2019-6-14 17:30 |

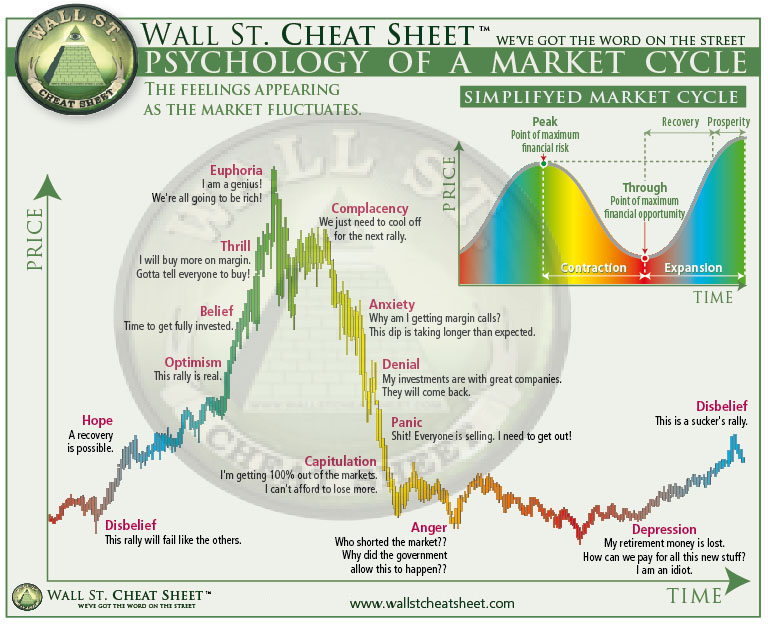

The cryptocurrency market has seen a significant change in character since the last bull run resulted in market cap and price elevation. This positive change was spearheaded by Bitcoin and adhering to previous patterns, the trickle-down effect had an impact on the rest of the market as well.

The market’s patterns have always generated several questions from the community and one such question was recently addressed by DonAlt, a cryptocurrency enthusiast. The question at hand was whether altcoins could rally, while Bitcoin is on a slight downtrend and is consolidating. An analysis was conducted where Bitcoin’s chart was placed side by side with that of Ethereum, the second largest cryptocurrency, to spot any similarities.

Source: Twitter

The graphs showed that despite the fact that Ethereum reached its all-time high after Bitcoin, 2018 was a testament to the fact Ethereum did not necessarily follow Bitcoin’s footsteps all the time. Although Ethereum exhibited similar patterns to that of Bitcoin during bearish phases, other situations yielded different results.

When Bitcoin prices consolidated between May and October, 2018, Ethereum prices were on a steep decline, making ETH one of the biggest losers in the top 10 cryptocurrencies. The November price crash was a fate that was shared by the entire cryptocurrency market and this was evident when both Bitcoin and Ethereum suffered one of their worst price falls at the time.

Bitcoin’s 2019 recovery has been stellar as the cryptocurrency witnessed a jump of over a 100 percent since January 1. However, Ethereum has not excelled equally, in terms of price. Holders in the community had other queries about the rally correlations as well, with @CryptoArchitect, a cryptocurrency enthusiast, asking,

“What about ETH USD, is it the same as the ETHBTC reaction as you have it on your illustrations?”

To this, DonAlt responded,

“ETHUSD is highly correlated with BTCUSD. Absolutely zero reason to do this chart against ETHUSD because it’d just be a slightly altered BTCUSD chart.We care about which performs better.”

At press time, a majority of the market was on an uptrend, with Bitcoin trading at $8106.73 and holding a market cap just shy of the $150 billion mark at $143.95 billion. Ethereum on the other hand, was trading at $258.01 with a market cap of $27.47 billion.

The post Ethereum’s price movement isn’t necessarily correlated to that of Bitcoin’s, suggests analysis appeared first on AMBCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|