2020-10-19 16:19 |

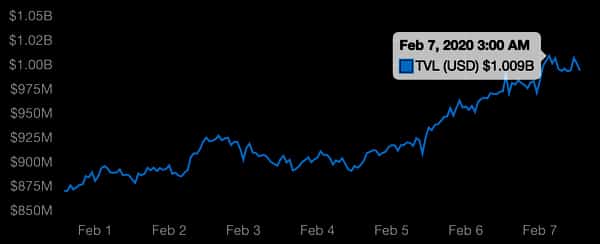

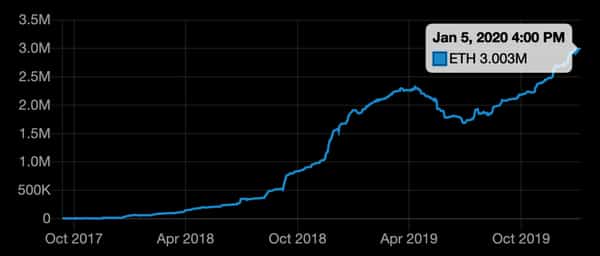

The DeFi market continues to see strong growth, with the total value locked (TVL) in the sector above $11 billion. While a record of almost 160k BTC is locked in DeFi, the locked Ether is also approaching the peak at 8.7 million ETH.

The mid of June was the “turning point” for DeFi finance, as per LunarCRUSH’s report confirmed by Google Trends when a steady upward trend in the US searches for the term DeFi was seen, which peaked in August only to fall sharply in September.

Interest in term DeFi over time, Source: GoogleTrendsBut the current scenario could further accelerate this growth.

The ongoing investigation into popular crypto derivatives platform BitMEX, and now issues at OKEx is likely to spur on further flow out of CEX and into DEX venues.

Already, as we reported, the trading volume on decentralized exchanges has rushed to new high thanks to DeFi and yield farming hype in Q3.

Monthly trading volumes for top 10 DEX increased 700% from July to $30.4 billion in Sept. while CEXs recorded $300 billion, the same as the previous month. The market share of DEXs that continues to increase is expected to grow further, that too, at the expense of CEXs.

The most popular DEX, which accounts for more than 60% of the volume, is Uniswap. The hottest trading platform was launched less than two years back and raised millions from venture capitalists, including Paradigm, Andreessen Horowitz, and Union Square Ventures LLC.

@Dharma_HQ is on the cusp of rolling out bank purchases of any asset in Uniswap up to $25,000 / week.

Want to help us test it? DM me and I'll white-list you to play with the feature starting this weekend :)

— Nadav from Dharma (@NadavAHollander) October 16, 2020

In the overall crypto space, it is the fourth-biggest exchange after Binance, OKEx, and Huobi. Paul Veradittakit, a partner at California-based Pantera Capital Management LP, which is considering investing in Uniswap’s governance tokens UNI said,

”It’s just phenomenal. We can really see decentralized exchanges make a huge dent in the market and potentially overtake centralized exchanges.”

Since dropping to half a billion dollars after its clone SushiSwap sucked the liquidity, the liquidity on Uniswap has been surging, surpassing $3 billion on Thursday. However, it is currently averaging a daily trading volume of $220 million, on a constant decline from Sept. 1st’s ATH of nearly a billion dollars.

Source: Uniswap InfoIt is rather a blessing for crypto projects as Uniswap, which generates revenue through transaction fees, doesn’t charge the issuers to list new tokens. Users don't have to provide documents for KYC or AML measures as required by traditional crypto exchanges because of regulatory pressure.

Trading on Uniswap also means a bigger market to trade as it currently has 845 tokens listed while the leading spot exchange Binance only has 820 coins.

However, while Binance had over 15 million users at the end of last year, Uniswap is used by only 50k to 100k people, Kyle Samani, co-founder of crypto hedge fund Austin, Texas-based Multicoin Capital Management told Bloomberg. He said,

“This competition is just getting started. We are in the first inning.”

The post Interest in DeFi Falls to Pre-Mania Level, Uniswap Volume on a Decline Despite CEX's Issue first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|