized applications (DeFI) has been on a constant decline since hitting the peak at 3.2 million ETH in February.

In the past three months, the amount of ETH locked dropped almost 19% and over 7% in less than a week.

Currently, 2.6 million ETH are locked in DeFi, as per Defi Pulse, with Maker accounting for 50% of this followed by Compound and InstaDapp.

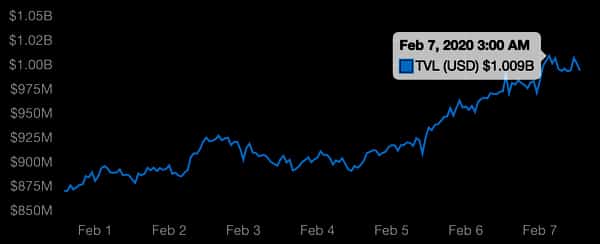

Total value locked in DeFi also fell from over $1.2 billion in February to $530 million in March, following the Black Thursday. However, unlike Ether, this amount has grown to nearly $850 million.

This growth could also be the result of the Bitcoin locked in DeFi besides rising price.

45% Jump in Locked BTCUp until March 15, the number of BTC locked remained flat at around 1.7k from where it continued to grow only to experience a huge spike this week.

Almost 1,000 BTC were added in a single day. With a jump of almost 45%, now more than 3.2k BTC are locked in DeFi.

While this growth has been in incomplete contrast with ETH, just like Ethereum, Maker dominates here as well.

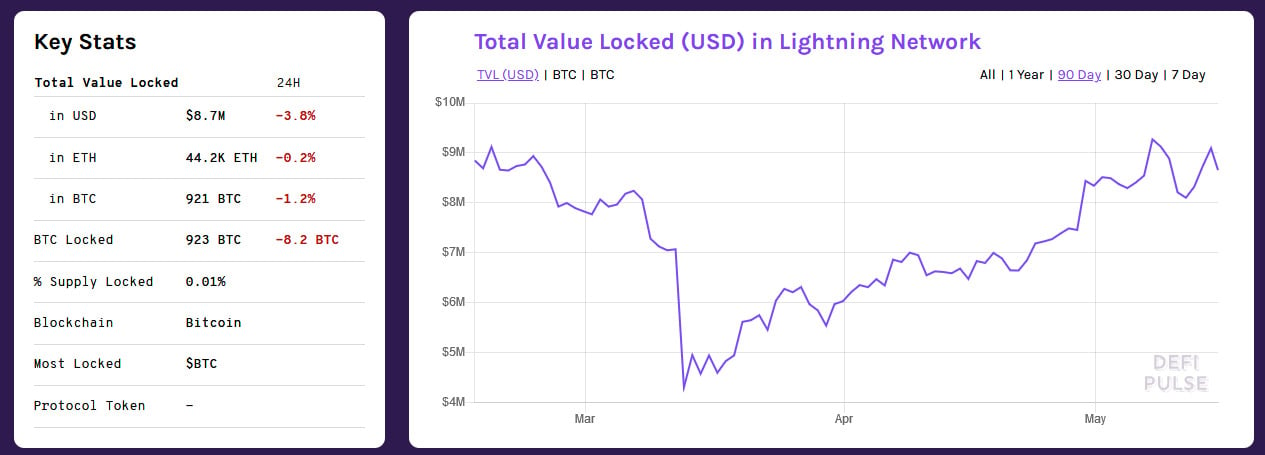

DeFi projects with the highest amount of locked bitcoin include WBTC, Lightning Network, and Compound.

This uptrend was also the result of Maker now accepting WBTC as collateral. An ERC-20 token backed with Bitcoin, WBTC makes BTC available on the Ethereum Network. An overview of WBTC transactions shows WBTC was minted on CoinList and then sent directly to the lending platform Nexo Wallet.

Most of the newly minted WBTC was used to create DAI. As such, customers at Nexo were depositing BTC to get a loan, and Nexo, in turn, took those BTC to CoinList to mint new WBTC.

These newly created WBTC were then sent to Maker, locked up as collateral and in turn, Nexo received DAI which was sent to the customer or sold for USD to send US dollars to the customer.

Good for BTC price but bad for ETH priceElsewhere, cryptocurrency exchanges continue to have steady bitcoin withdrawals, which started right after Black Thursday.

BTC balance on exchanges is down more than 300k BTC, worth about $3 billion, since the violent sell-off on March 12. This is the lowest balance held on exchanges since May 22, 2019.

As we reported, spot exchange Bitfinex saw the biggest decline of more than 50% followed by derivatives exchange BitMEX’s 32%.

This is good for the leading digital currency as investors are choosing to keep their BTC off the exchanges in favor of holding them.

In complete contrast, Ether (ETH) balance on crypto exchanges has hit an all-time high, up 132k ETH, worth about $26 million, since the sell-off in March.

Increased balance on exchange could mean holders are looking to sell-off their ETH.

origin »Bitcoin price in Telegram @btc_price_every_hour

Decentralized Machine Learning (DML) на Currencies.ru

|

|