2018-12-2 03:55 |

A study that tried evaluating decentralization level of top 2 cryptocurrencies found that a blockchain designed like EOS with 21 “miners” (block producers) is more decentralized than Bitcoin and Ethereum.

Decentralized is a term that most people use to describe distributed, but technically it means things that require you to go through a third party, but there are at least a few third parties you can pick from.

Centralized technically means you have to go through one party (as in a monopoly) but people use it to mean a limited number of options. So when people say banks are centralized, they mean you can’t avoid using a bank.

EOS uses clever parallelization techniques on top of Graphene, an Open Source, mostly C++, blockchain implementation that was originally developed as the foundation of Bitshares, a cryptocurrency exchange marketplace. Thanks to this design, EOS promises it will be able to support more than 100,000 transactions per second – more than adequate speed to support NYSE, VISA and cryptokitties on one blockchain.

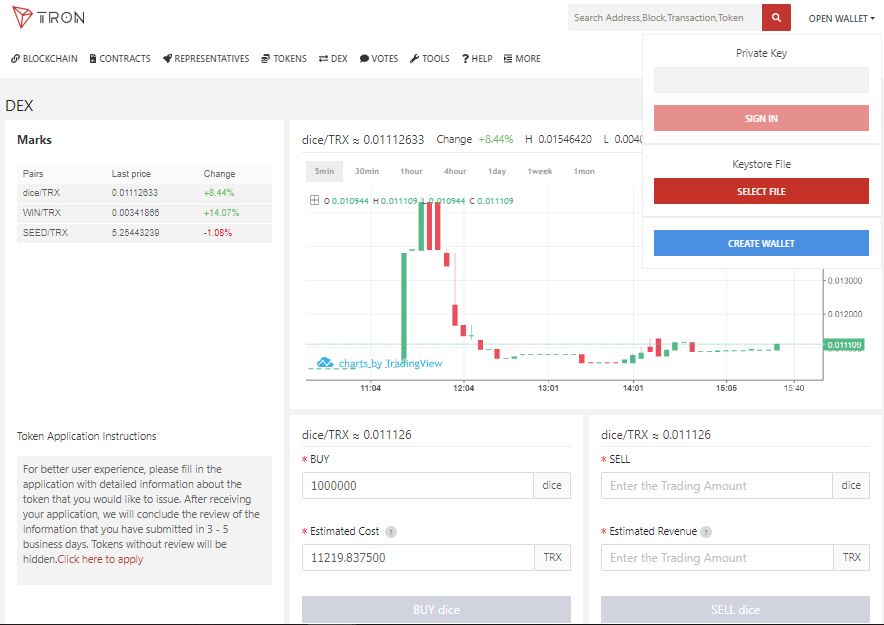

EOS pulls off this remarkable scalability through the use of something that’s called dPOS – delegated proof-of-stake. While in conventional POS and POW blockchains there are unlimited number of nodes and miners who are in competition to produce a new block, in EOS this number is finite and will be limited to 21 nodes. The 21 nodes aka block producers will be elected by network participants and token holders through a voting mechanism.

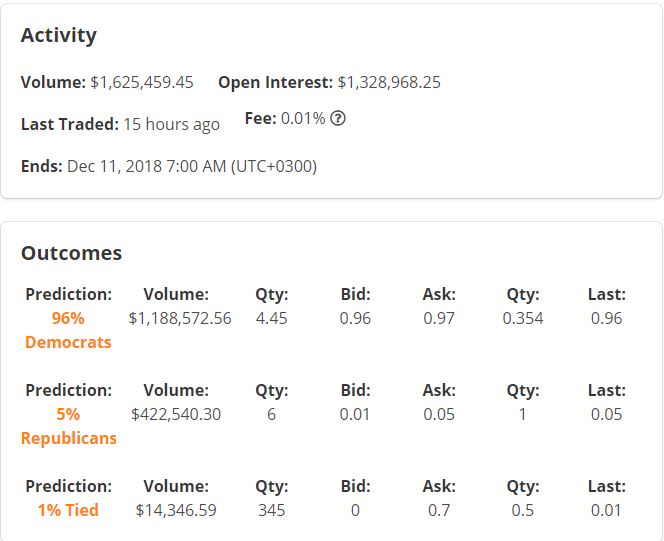

Ethereum supporters will be fast to jump on this and mention that this setup is much more centralized than Vitalik’s ETH blockchain. But is that really the case? A peer reviewed study conducted at the beginning of the year indicates that EOS might actually be a more decentralized network than Bitcoin or Ethereum.

Distribution of mining power in Bitcoin and Ethereum networksBitcoin and Ethereum are centralized because top three miners in Bitcoin and top 4 miners in Ethereum control more than 50% of the overall hashrate. The study also states that a Byzantine quorum system of 20 block producers would create a better decentralization in real world than theoretically infinite-decentralized BTC and ETH.

Other findings from the same paperThe study has some more results that draw attention.

Bitcoin can safely increase block size by 1.7xOne of the arguments against block size increase, and against the infamous SegWit2x hard fork, was that bigger block size would make the network less centralized because of larger hardware requirements. However, the study shows that since 2016 the majority of BTC full nodes have increased their bandwidth by 1.7x. To put this another way, if people were happy with how Bitcoin was decentralized in 2016 then increasing block size by 1.7x would provide the same level of decentralization as back then.

Maybe if this study appeared earlier we would have successfully hard forked to SegWit1.7x, which would have almost doubled the amount of transactions the network can process without taking a hit on decentralization.

Ethereum is more decentralized than BitcoinBitcoin is serious business. Compared to Ethereum, more bitcoin nodes are clustered together. In other words, Ethereum is better distributed geographically. Only 28% of Ethereum nodes were identified to be running in a datacenter, compared to Bitcoin’s 56%. This could be an indicator of increased corporatization of BTC.

SummaryNo matter what coin you hold in high regard, it’s important to regularly inspect your choices and to look at the cryptocurrency’s fundamentals. Bitcoin’s and Ethereum’s biggest assets are strong brand presence and alleged decentralization. The study that we spoke about in this blog post indicates that as time goes by POW based systems have a tendency to become more centralized. Thus, in the future, branding might become the only asset of these digital assets. Especially in case of bitcoin, since Ethereum plans to change its consensus model to POS.

EOS, despite going for a higher level of centralization in the protocol’s design, might actually have higher decentralization than Bitcoin and Ethereum in real world. When you combine this higher degree of decentralization with 100,000 transactions per second output you get a blockchain that might rocket to the top and dominate the market in the future.

The post Outlandish claims: EOS is more decentralized than Bitcoin and Ethereum appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Decentralized Machine Learning (DML) íà Currencies.ru

|

|