2020-6-22 22:00 |

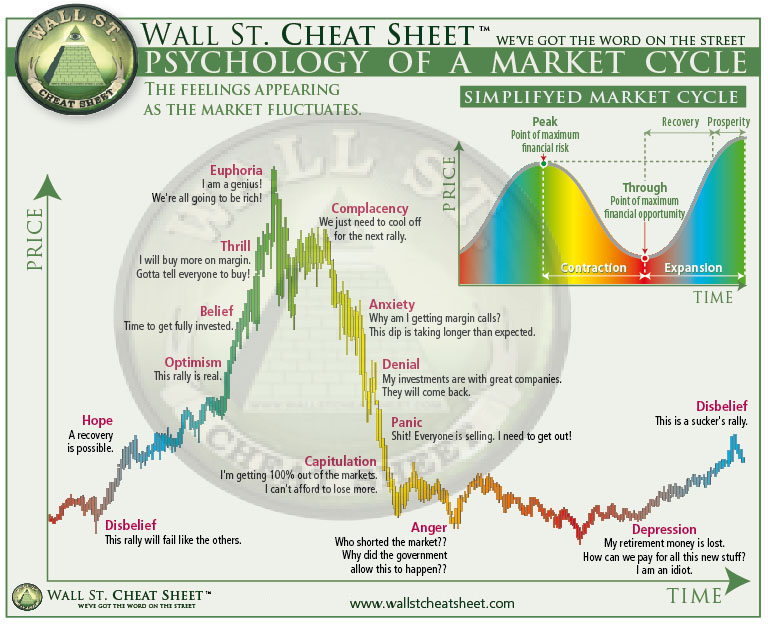

Ethereum has seen a distinct divergence between its fundamental utility and its price action Despite seeing unprecedented usage rates, the cryptocurrency’s price action has been closely correlated to that of Bitcoin and the aggregated crypto market One prominent investor is now noting that ETH appears to be entering a new market cycle This comes as the explosively popular DeFi trend continues gaining major traction From a technical perspective, some analysts do believe that it may even see further weakness in the days and weeks ahead, despite this not being reflective of its fundamental strength Ethereum and the aggregated crypto market have been caught in the throes of an intense bout of sideways trading throughout the past several days and weeks. This consolidation phase has offered little insight into the cryptocurrency’s mid-term outlook, and some analysts believe that the likelihood of it seeing further technical weakness is growing as it continues trading sideways. ETH’s current weakness, however, is not emblematic of its underlying fundamental strength. One prominent investor is now noting that the divergence between Ethereum’s price and its utility and usage seems to indicate that it has entered a new market cycle. Here’s Why This Investor Thinks Ethereum has Entered a New Market Cycle One source of utility for Ethereum has been the explosive rise in the popularity of decentralized finance (DeFi). This trend gained major momentum throughout 2019 and early-2020, but lost this upwards trajectory during the mid-March meltdown seen by the aggregated crypto market. DeFi’s growth has seen an intense recovery in the months since, however, with the total value locked within collateralized loans reaching fresh all-time highs earlier this week. One of the hallmark examples of DeFi’s current popularity can be seen while looking towards the recent launch of Compound. The token associated with the platform – COMP – has seen a parabolic price rise, but many investors are speculating as to why this hasn’t created an upwards tailwind for ETH. Su Zhu – the CEO and CIO of Three Arrows Capital – spoke about this in a recent tweet, explaining that Ethereum insiders questioning how ETH can accrue value suggests that the crypto has entered a new market cycle. “ETH 2017: everyone was long but wasn’t sure why it was valuable. ETH 2020: even insiders aren’t sure how it accrues value, while usage is through ATHs… this is what it means to be in a market cycle,” he noted. ETH Could See Even Further Weakness as Consolidation Phase Persists Despite there being incredible growth in certain aspects of the Ethereum ecosystem, prominent venture capitalist Chris Burniske recently explained that its chances of plunging lower are growing as it continues trading sideways – as Bitcoinist explained yesterday. “The longer BTC & ETH fade here the more likely we take another leg down to test key supports, despite the strong fundamentals of both. I would see this as more macro-jitters driven than specific to crypto’s future.” Featured image from Shutterstock. origin »

Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|