2020-6-20 04:00 |

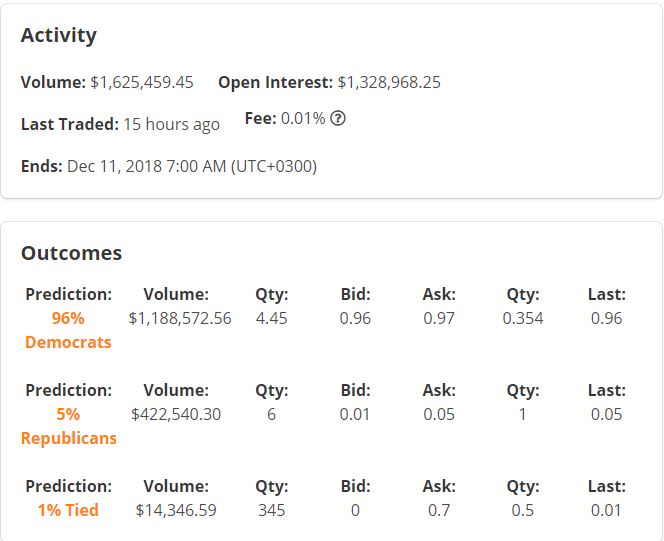

For months now, decentralized finance has been deemed one of Ethereum’s “killer use cases.” The concept of migrating financial services onto a relatively decentralized platform has been deemed a genius idea by many investors. Over the past few weeks, this has culminated in rapid growth in DeFi protocols. According to DeFiPulse, there is now in excess of $1.3 billion of value locked in Ethereum DeFi applications. Yet ETH has yet to trend higher on the back of this positive fundamental trend, leaving many scratching their heads as to why this is the case. Ethereum DeFi Protocols Are Rapidly Seeing Adoption Ethereum-based decentralized finance has performed extremely well over recent weeks. This can be attributed to a confluence of catalysts: Coinbase has begun to list a number of DeFi tokens. Investors are seeking non-BTC investments and use cases after the altcoin crash of 2018-2019. Cryptocurrency users are looking to leverage their investments, leading them to DeFi. No signal shows DeFi’s recent outperformance as well as Compound’s COMP token, which is trading more than 900% higher since Monday of this week. Analysts see COMP’s parabolic performance as a sign of what’s happening to and what’s to come for DeFi. Kelvin Koh of The Spartan Group commented: “The $COMP distribution has been enthusiastically received by the community so far. Many more such offerings are likely to follow, creating a positive feedback loop.” The issue: the price of the underlying Ethereum token has not followed the parabolic growth of DeFi, one of its killer use cases. In fact, on the week, ETH is actually flat, despite one of the best weeks ever for the broader Ethereum ecosystem. Why ETH’s Price Isn’t Following Ryan Sean Adams, a founder of Mythos Capital, opened a public forum through his Bankless newsletter titled “Why isn’t ETH pumping” in response to COMP’s and DeFi’s recent strength. According to participants in the online forum, DeFi is simply too small and unknown to make ETH budge at the moment. As one commenter explained: “DeFi is more complicated than ICOs, it cannot be just ‘do this and get a ton of money’, it will take longer. The average Joe doesn’t know what traditional financial instruments really are, let alone DeFi. Without even mentioning the ‘hard’ times we are in.” Another added that it takes millions to move the price of COMP but billions to move Ethereum. This may be the case: ETH’s market capitalization is approximately $25 billion while that of COMP is around 2% of that. Others suggested that the technology behind DeFi is too nascent to cause a true bull run. At least two commenters identified the high Ethereum transaction fees as potential medium-term impediments to DeFi’s adoption, thus decreasing how much of a demand increase ETH experiences. Featured Image from Shutterstock Price tags: ethusd Charts from TradingView.com Ethereum DeFi Is "Going Parabolic" But ETH Isn't Following: Investors Explain Why origin »

Bitcoin price in Telegram @btc_price_every_hour

Decentralized Machine Learning (DML) на Currencies.ru

|

|