2020-8-4 15:36 |

It’s been over a week now since bitcoin first hit $11,000. Although there have been a few small dips below this level, the world’s largest cryptocurrency is hovering around this level for the majority of the time.

Last month, when the digital asset had a strong breakout above $10,000, it was a critical moment for the cryptocurrency, which got the market a lot of attention from the mainstream media.

Analyst Mati Greenspan noted that most of the mainstream media misses all the development that goes into the space, such as the recent announcements from Mastercard and Visa and that PayPal and Revolut might be about to open crypto-related services.

But what the media doesn’t miss is the price, “When bitcoin starts to moon, people notice,” he wrote in his daily newsletter Quantum Economics.

“The longer we hold current levels or even advance further,” the more the media will notice and cover bitcoin and cryptocurrencies “as they clearly outperform every other asset class,” Greenspan said.

Up until the last week of July, stock, bonds, and commodities were enjoying their best four-month spurt in decades, but bitcoin joined them just recently. However, small and mid-cap cryptocurrencies, especially DeFi tokens, have already been rallying hard.

If it dips to $10.5k, BTFD hard

— Squeeze (@cryptoSqueeze) August 4, 2020

This is thanks to the Federal Reserve, which stepped in with the support of trillions of dollars to prop up the markets during the coronavirus pandemic. All this money printing resulted in government bond yields falling to record yields and the dollar to hit a 2-year low, forcing investors to yield elsewhere.

Capturing the AttentionIn the past four months, after March sell-off, the S&P 500 rose 27% while gold jumped 34%. But these gains pale in comparison to bitcoin’s, which rallied 196% since its March lows. BTC/USD is also up 53% YTD.

“Its volatility and potential for outsize gains make bitcoin more enticing to some investors, and money from traditional markets is finding its way into cryptocurrencies,” wrote the Wall Street Journal, which covered bitcoin’s extravagant move this week.

Besides noting how speculators are betting on bitcoin to continue rising on the back of central-bank intervention, falling interest rates, and the drop in the US dollar and 57% of $900 million investment in Grayscale Investments in Q2 being from new investors, WSJ discussed DeFi — “an emerging trend within the crypto sector itself.”

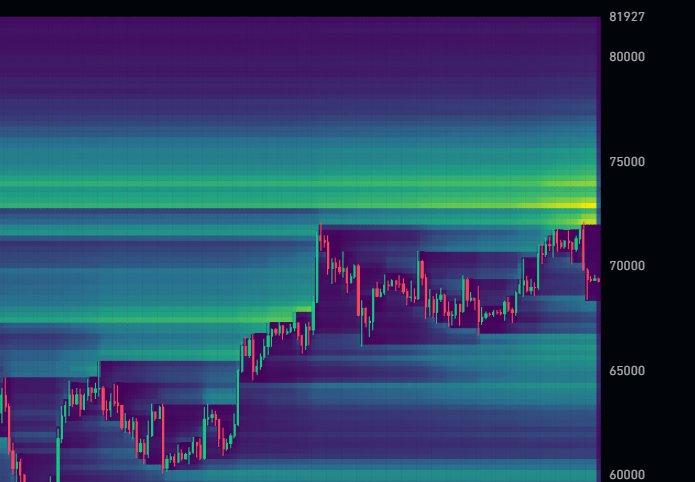

Source: OKEx CEO @JayHao8“A surge of trading that has been enabled by a new crop of specialized apps,” it reported adding this sector has further given traders “more ammunition to leverage up and make increasingly risky, and potentially lucrative, options bets and arbitrage plays on a range of cryptocurrencies.”

But there’s still doubt about the entry of new investors in the space given that the number of daily transactions on the bitcoin blockchain hasn’t exceeded 350,000. “Nothing’s screaming at me that there’s a bunch of new people,” said Beatrice O’Carroll, co-founder of boutique OTC trading firm Reciprocity Trading.

But once bitcoin spikes to new highs, new investors could be expected to rush in.

“Now that $10,000 is broken, there really isn't anything in the way of resistance, until the all-time high of $20,000, which represents an entirely conceivable year-end target,” said Greenspan.

Bitcoin (BTC) Live Price 1 BTC/USD =$11,188.6758 change ~ -1.51%Coin Market Cap

$206.45 Billion24 Hour Volume

$6.22 Billion24 Hour VWAP

$11.28 K24 Hour Change

$-168.8454 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Level Up Coin (LUC) на Currencies.ru

|

|